Goldman Sachs raises gold price target for year-end to $2,700

Gold 10 minutes

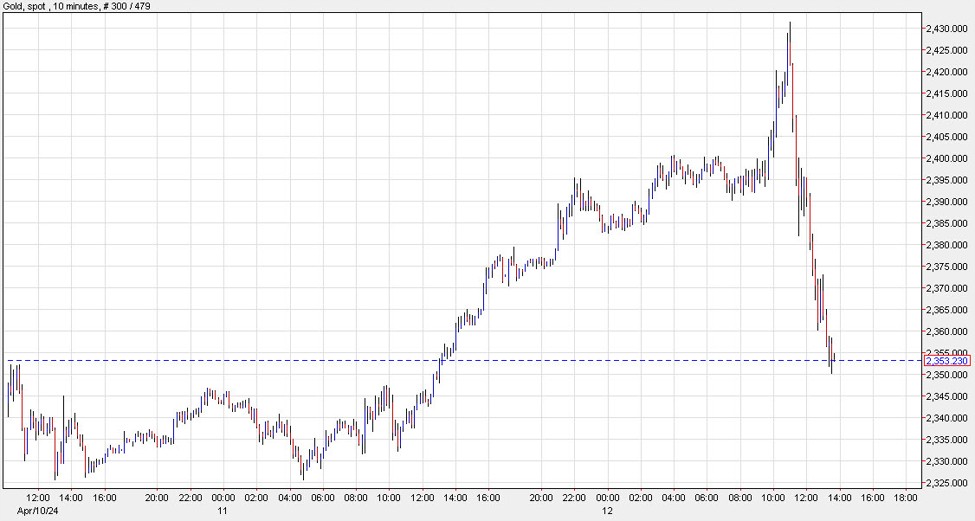

Gold plunged $70 after hitting an all-time high of $2,431 earlier in the day. This spike and reversal was accompanied by growing angst in the broader markets and a nearly 2% decline in the Nasdaq. The market is worried about a war in the Middle East.

Goldman Sachs raised its year-end gold price target from $2,300 to $2,700 earlier today, noting that momentum and retail trading have yet to take over.

“With Fed cuts remaining a likely catalyst to ease ETF headwinds later in the year, tail risk from the US election cycle and fiscal backdrop, gold’s bullishness remains clear ” Goldman wrote in a note.

“Retail demand in Asia, led by China, was driven by fears about economic stability and currency depreciation, particularly linked in China to the real estate sector,” writes GS.

They see risks for gold, including peace, better growth in China and a decidedly hawkish turn by the Fed.

cnbctv18-forexlive