ICYMI – PIMCO now expects only two rate cuts from the Federal Reserve this year. Were previously at 3 hours.

Friday’s US jobs report on non-farm payrolls was scorching:

- Forexlive Americas FX News Roundup: US Dollar Jumps on Hot NFP, Then Gives It Back

Bond giant Pacific Investment Management Company (PIMCO) has lowered its Federal Open Market Committee (FOMC) rate cut forecast this year. PIMCO’s previous projection was 3, but they have lowered it to 2 now as a “base case”. A PIMCO representative spoke to Reuters after Friday’s NFP numbers:

- that means a little less from the Fed

- the economy is proving for now that it can withstand higher rates

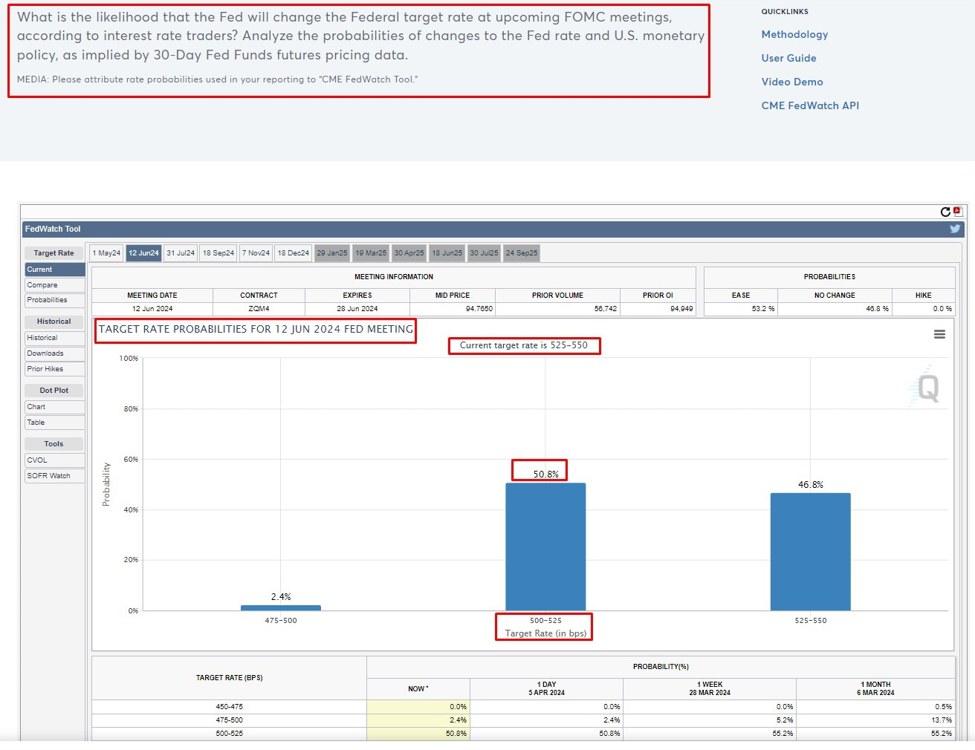

Check FedWatch and you’ll see that the price of a June rate cut is now close to a coin toss. I think the probability is closer to 10% than 50%. If you followed my message “no rate cut in June for you!” » shouting this will come as no surprise.

FOMC members pile in on further cuts:

- Fed’s Logan: It’s far too early to think about lowering interest rates

- Fed’s Waller says current rate may need to be held longer than expected, without rushing to cut

- Waller’s remarks sent the US dollar soaring

- (ps, that’s still the case too)

- Fed Waller: Economy Supported Federal Reserve’s Cautious Approach

- Fed’s Waller says more: If unemployment rises, there’s no reason to panic

- Fed’s Bostic says he now expects only one rate cut this year

- If the economy continues to be healthy, why would we cut rates?

And I like this reasoning:

- Global economic recovery and meteoric rise in commodities threaten to derail the Fed

FedWatch Update:

This article was written by Eamonn Sheridan at www.forexlive.com.

cnbctv18-forexlive