(Bloomberg) – President Donald Trump says he is looking forward to April 2. Global action investors, not so much.

Most of Bloomberg

The administration should unveil a large list of so -called reciprocal prices against American trade partners on Wednesday, and it is imminent as the next potential bodily blow for the markets.

The President said that the direct debits will be “indulgent”, but that fund managers are in care given the lack of details on what the next price package may include. In a suspicion of potential volatility to come, last week’s announcement of automotive prices rocked the actions of industry around the world.

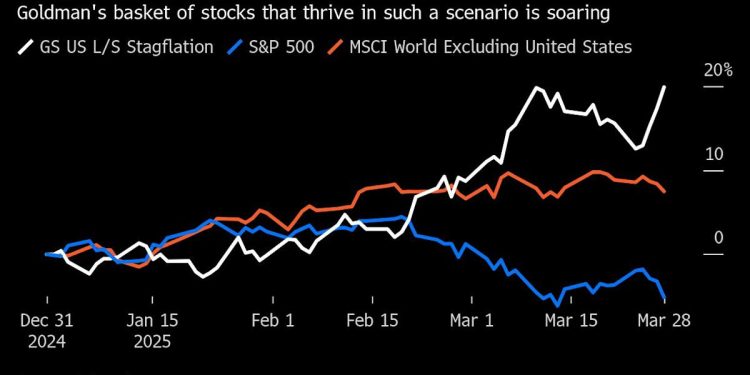

Depending on the scale of what is announced, Bloomberg Economics sees the scope of a GDP for us and a shock at prices in the coming years, given the possibility of massive price increases on imports of certain countries. An index of the actions of Goldman Sachs Group Inc. which thrive during stagflation – a period of low growth and high inflation – has shown up.

“Everything is at stake, everything,” said Mark Malek, director of investments at Siebert. “Inflation is increasing, consumption shows signs of weakness, the feeling of consumers slides, all from the pricing policy of the administration.”

April 2 should set the tone for the next few months on the markets, the PLC Barclays strategists said last week. A large set of steep rates is poorly increased for risk assets at the beginning of the second quarter, they wrote in a report. But with sufficiently large exemptions or a delay, investors should prepare for “a rescue rally”.

There is also the threat of reprisals of American trade partners who stimulates volatility, said Solita Marcelli, director of investments at the American Wealth Management Brack in UBS.

In preparation for all this, traders left segments that could be taken in the reticle. The baskets that follow the most risky shares have plunged this year, which drags wider clues considerably in the United States and Europe.

Here is a ventilation of the sectors and actions to be monitored by region:

WE

The automotive industry – including car manufacturers, parts suppliers and dealers – remains at the center of prices, especially after the 25% samples announced last week. General Motors Co. is expected to deal with highly higher costs, and although Ford Motor Co. produces a larger share of its American sales at the national level than its peers of Detroit, it will not be spared. An index of car manufacturers and components flowed 34% since Trump took office.

Reciprocal prices could add to pain for cars. There could also be sectoral prices on semiconductor shavings, medicines and wood. Flea manufacturers, which, such as automotive companies, have a global supply network, are vulnerable at a time when the sector is already struggling with signs of problems with the growth of the data center and the rate of capital expenditure. Actions such as Nvidia Corp., Advanced Micro Devices Inc. and Intel Corp. will be to the point.

Pharmaceutical giants such as Pfizer Inc., Johnson & Johnson, Merck & Co. and Bristol Myers Squibb will be exposed because all reciprocal prices can have an impact, from the supply of distribution drugs.

Last week, reports indicate that American prices on copper imports could arrive in several weeks. The price of copper has climbed recently. Even if these samples are not revealed on April 2, this group overall can be volatile, including copper minors, as well as steel and aluminum companies. The actions to be monitored include Freeport-McMoran Inc. and Southern Copper Corp.

The Trump administration plans to almost double the functions on Canadian soft wood wood at 27%, with the possibility of additional samples. If prices announced on April 2 have the impact of this group, actions such as Weyerhaeuser Co. can be volatile.

Other sectors that can be taken in the fray include industrial manufacturers and consumer companies with suppliers from around the world. Some names which are often used as an indirect indicator of these trade tensions and economic anxiety include Caterpillar Inc., Boeing Co., Walmart Inc. and Deere & Co.

Europe

The European Union identifies the potential concessions to have certain samples removed, although the block officials were informed that there was no way to avoid the new American and reciprocal automotive rates expected this week.

Cars in the region have seen an impact, the Stoxx Auto & Pares index fell by around 12% compared to this year’s peak.

German car manufacturers are at home because they send more vehicles to the United States than in any other country, including certain models with upper margin of Porsche AG and Mercedes-Benz Group AG. Automobiles could erase around 30% of operating income provided for by these companies, Bloomberg Intelligence estimates. Manufacturers can increase prices – Ferrari NV plans to do so for certain models – or move more production in the United States.

Trump’s threat of a 200% rate on alcoholic products shipped from the EU is already a puzzle for producers of wines and spirits in the region. Aperol manufacturer Davide Campari-Milano NV said that even a price of 25% would result in losses of at least 50 million euros ($ 54 million).

European minors, in particular aluminum and steel producers, were developed in the mid 25% of Trump on metals. After the countermeasures of Europe, the eyes are now on the question of whether the American president will answer. Among the companies to watch, Rio Tinto Group, with two announcements in Australia and London, is the largest aluminum supplier on the American market, with about half of the production made last year in Canada.

As one of the largest listed companies in Europe, the fortune of the manufacturer of weight loss drugs Novo Nordisk A / S has major implications for the region’s stock market. This is why the threats of a 25% levy on the EU, with pharmaceutical products as an attention industry, are acconcern. The manufacturer of Ozempic and Wegovy said that he was not “safe” of prices.

Asia

Despite the massive trade surplus of China with the United States, companies in the country are less vulnerable to prices than during Trump’s first term. Indeed, the share of China of American goods imports fell from nearly 8 percentage points from 2017 to 2023, according to data from the US Census Bureau.

There are still actions that are worth watching. In Hong Kong, the actions of Power-Tool Maker Techtronic Industries Co., for which the United States is a higher market, according to BI-has dropped by around 8% since the inauguration of Trump due to tariff threats.

Japanese car manufacturers, familiar names in the United States, can see their stocks undergo pressure on April 2 if reciprocal prices are seen aggravated the prospects of this group. Automobiles and automotive parts are the largest export products in Japan in the United States. The stocks to be monitored include Toyota Motor Corp., the largest car manufacturer in the world on delivery; and Honda Motor Co., who obtains more than half of her income from North America.

The mastery powers in global tokens – South Korea and Taiwan – will be at the point, with all eyes on Taiwan Semiconductor Manufacturing Co. and Samsung Electronics Co. TSMC – of which almost 70% of income comes from the commitment of the United States. For South Korea, car prices of 25% Trump weigh on car manufacturers and their suppliers, including Hyundai Motor Co. and Kia Corp.

In Southeast Asia, Thailand is distinguished as a potential major injury, with its substantial dependence on agriculture and transport.

– With the help of Matthew Griffin.

Most of Bloomberg Businessweek

© 2025 Bloomberg LP