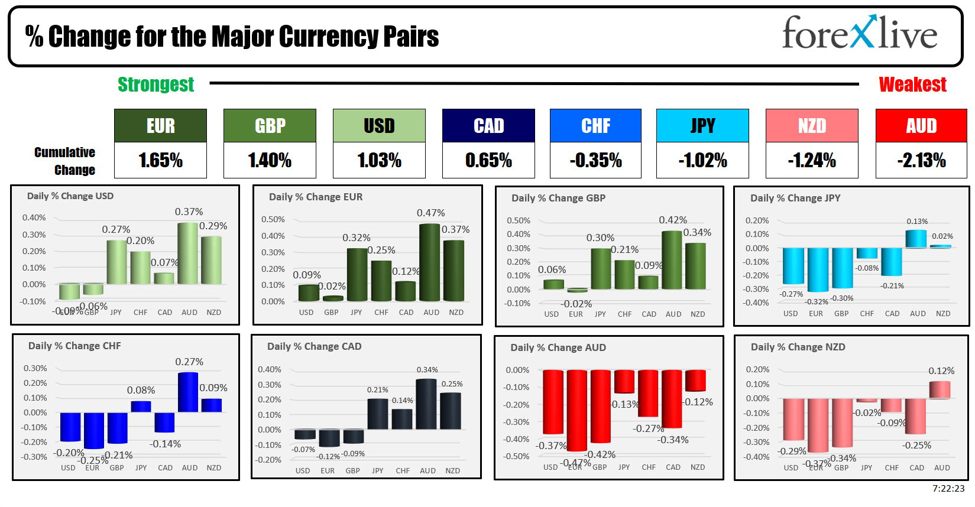

EUR is strongest and AUD is weakest at the start of the NA session.

As the North American session begins, the EUR is the strongest and the AUD the weakest. The USD is stronger overall.

Geopolitical risk remains at a scorching high as Israel’s War Cabinet meets today to discuss a response to the weekend’s Iranian attack. Meanwhile, in the United States, the administration is preparing economic sanctions in support. “How far can you push without going too far?” it’s the tightrope walking that takes place.

Today in Europe there was a data breach with mixed results. Below is a summary:

-

German Wholesale Price Index (WPI) m/m (EUR): Actual data showed an increase of 0.2%, slightly higher than the forecast of 0.1%, and an improvement from the previous -0.1%. This indicates a modest rebound in wholesale prices.

- Change in number of applicants in the United Kingdom (GBP): The actual variation was 10.9K, lower than the predicted 17.2K but higher than the previous 4.1K.

- Average earnings index in the United Kingdom 3 months/year (GBP): Actual growth was 5.6%, slightly above the forecast of 5.5% and consistent with the previous 5.6%. This shows stable wage growth over the past three months.

- Unemployment rate in the United Kingdom (GBP): The actual unemployment rate was 4.2%, higher than the forecast of 4.0% and the previous 3.9%. Overall, a declining employment situation in the UK

- Italian trade balance (EUR): Italy recorded a trade surplus of 6.03 billion euros, exceeding the forecast of 3.44 billion euros and the previous 2.50 billion euros. This significant improvement suggests stronger than expected business performance.

- Trade balance (EUR): The actual trade balance was 17.9 billion euros, lower than the forecast 27.3 billion euros and down from the previous 27.1 billion euros, indicating a smaller trade surplus than expected.

-

German Economic Sentiment ZEW (EUR): The confidence index reached 42.9, well above the previous forecast of 35.9 and 31.7, demonstrating increased optimism among financial analysts and institutional investors regarding Germany’s economic outlook .

-

ZEW economic sentiment in the EU (EUR): Overall European economic sentiment as measured by ZEW rose to 43.9, higher than the previous forecast of 37.8 and 33.5, reflecting an improvement in overall economic confidence.

These indicators suggest mixed economic conditions across Europe, with signs of improving confidence and business performance in some areas, but issues such as rising unemployment in the UK present challenges.

In China, GDP was stronger overnight, at 5.3% versus 4.8% (and up from 5.2% last month). However, industrial production (4.5% vs. 6.0% est.) and retail sales were lower (3.1% vs. 5.1% est.).

This morning’s earnings schedule showed generally better than expected results.

-

Morgan Stanley (MS) Q1 2024 (USD):

- PES: $2.02 vs. expectations of $1.66 (BEAT)

- Income: $15.14 billion versus expectations of $14.41 billion (BEAT)

-

Bank of America Corp (BAC) Q1 2024 (USD):

- Adj. PES: $0.83 vs. expectations of $0.77 (BEAT)

- Income: $25.82 billion versus expectations of $25.46 billion (BEAT)

-

PNC Financial Services Group Inc (PNC) Q1 2024 (USD):

- PES: $3.10 vs. expectations of $3.02 (BEAT)

- Income: $5.145 billion versus expectations of $5.19 billion (MISSED)

-

Bank of New York Mellon Corp (BK) Q1 2024 (USD):

- Adj. PES:$1.29 vs. expectations of $1.19 (BEAT)

- Income: $4.53 billion versus expectations of $4.39 billion (BEAT)

-

Johnson & Johnson (JNJ) Q1 2024 (USD):

- Adj. PES: $2.71 vs. expectations of $2.64 (BEAT)

- Income: $21.383 billion versus expectations of $21.4 billion (MISSED)

-

UnitedHealth Group Inc (UNH) Q1 2024 (USD):

- Adj. PES: $6.91 vs. expectations of $6.61 (BEAT)

- Income: $99.80 billion versus expectations of $99.26 billion (BEAT)

What gains are coming this week? Below is a list of some of the major releases:

Tuesday after closing:

- United Airlines, Interactive Brokers, JB Hunt

Wednesday before opening

- Abbott, Travelers, US Bancorp

Wednesday after closing:

- Alcoa, Kinder Morgan, Discover, CSX

Thursday before opening

- TSMC (Taiwan Semiconductor), Nokia, DH Wharton

Thursday after closing:

- Netflix, intuitive surgical

Friday before opening:

European Central Bank (ECB) policy chief Olli Rehn recently claimed the ECB was on track for a possible interest rate cut in June, provided there is no rollback inflation and that economic conditions align with their objectives. Rehn stressed that a decision to cut rates would depend on the June assessment confirming that inflation is converging towards the ECB’s target. He noted that this outlook assumes there will be no further setbacks in geopolitical or energy prices that could affect inflation. Additionally, Rehn said any future rate decisions would maintain policy restrictive enough to effectively manage inflation, indicating a cautious approach to ensuring stability. The upcoming first quarter wages data, expected next month, will play a crucial role in solidifying this outlook and potentially strengthen the case for a rate cut.

Today, several key speeches from Federal Reserve officials will be delivered as the clock ticks toward the so-called quiet period before the May 1 interest rate decision, after the close Friday.

- At 9:00 a.m., FOMC member Jefferson will speak, likely addressing current economic conditions or monetary policy.

- FOMC member Williams will follow with a speech at 12:30 p.m.

- At 1 p.m., FOMC member Barkin is scheduled to speak.

- Shortly after, at 1:15 p.m., Fed Chairman Powell will also make remarks.

U.S. stocks in pre-market trading are higher. US yields are slightly higher after rebounding yesterday following better-than-expected retail sales data. Oil prices are lower to start the trading day in the United States despite conflict(s) in the Middle East.

A look at other markets at the start of the North American session currently shows this. :

- Crude oil is trading down -$0.45 or -0.49% at $84.96. Yesterday at this time the price was $84.95

- Gold is trading down -$9.30 or -0.39% at $2,372.82. At this time yesterday, the price was $2,359.67.

- Silver is trading down $0.58 or -2.0% at $28.26. Yesterday at this time the price was $28.52

- Bitcoin is currently trading at $62,980. At this time yesterday, the price was trading at $66,097. Bitcoin has not been the safe haven, but this time risk aversion:

In pre-market, the main indices are trading on the rise:

- Dow Industrial Average futures imply a gain of 239.89 points. Yesterday, the index fell -248.13 or -0.68% to 37735.12

- S&P futures imply a gain of 11.43 points. Yesterday, the index fell -61.59 points or -1.20% to 5061.81

- Nasdaq futures imply a gain of 28.17 points. Yesterday, the index fell -290.08 points or -1.79% to 15885.02

European indices are trading lower:

- German DAX, -0.96%

- CAC France, -0.96%

- British FTSE 100, -1.24%

- Spanish ibex, -0.82%

- Italian FTSE MIB, -0.85% (delayed by 10 minutes)

Stocks in Asia-Pacific markets were mostly lower:

- Japanese Nikkei 225, -1.94%

- Chinese Shanghai Composite Index, -1.65%

- Hong Kong Hang Seng Index, -2.12%

- Australian S&P/ASX index, -1.81%

In the US debt market, yields are slightly higher. Yields rose yesterday as flight to safety flows reversed and then retail sales strengthened.

- 2-year yield 4.944%, +0.6 basis point. At this time Friday, the yield was at 4.959%

- 5-year yield 4.658%, +1.3 basis points at this time Friday, the yield was at 4.625%

- 10-year yield 4.6.2 percent, +1.5 basis points. At this time Friday, the yield was at 4.581%

- 30-year yield 4.752%, +1.2 basis points. At this time Friday, the yield was at 4.674%

Looking at Treasury yield curve spreads, the state of the yield curve over the last 24 hours:

- The 2-10 year spread stands at -30.1 basis points. As of this time Friday, the spread was -37.8 basis points.

- The 2-30 year spread stands at -19.2 basis points. As of this time Friday, the spread was -28.5 basis points.

European 10-year benchmark yields are higher:

European 10-year yields

cnbctv18-forexlive