Forexlive Americas FX News Recap April 15: Stocks Fall/Returns with Geopolitical and Strong Growth

Now, a combination of higher rates after stronger-than-expected retail sales for March and geopolitical fears following Iranian military aggression against Israel over the weekend has sent yields higher and prices lower. actions. Reports that Israel would seek to retaliate were also a catalyst for market action.

U.S. retail sales for March beat expectations with a significant increase of 0.7%, beating the forecast increase of 0.3%. This performance marks a notable rebound compared to previous months, when retail sales were weaker. Sales excluding automobiles jumped 1.1%, more than double the expected 0.5% and the previous month’s figure of 0.3%. The control group, which provides a finer measure excluding volatile items like automobiles, gasoline, building materials and food services, also posted strong growth at 1.1%, considerably higher than the 0.4 % expected. Additionally, sales excluding gasoline and automobiles increased 1.0%, compared to 0.3% previously. This increase in March was the largest since January 2023. Although the positive development in retail sales could be partly attributed to an earlier Easter, which complicates seasonal adjustments, the data nevertheless represents a robust improvement, particularly after a weak performance in previous months. of the year.

Empire regional manufacturing data was worse than expected, at -14.3 versus -7.5 expected. Over the coming weeks, other regional indexes will provide a national portrait of the manufacturing sector.

The Fed’s speech was somewhat limited today, with only one Fed official (President Williams of the New York Fed). This week will give Fed officials the last chance to weigh in on the economy and policy before the so-called quiet period ahead of the Fed’s May 1 rate decision schedule. The quiet period will begin Friday after the close, although the Fed’s speech was limited today. , the program is complete for the rest of the week:

Monday April 15

- 8:00 p.m.: FOMC member Daly speaks

Tuesday April 16

- 9:00 a.m.: FOMC member Jefferson speaks

- 12:30 p.m.: FOMC member Williams speaks

- 1:00 p.m.: FOMC member Barkin speaks

- 1:15 p.m.: Fed Chairman Powell speaks

Wednesday April 17

- 2:00 p.m.: Release of the Beige Book

- 5:30 p.m.: FOMC member Mester speaks

- 6:30 p.m.: FOMC member Bowman speaks

Thursday April 18

- 9:05 a.m.: FOMC member Bowman speaks

- 9:15 a.m.: FOMC member Bowman speaks (additional session)

- 9:15 a.m.: FOMC member Williams speaks

- 11:00 a.m.: FOMC member Bostic speaks

- 5:45 p.m.: Bostic, member of the FOMC, speaks (additional session)

Today, John Williams, president of the New York Federal Reserve, expressed optimism about the U.S. economy, expecting a growth rate of around 2% for the year. Speaking on April 15, 2024, he highlighted the robustness of consumer spending and highlighted positive supply-side contributions to the economy. Despite recent data, Williams does not view current inflation trends as a significant turning point. He acknowledged that markets have adjusted their expectations in light of gradual progress in inflation. Highlighting his flexible approach, Williams reiterated his commitment to relying on data in his policy decisions.

Looking at the markets, US stocks were down sharply:

- The Dow Industrial Average fell -0.65%

- The S&P index fell -1.20%

- The NASDAQ index fell -1.79%.

The small cap Russell 2000 fell -1.37%.

In the US debt market, yields have increased with the steepening of the yield curve:

- 2-year yield 4.918%, +3.6 basis points

- 5-year yield 4.625%, +9.0 basis points

- 10-year yield 4.609%, +11.1 basis points

- 30-year yield 4.726%, +12.3 basis points

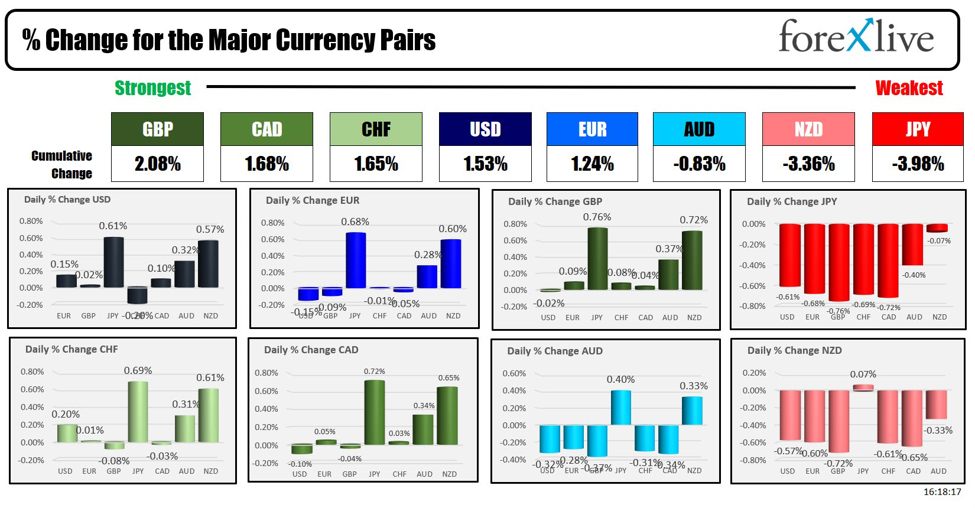

In the foreign exchange market, the USDJPY rose, with the JPY being the weakest of the major currencies. The GBP was the strongest. The USD was only points higher overall against the GBP today.

Crude oil was down for most of the day, but it traded virtually unchanged after hours. Gold rose on security concerns. Bitcoin was not a safe haven today, but a “risk-free” instrument. It is trading at $63,207. The day’s low reached $62,340. The day’s high was $66,900.

cnbctv18-forexlive