Ether and Top Altcoins, including Cardano, fell two -digit in an hour while the market continued to fall back from the first cycle of US President Donald Trump against imports from China, Canada and Mexico.

Ether (ETH), the second largest cryptocurrency by market capitalization, dropped from 16% in one hour to $ 2,368 on February 3 at 2 h UTC.

It has since been awarded to $ 2,521, but is still down 38% compared to its 2024 summit of $ 4,078 reached on December 17 – almost six weeks after Trump’s presidential victory.

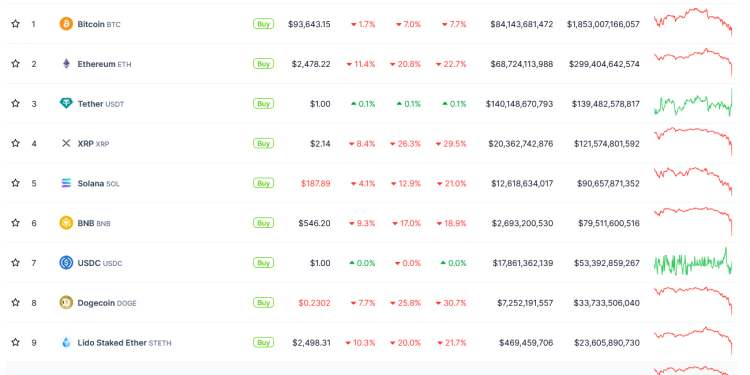

Meanwhile, Avalanche (Avax), XRP (XRP), ChainLink (Link), Dogecoin (Doge) and other best altcoins have dropped more than 20% in the last 24 hours, contributing to a drop of 11, 4% of Crypto market capitalization at 3.17 billion dollars at $ 3.17 billion to $ 3.17 billion to $ 3.17 billion to 3.17 billion dollars at $ 3.17 billion in dollars $ 3.17 billion to $ 3.17 billion to $ 3.17 billion to $ 3.17 billion to $ 3.17 billion to 3.17,000 billion dollars at $ 3.17 billion in dollars 3.17,000 billion dollars to $ 3.17,000 billion to $ 3.17,000 billion to $ 3.17,000 billion to $ 3.17 billion to $ 3.17 billion at 3.17,000 Billion dollars at $ 3.17 billion at $ 3.17,000,000, Coingecko data shows.

Altcoins, including Ether and Cardano, fell two figures on February 3. Source: Flirtatious

The founder of research 10x, Markus Thielen, told Cintelegraph: “The clear drop in altcoins reflects a wave of arrest triggers combined with a buyer’s strike from retail investors.”

Thielen said the negotiation volumes have dropped in recent weeks, “reporting a decreasing appetite and the lack of conviction of investors”.

While the market knew that Trump’s prices were potentially arrived, they were not evaluated because investors had been “obsessed” on Deepseek news in last week, Thielen wrote in a previous February 2 report .

The market could face “prolonged uncertainty” as opposed to a “day shock,” said Thielen. The question of whether these support areas will largely depend on how American actions operate on February 3, he added.

In relation: Inside Trump crypto agenda: same, dry task force and bitcoin reserve plans

It occurs after the term contracts on the Nasdaq 100 fell on February 3, down almost 2.7% after the announcement of the prices, while the S&P 500 and the term contracts linked to the industrial average of Dow Jones fell by 2% and 1.5%, respectively.

The withdrawal of the market also reflected in the Crypto Fear & Greed index, a measure of the feeling of the cryptocurrency market which fell 16 points in the “fear” area to a score of 44 out of 100.

The score has not been less than 44 since October 11.

Change in the score of the Crypto Fear & Greed index in the last month. Source: Alternative.me

Bitcoin (BTC) also dropped by 6.8% in the last 24 hours to $ 94,743 – but was less hard in the last fall in the market, which started in the early hours of February 3.

Consequently, the domination of bitcoin rose from around 61.1% to 64%, according to tradingView data.

“The increase in the domination of Bitcoin without corresponding increase in the overall market capitalization of cryptography suggests that the traders opposed to risk run out of altcoins and in Bitcoin,” said Thielen.

Review: How the laws on cryptography change around the world in 2025