In an aerial view, brand-new Tesla cars are parked in a parking lot at the Tesla Fremont factory on April 24, 2024 in Fremont, California.

Justin Sullivan | Getty Images

Ancient You’re here Executive Drew Baglino, who announced his resignation earlier this month, sold shares of the electric vehicle company worth about $181.5 million, according to an SEC filing Thursday.

Baglino, who joined Tesla in 2006, is selling about 1.14 million of his shares, the filing said, giving an “approximate sale date” of April 25 and describing it as an exercise of stock options.

Tesla announced on April 15 that it was laying off 10% of its global workforce, following a drop in deliveries in the first quarter and a sharp drop in the stock price. That day, Baglino and his colleague Rohan Patel announced they were leaving the company.

Baglino announced his departure in a statement published on.

“I made the difficult decision yesterday to leave Tesla after 18 years,” he wrote. “I am very grateful to have worked and learned from the countless incredibly talented people at Tesla over the years.”

Baglino started as an engineer and worked his way up to senior vice president of powertrain engineering and energy, a position he had held since 2016. Reporting directly to Musk, Baglino was considered the unofficial head of operations by many colleagues.

Before the latest sale, Baglino had sold about $4 million in stock in two transactions this year — one in late February and another in early April, according to filings. In each case, he sold 10,500 shares, exercising stock options in both cases.

During earnings conference calls and other major company events, including Tesla’s spring 2023 “Part 3 Blueprint” presentation, Baglino had become a familiar voice and face to shareholders, often discussing mining, battery manufacturing and performance.

Baglino did not respond to requests for comment. Tesla also did not provide a comment.

Baglino resigned as Tesla appeared to be embarking on a major strategic shift.

Musk said during the company’s earnings conference call this week that while Tesla still intends to produce new affordable electric car models in 2025, investors should focus more on the “roadmap of autonomy” from Tesla. Tesla has announced plans to unveil a robotaxi model, or CyberCab, on August 8.

Musk also touted Tesla’s investments in AI infrastructure and the company’s potential to finally deliver autonomous vehicle technology, robotaxis, a driverless ride-hailing service and a “sentient” humanoid robot. He even told skeptics to stay away from the stock.

“If someone doesn’t believe that Tesla is going to solve the autonomy problem, I think they shouldn’t invest in the company,” Musk said on the call.

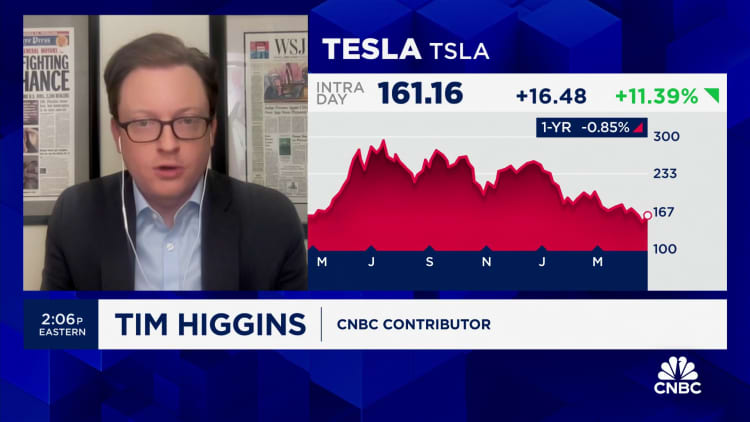

Tesla’s stock price, which was down about 40% over the year before the earnings release, jumped 18% in the two trading days following Musk’s comment, closing Thursday at $170.18.

Bernstein analyst Toni Sacconaghi is among the skeptics. In an interview with CNBC’s “Squawk on the Street,” Sacconaghi questioned whether the affordable electric vehicles Musk promised would be “really new models or modifications on existing models.” He also said that competitors, including Waymo, already have robotaxi services on the road, while Tesla is still grappling with autonomous vehicle research and development.

Tesla reported a 9% drop in first-quarter revenue, its biggest year-over-year decline since 2012, due to lower demand and increased global competition. The company also reported a 55% drop in net income during the quarter.

Although Musk said he expects the second quarter to be better than the first, the company has not released guidance for the year.

At the end of the earnings conference call, Martin Viecha, Tesla’s vice president of investor relations, announced that he was also resigning.

WATCH: Tesla and Musk fans are optimistic

cnbc