Fed Chairman Powell in the spotlight at Jackson Hole

(Bloomberg) — All eyes will be on the Wyoming mountains this week for the Federal Reserve’s Jackson Hole symposium, your best chance each year to see a Nobel Prize-winning economist in a cowboy hat.

Bloomberg’s most read articles

The highlight will come Friday, when Fed Chairman Jerome Powell will address the economic outlook in a keynote address at 10 a.m. New York time.

As the U.S. central bank approaches a crucial tipping point, it’s hard to overstate the attention financial markets will be paying to it. For starters, they’re waiting for confirmation that the Fed will cut rates in September. But what happens next and the pace of further cuts in the coming months is more in focus than ever, as the Fed faces a dual risk to inflation and employment.

Bank of England Governor Andrew Bailey will also make an appearance Friday, and Philip Lane, the European Central Bank’s chief economist, will speak a day later. The conference is usually conducive to a torrent of additional commentary from a wide range of policymakers and economists.

Details of the symposium program from Friday to Saturday will be made public on Thursday evening, local time.

Just before the event begins, and also likely to attract attention, the minutes of the Fed’s July 30-31 policy meeting will be released on Wednesday.

What Bloomberg Economics says:

“Powell is very likely to use his Jackson Hole speech to say that the time for a rate cut is coming soon. So the focus will shift to a more specific question: will he signal that he is open to a 50 basis point cut? We don’t think Powell will close the door on a 50 basis point cut, but he won’t show any particular inclination to do so either. This is likely because policymakers have not yet reached a consensus on the urgency of a rate cut.”

—Anna Wong, Stuart Paul, Eliza Winger, Estelle Ou, and Chris G. Collins. For a full analysis, click here

U.S. housing demand figures, along with weekly jobless claims, are the highlights of a lean week for the U.S. economy. On Thursday, the National Association of Realtors will release figures on sales of used homes, followed the next day by the government’s report on new home purchases. Both figures are expected to show modest increases, suggesting that the housing market is stabilizing after a recent drop in mortgage rates.

The Bureau of Labor Statistics is scheduled to release its preliminary estimate of wage revisions for the year ending in March on Wednesday. Final figures are expected early next year.

Further north, Canadian inflation data for July will be important in helping the central bank stay the course and deliver a third straight rate cut in September. The Bank of Canada expects uneven progress toward the 2% target and is increasingly focused on downside risks, so it is looking primarily for sustained signs of easing. Retail sales data for June and a flash estimate for July will also provide insight into the health of the country’s consumers.

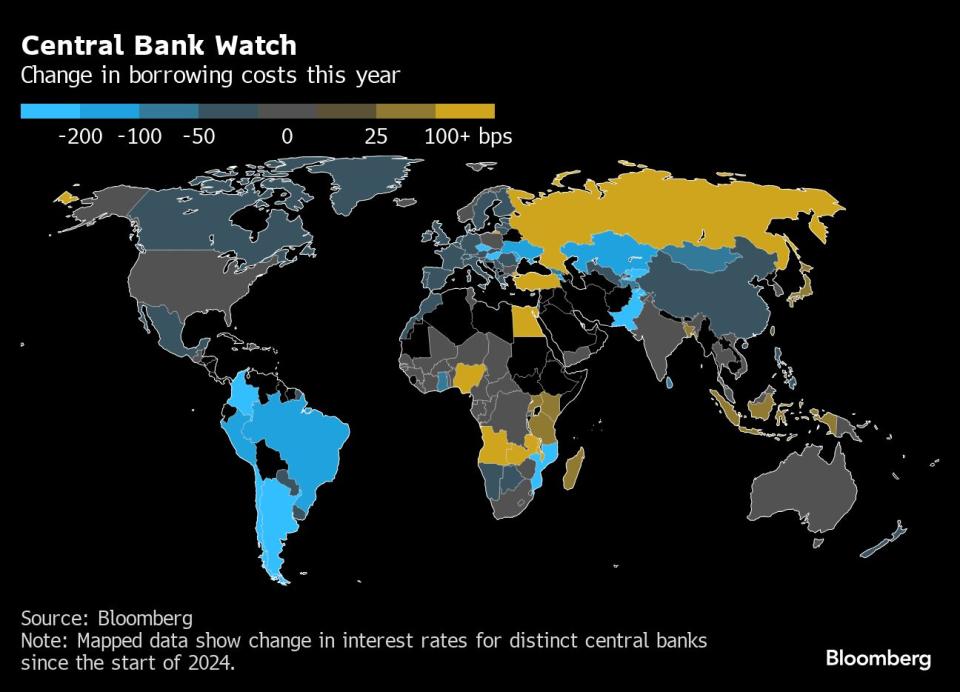

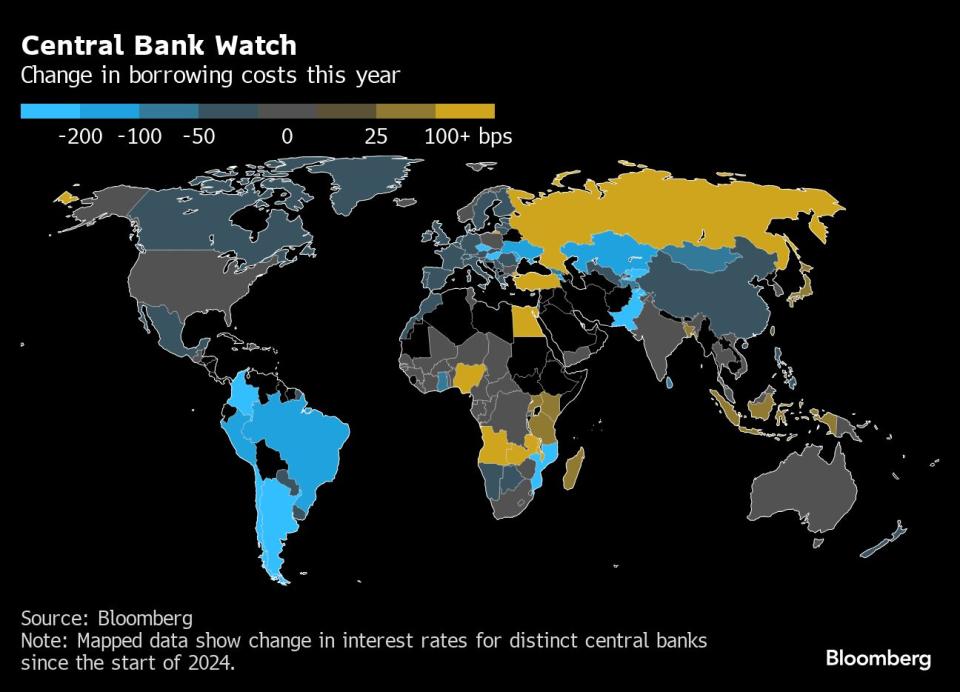

Purchasing managers’ indices (PMIs) from Japan, the UK and the eurozone will also be in focus, while China is expected to hold its key rates steady. Sweden’s Riksbank is expected to cut rates, while central banks in Turkey, Thailand, Indonesia and South Korea are expected to hold rates steady.

Asia

Bank of Japan Governor Kazuo Ueda will be in the spotlight on Friday when he appears in parliament to explain the reasons behind the July 31 rate hike, after some traders cited the move as a catalyst for market tensions earlier this month. Ueda is also expected to discuss the outlook for monetary policy.

Elsewhere, the People’s Bank of China (PBOC) is expected to keep prime rates on 1-year and 5-year loans unchanged after surprise cuts last month. Bloomberg Economics expects the PBOC to cut rates by 10 basis points in the fourth quarter.

The Reserve Bank of Australia (RBA) released the minutes of its monthly meeting on Tuesday, as economists watched for signs of the RBA easing its aggressive rhetoric. The Bank of Korea (BoK) is expected to keep its policy rate at 3.5% to prevent household debt from rising. Thailand and Indonesia are also expected to keep borrowing costs unchanged.

The region will receive PMI data for Australia, Japan and India on Thursday, and Thailand’s second-quarter economic growth is expected to accelerate year-on-year and slow from the previous period.

Consumer price inflation in Japan likely rose for the third straight month in July, and trade figures from Japan, Malaysia and New Zealand are due this week. Malaysia also releases inflation data.

Europe, Middle East, Africa

With the European Central Bank widely expected to resume rate cuts in September, all eyes will be on data on negotiated wages and the minutes of policymakers’ July decision, both due Thursday.

Flash PMIs for Germany, France and the eurozone are also due out that day, with economists predicting results that will be just as bad as last month.

The situation in the UK, which has just recorded exceptional figures for GDP in the second quarter, is much rosier, and the PMI figures there should be optimistic.

Data from South Africa is expected to show on Wednesday that inflation slowed to an 11-month low of 4.8% in July, from 5.1% a month earlier. That could allow the central bank to cut rates at its September policy meeting if the disinflationary process continues. Governor Lesetja Kganyago has repeatedly said he will adjust rates once inflation is sustainably at the 4.5% midpoint of his target range.

Five central bank rate decisions are scheduled in the region:

On Tuesday, the Riksbank is expected to announce another cut, with Swedish officials likely to resist domestic calls for a half-percentage point cut in the benchmark rate and opt for a more conventional 25 basis point reduction.

On the same day, Turkey’s central bank is expected to leave its key interest rate at 50% for a fifth consecutive month, due to visible signs of economic slowdown, even though annual inflation remains above 60%.

Iceland plans to keep interest rates on hold at 9.25 percent on Wednesday, the highest in Western Europe. Market participants expect monetary easing to begin in the last quarter of the year, according to a central bank survey released Friday.

On the same day, Rwanda is set to cut its key interest rates for a second consecutive time as inflation remains moderate.

Botswana is likely to leave its policy rate unchanged on Thursday to support the economy which contracted for the first time since the peak of the pandemic in the three months to March and as inflation remains within target.

Latin America

Chile’s economy likely shrank in the three months through June due to weak investment and exports, but consensus is for a rebound in the second half.

Economists surveyed by the central bank forecast GDP growth of 2.3% in 2024, up from 0.2% last year.

Paraguay’s central bank kept its key interest rate unchanged at 6% for a fourth consecutive month in July and could do so again this week after annual inflation edged up to 4.4% in July.

Last month, Argentina released surprisingly strong May GDP benchmark data, largely thanks to a bumper harvest that won’t support the June results released this week.

In Mexico, nearly two years of double-digit interest rates are holding back domestic demand and are expected to weigh on June retail sales, GDP indicators and full second-quarter results released this week. Economists in Citi’s biweekly survey forecast GDP growth for the whole of 2024 to slow for the third straight year, to 1.7%.

Mid-month inflation data will give Mexican observers a first chance to assess the Central Bank of Mexico’s quarter-point rate cut on Aug. 8 to 10.75%.

The minutes of the meeting could shed more light on Banxico’s position that the rise in food prices will be temporary and that slowing growth should help curb the rise in consumer prices.

—With assistance from Beril Akman, Brian Fowler, Vince Golle, Robert Jameson, Laura Dhillon Kane, Niclas Rolander, Monique Vanek, and Ott Ummelas.

Bloomberg Businessweek’s Most Read Articles

©2024 Bloomberg LP