Eli Lilly outperformed the S&P 500 for five straight years as Wall Street realized the enormous opportunity in the obesity drug sector. Six in a row is not out of the question. Performance since the start of the year: up 33.7% Forward price/earnings ratio: 34.3 versus a five-year average of 34.5 Our rating: buy equivalent 1 Our price target: $1,000 LLY year-to-date Stock performance of Eli Lilly year-to-date. ’24 look back The dominant theme for Eli Lilly this year has been the rollout of its very important GLP-1 obesity drug, Zepbound, which was approved by the Food and Drug Administration in late 2023. It was a real success : Sales are expected to be about $5.1 billion, according to analyst estimates compiled by FactSet. At the end of last year, Wall Street projected revenue from Zepbound of $1.9 billion. Upward revisions of this magnitude help explain why the stock followed its 59% jump in 2023 with another strong year. Eli Lilly has steadily increased its supply of Zepbound and its sister drug Mounjaro, used to treat Type 2 diabetes, in a bid to ease short-term shortages amid booming demand. But just as crucially, the company announced a series of additional manufacturing investments, with new investments seemingly every few months, in a sign of long-term confidence in the GLP-1 market. Given Lilly’s decades-long quest for Alzheimer’s disease, it’s worth noting that the company’s first successful treatment for the memory-stealing disease, Kisunla, was approved in July, although it hasn’t not yet made a significant contribution to revenue. ’25 looking ahead Eli Lilly’s ability to expand the available offerings of Zepbound and Mounjaro in the new year will be crucial. This seems obvious at first glance, but there is a more nuanced explanation: Keeping these products off the FDA’s shortage list will hamper the ability of so-called compounding pharmacies to make unapproved copies of drugs. Another area to watch in 2025 is whether the FDA expands Zepbound’s label, which would allow the obesity drug to be prescribed as a treatment for other conditions, such as obstructive sleep apnea and reduction risks of heart failure. This would help advocate for broader insurance coverage and, therefore, a greater revenue opportunity. Updates on Eli Lilly’s weight loss pipeline could also be significant, including the expected readout of its advanced trial of the obesity pill or forglipron. Mid-term results released in June 2023 showed it was highly effective, and Wall Street views oral versions of obesity treatments as key to meeting peak demand. Zepbound and its main rival, Novo Nordisk’s Wegovy, are administered by injection once a week. In the year ahead, investors will keep a close eye on health care policy outside Washington, particularly with noted pharmaceutical industry critic Robert F. Kennedy Jr. awaiting confirmation of the management of the Ministry of Health and Social Services. Although he recently told Jim that he sees GLP-1 as part of the solution to America’s obesity crisis, Kennedy has often derided the drugs in the past. Additionally, it’s unclear what the incoming Trump administration might mean for the Biden White House’s proposal to expand Medicare and Medicaid access to GLP-1s. Positive updates from Novo Nordisk and other hopeful challengers such as Viking Therapeutics could put pressure on Lilly’s stock in the near term, but we are confident in its competitive advantage, largely due to its advantages in terms of manufacturing capacity. Jim Cramer recently named Eli Lilly as one of the top 12 holdings in the portfolio through 2025. (Jim Cramer’s Charitable Trust is long LLY. See here for a complete list of stocks.) As a CNBC Subscriber Investing Club with Jim Cramer, you will receive a trade alert before Jim makes a trade. Jim waits 45 minutes after a trade alert is sent before buying or selling a stock in his charity’s portfolio. If Jim talked about a stock on CNBC TV, he waits 72 hours after the trade alert is issued before executing the trade. THE ABOVE INVESTMENT CLUB INFORMATION IS SUBJECT TO OUR TERMS AND CONDITIONS AND PRIVACY POLICY, AS WELL AS OUR DISCLAIMER. NO OBLIGATION OR FIDUCIARY OBLIGATION EXISTS, OR IS CREATED, BY VIRTUE OF YOUR RECEIPT OF ANY INFORMATION PROVIDED IN CONNECTION WITH THE INVESTMENT CLUB. NO SPECIFIC RESULTS OR PROFITS ARE GUARANTEED.

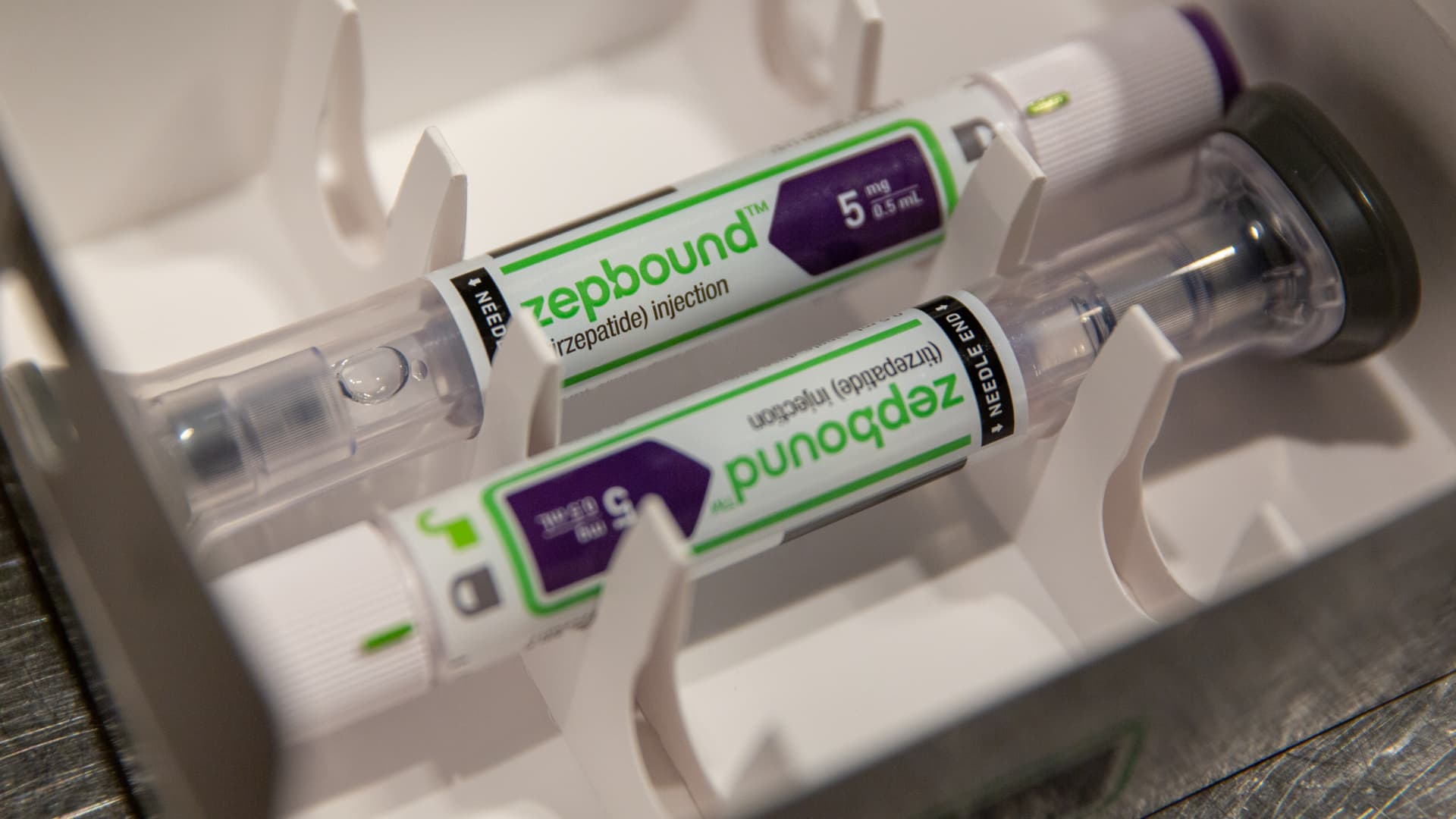

An Eli Lilly & Co. Zepbound injector pen displayed in the Brooklyn borough of New York, United States, on Thursday, March 28, 2024.

Shelby Knowles | Bloomberg | Getty Images

Elie Lilly outperformed the S&P500 for five years in a row as Wall Street realized the enormous opportunity in obesity drugs. Six in a row is not out of the question.

cnbc-health care