Getty Images

Getty ImagesBritish inflation fell unexpectedly in December, raising expectations of an interest rate cut next month.

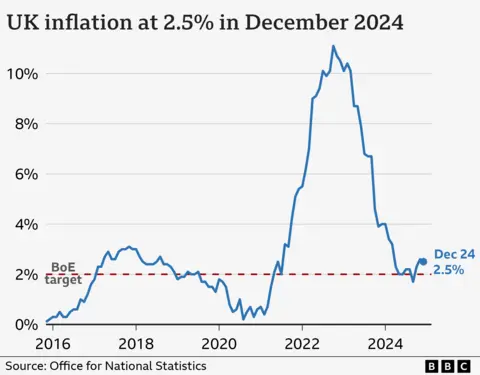

Prices rose 2.5% in the year to December, compared with 2.6% the previous month, marking the first fall in inflation in three months.

The fall was driven by falling hotel prices and a smaller than usual rise in airfares, but prices are still rising faster than the Bank of England’s target.

Borrowing costs in the UK, which have risen in recent weeks, fell and sterling rose, easing pressure on Chancellor Rachel Reeves, whose fiscal policies have been criticized for contributing to market turmoil .

Government borrowing costs rose to a 16-year high and sterling fell to a 14-month low.

After the inflation figure, investors increased their bets on the likelihood of an interest rate cut next month and support a second cut by the end of this year.

The Bank of England decided to hold interest rates at 4.75% last month after policymakers said Britain’s economy had performed worse than expected, with no growth between October and December.

Ruth Gregory, deputy chief economist at Capital Economics in the UK, said the inflation figure “strengthens the case” for a cut to 4.5% in February.

Inflation is well below its peak in October 2022, when prices soared, pushing up the cost of living for households and leading to higher interest rates, making the cost of loans, more expensive credit cards and mortgages.

Economists had expected inflation to remain unchanged last month.

Easing restaurant price rises and falling hotel prices have helped bring down inflation, the Office for National Statistics (ONS) said.

Prices of tobacco products, which include cigarettes, pouches, vape refills and cigars, have also increased at a slower pace.

But Grant Fitzner, chief economist at the ONS, said the rise was offset by the rising cost of fuel and used cars.

Following the release of UK data, government borrowing costs returned to last week’s levels and sterling rose slightly to $1.22.

The cost of debt in the UK then fell further after US figures revealed core inflation had fallen more than expected. the headline inflation figure in the United States has increased.

Chancellor Reeves said there was “still more work to be done to help families across the country cope with the cost of living”, but added that the Government had “taken action to protect health records pays workers for higher taxes” and raised the minimum wage.

But shadow chancellor Mel Stride said economic growth had been “killed to death by this government” and called on Reeves to “urgently explain how it is now going to achieve it”.

In response to the market turmoil, it is understood Reeves will make announcements on Labour’s industrial strategy.

Jane Sydenham, investment director at Rathbones Investment Management, told the BBC’s Today program that investors needed to “see some details” about the UK’s plans.

“Will there be tax breaks for certain industries? I think the market wants to see details and concrete actions,” she said.

Rising borrowing costs have a knock-on effect on the government’s tax and spending plans, as it will have to pay more interest to finance its existing debt. This leaves less spending on utilities and investments.

Darren Jones, chief secretary to the Treasury, told BBC Public Services they “should live within their means”.

Asked if this gave the impression that cuts were being made, he said: “It’s just a matter of prioritization.”

“You can’t charge that much.”

Jonny Gettings, operations director of Ennio’s Italian restaurant and small hotel in Southampton, told the BBC the outlook for the business looked “considerably worse” with increases in the minimum wage and national insurance contributions and reductions in reductions in professional rates from April.

Mr Gettings added that reducing staff hours would be the “last scenario”, but said the restaurant could consider reducing the size of its menu, reviewing its suppliers or changing its opening hours.

“As soon as you raise prices, you still have a series of problems to solve, because then the problem is that customers will vote with their feet and eat elsewhere,” he added.

“You can only charge so much for a menu item before the customer says, ‘Well, wait a minute.'”

Rising rent and bills

Some people have inflation-linked phone and broadband contracts, meaning their bill will rise in April in line with the latest data.

Comparison site Uswitch said these bills are expected to rise by an average of £21.99 a year for broadband and an average of £15.90 a year for mobile.

However, due to new rulesmany contracts now state expected increases in pounds and pence each year over the course of the agreement.

Separate ONS figures released on Wednesday showed the average cost of rent rose 9% in December compared to the previous year, with UK house prices rising 3.3% in in the 12 months to November, with the largest increase seen in Northern Ireland.