Unitedhealth (UNH) experienced significant volatility, with its actions down approximately 55% compared to its 52 -week highest. Once considered a first -rate stable pillar, the company is more negotiated as an asset in distress in the middle of a series of negative developments. The increase in medical costs, an unexpected departure from the CEO and increased regulatory uncertainty resulting from the recent executive decree of former president Trump on drug prices have all contributed to the discomfort of investors.

The confident investment begins here:

Although the stock may seem attractive after its sharp decline, caution is justified. The current environment remains very uncertain and the additional risks could materialize in the short term. Consequently, I am a lowering on one.

Increase in medical costs

The most important challenge in UNH these days is the underlying push of medical costs that have blind management. As the most eminent supplier of Medicare Advantage plans in the United States, serving more than 8 million elderly people, the UNH has faced a burst of complaints while patients are looking for delayed procedures such as hip and knee replacements after the case. It was one of the main reasons why UNH reduced its prospects from year to year after a rare results.

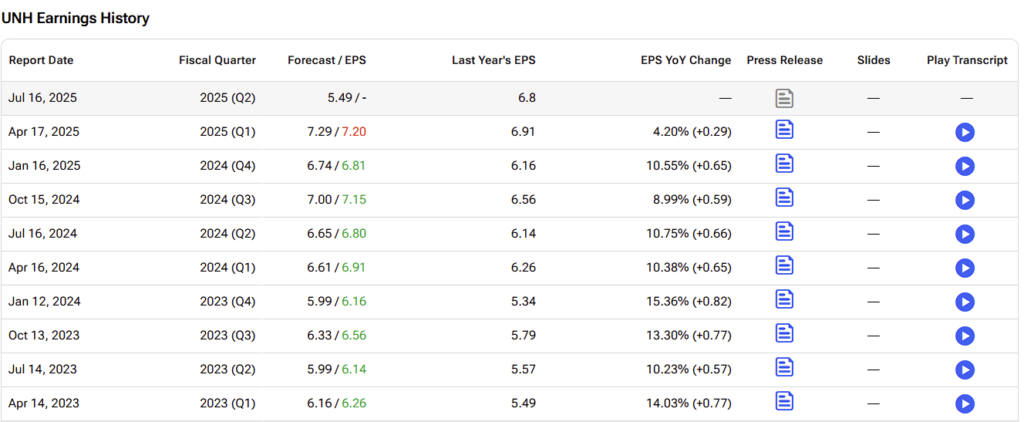

In fact, it was the first round of UNH’s results since 2008. The company cited the “unforeseen changes” of its Optum unit and the use of care higher than expected. Since then, investors have naturally continued to pour actions while faith in UNH cost management has not set.

The exit of the CEO Sparks Leadership Crisis

While the dust sets in, a UNH dropped a bomb: CEO Andrew Witty suddenly resigned two days ago for “personal reasons”, and society withdrew its previous prospects. Stephen Hemsley, a former CEO and current president, returned to the higher role, but this decision looks like an unexpected judgment.

Witty’s departure is capping a difficult year for the company, the one that saw a massive cyber attack exhibiting the data of 190 million customers and the shocking murder of the CEO of Unitedhealthcare, Brian Thompson, in December. In particular, the fact that his resignation came after UNH revenue for the first time since the great financial crisis raised questions about what could go behind the scenes. At 72, analysts see Hemsley as a temporary solution. So, this is only reasonably added to investors’ anxiety in the face of the long -term lack of plan of the company.

The craziest part is that the emptiness of UNH leadership could not arrive at a worse moment. The UNH faces a meticulous examination on the outbreak of medical costs and the indignation of the public linked to the murder of Thompson, which triggered debates on the practices of insurers. Witty had led UNH revenues to $ 400 billion, but recent stumbling trees have eroded confidence. Hemsley directing a ship under regulatory and operational tension, the absence of a long -term leader may keep UNH stocks in the penalty box.

The tarification order of target Trump drugs PBMS

However, the most decisive blow landed on Monday this week on Monday, when President Trump signed an executive decree to reduce the prices of American drugs by lining them up with lower costs abroad. It was not only a success for drug manufacturers because it directly targeted pharmacy services (PBMS) as ONH Optum RX, accusing them of inflating costs.

Reuters said that the prescription aims to ignore PBM, potentially disturbing their role in the negotiation of drug prices. Obviously, the broader threat to the margins of Optum RX is significant, especially since analysts warn against the legal and regulatory obstacles which could prolong uncertainty.

A good deal with luggage

On paper, one could say that UNH looks like a flight. Trading at around 13 times the consensual BPA this year is far from its historic premium, while the course of the action of 55%, which mainly took place in just one month, suggests that the market may have done excessively.

The main thing is that UNH is not a small capitalization with a speculative commercial model but an insurance giant that generates income of more than $ 400 billion per year. It has a fantastic history of generation of high yields on capital and returning in cash to shareholders.

However, risks are difficult to ignore. Trump’s decree could compress the benefits of the PBM if drug prices drop without compensating the gains elsewhere. And of course, the diversified UNH business model could amortize the blow in relation to peers like Cigna (CI), but the negative feeling is palpable.

Legal challenges to order, as reported by experts in health policy, could cause uncertainty, keeping UNH’s actions in limbo. Thus, until clarity emerges, what some call a good deal could be dead money.

Is stock Unitedhealth a purchase or a sale?

Wall Street is very optimistic about United after its steep sale. The title retains a high purchase consensus rating, with 21 analysts still bullish and four neutrals. Not a single analyst is lower on one. Currently, the average objective of the UNH stock market price is $ 540.68, indicating an increase in ~ 76% in the next twelve months.

Stockh Stock looks cheap, while risks are looming

The drop in the course of United Action of United Health has left multiple trade in distress, but significant winds remain. The climbing of medical costs, a vacuum of leadership and an increased regulatory uncertainty – in particular following the executive decree of former president Trump on the pricing of medicines – rocked the confidence of investors. Although the current evaluation may seem attractive, the risks surrounding pharmacy services (PBM) and wider structural concerns suggest a cautious approach.

Currently, UNH looks like a potential value trap rather than an imperative opportunity. Investors can be better served while waiting for lighter signs of stability, such as regulatory clarity on PBMs or the appointment of a new CEO with a credible strategic vision – before entry.

Warning and disclosure