- Whale portfolios increased the assets to 16.793 million ETH while Netflows exchange has shown a sharp increase in outings.

- A USDT entry of $ 398 million and an ETH exit of $ 540 million on the same day, the same day, aggressive repositioning by major investors.

Ethereum (ETH) dropped to $ 2,492, losing 3.73% in 24 hours, following a rejection near the $ 2,800 bar.

This withdrawal took place even though the whale wallets accumulated accumulation and stable inputs jumped, referring to a strategic repositioning behind the scenes.

However, short -term feeling remains fragile.

While some traders seem to go out with losses, chain activity shows a strategic accumulation. This divergence creates an uncertainty around the next ETH movement as key technical levels come into play.

Double or report caution?

Whale portfolios holding 10k to 100K ETH increased their assets to 16.793 million ETH, which suggests a strong accumulation.

At the same time, Exchange Netflows showed a weekly point of 84.22% in ETH outings, strengthening a long -term bull view.

However, a whale recently sold 10,543 ETH at $ 2,476, resulting in a loss of $ 2 million in just two days.

This lonely discharge, although striking, does not necessarily know the wider accumulation trend. That said, he reflects the unemployed discomfort in a volatile market.

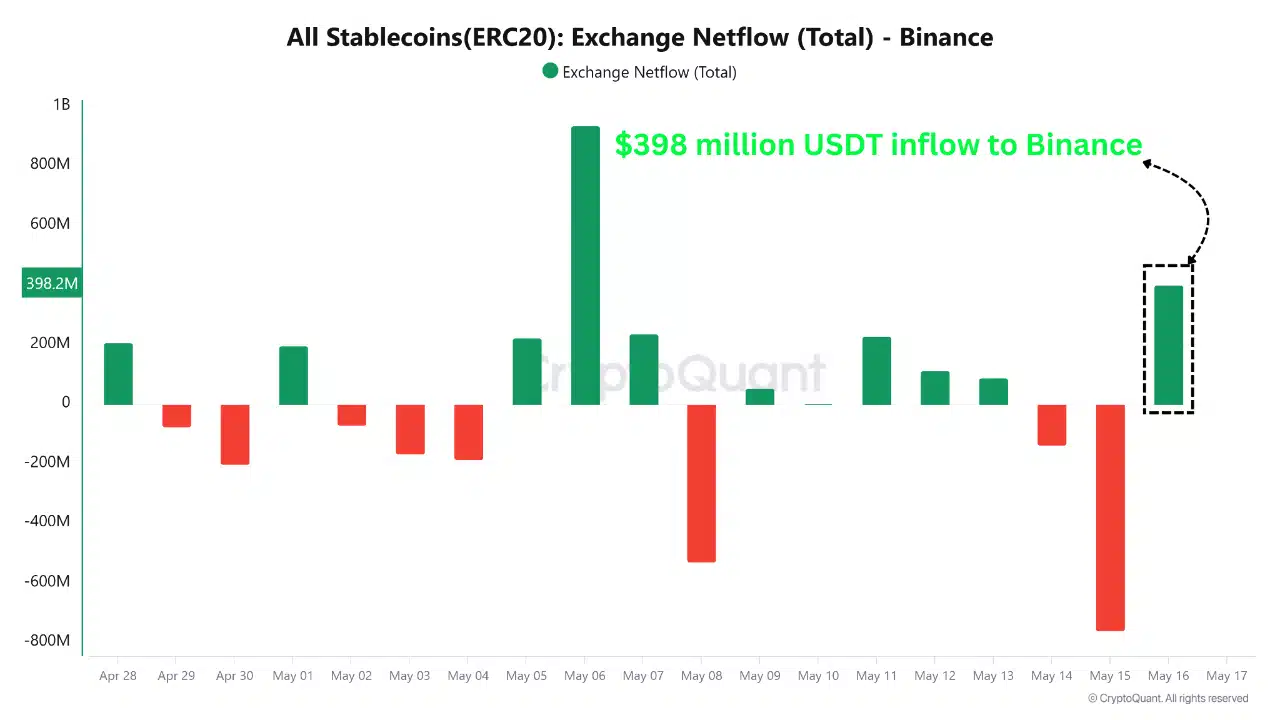

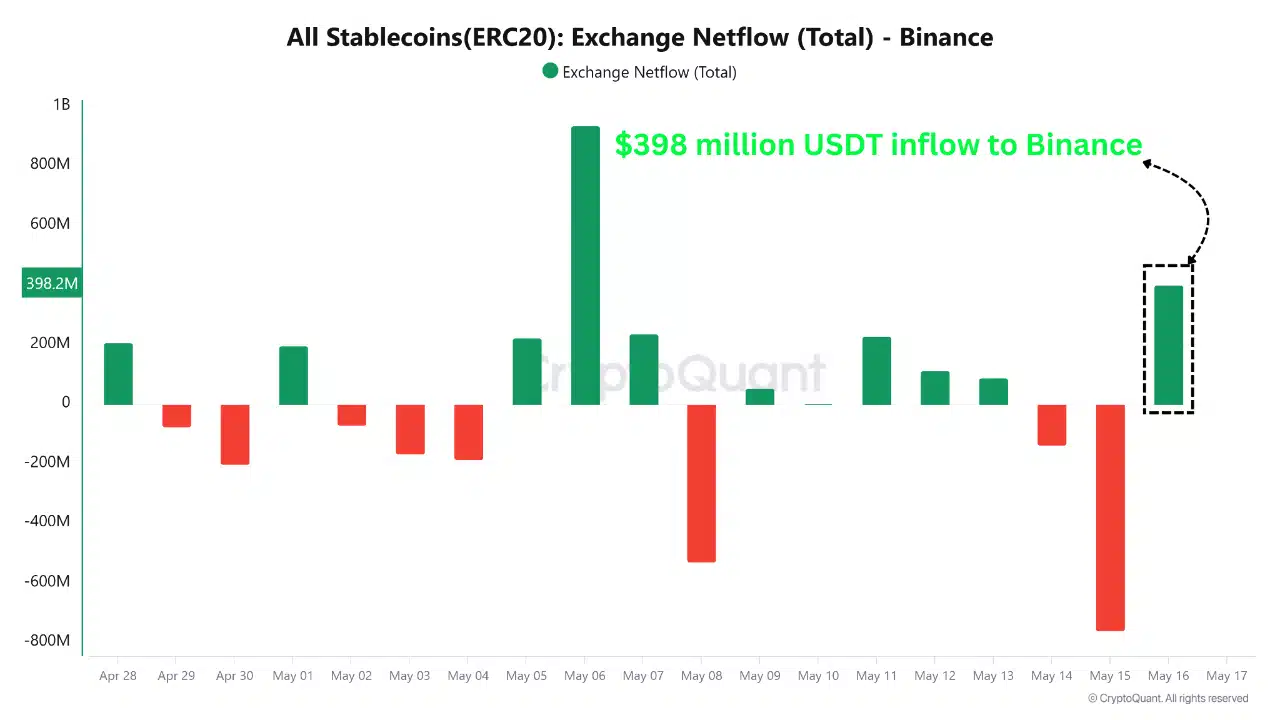

Source: cryptocurrency

What is $ 398 million in USDT and $ 540 million in ETH signal?

The chain data revealed a significant change: a value of $ 398 million from Tether (USDT) took place in Binance, while $ 540 million of ETH were removed from centralized exchanges on the same day.

This marks the biggest ETH -downside in one day since early April, reporting that large holders probably move assets in storage or cold storage environments.

Meanwhile, the massive inputs of the USDT suggest that the whales stop dry powder to accumulate more eth because it is negotiated in a perceived accumulation range.

Source: cryptocurrency

Of course, this double movement suggests more than chance. He suggests that whales are precisely running.

More users join Ethereum, existing users calm

Interestingly, the Ethereum network experienced an 18.73% increase in new addresses in last week. However, active addresses fell 3.18%, which suggests that existing users have withdrawn.

This divergence suggests that if the long -term interest in Ethereum increases, the short -term commitment is cooling.

Therefore, although new users join, those existing can wait for the key. This behavior is often observed during the transitional market phases when investors hesitate before the next major decision.

Source: intotheblock

Ethereum’s open interest abandoned From 3.29% to $ 16.02 billion, highlighting a reduction in speculative positions.

Merchants seem to close the betting effects after the recent prices rejection at $ 2,800. This drop reflects the feeling of risk as volatility peak.

However, he can also point out that the market resets, eliminating weak hands before the next leg.

Does ETH find support or a dead point at the key levels of the FIB?

Ethereum recently affected $ 2,629, lining up with the extension of 2.618 Fibonacci, before retiring.

The current price oscillates nearly $ 2,492, being between critical support and resistance areas. The Stochastic RSI shows a neutral moment with values at 61.31 and 51.47.

Therefore, the ETH can consolidate before a directional break.

The price action around this FIB level should be closely monitored. If the bulls are greater than $ 2,292 (FIB 1.618), the upward continuation remains possible.

Source: tradingView

Despite today’s decline, Ethereum shows a strong support for whales and an increase in stablecoin entrances. While short -term volatility has triggered isolated outputs, wider metrics indicate an accumulation.

If buyers defend the current levels, a rebound around $ 2,800 remains possible.