- The long -term merchants are highly long on Doge, showing a short -term sentence.

- No strong correlation between DAA points and price gains, referring to speculative activity.

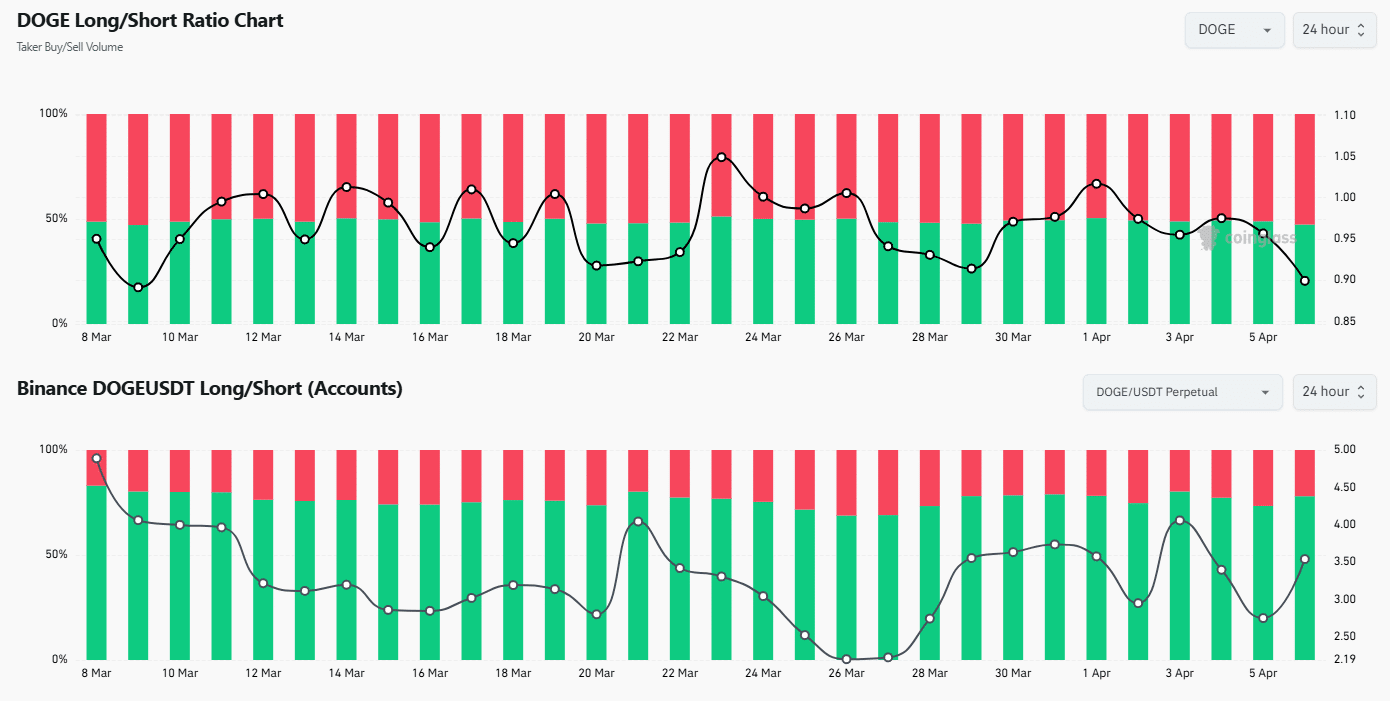

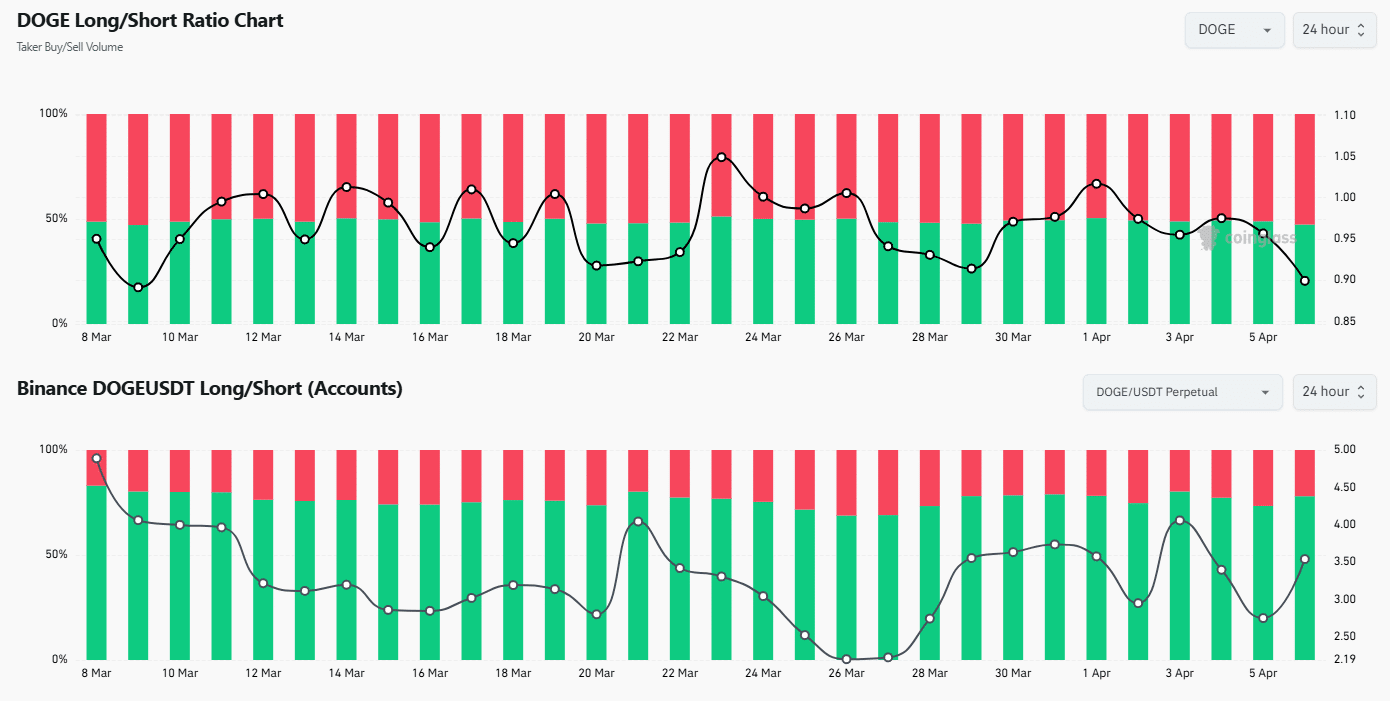

Binance’s term merchants seem extremely confident in Dogecone (Doge), with long positions exceeding shorts over several intervals.

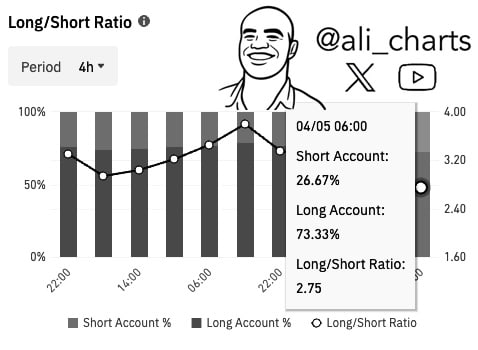

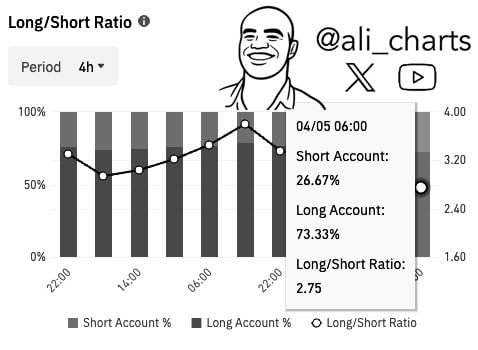

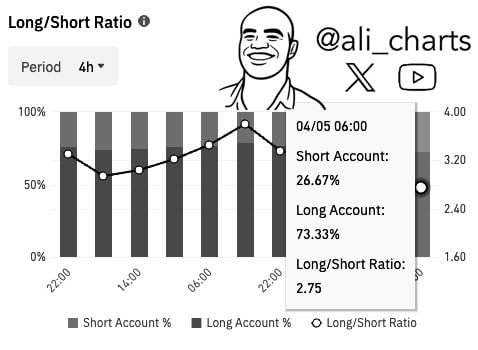

According to a graph shared by Ali Martinez, long accounts culminated at 73.33% with a long / short ratio of 2.75 on April 5.

Source: X

The previous data sets show an even stronger feeling.

For example, on April 3, long positions increased to 80.23%, with a long / short ratio of 4.06. Meanwhile, short accounts fell high at only 19.77%.

On April 6, long interest had decreased slightly, but still represented 77.98% of the open positions.

Source: Coringlass

Future long / short / short / short ratio data between March 30 and April 6 reveal a change in brutal feeling.

Of course, the long -term book has leaned for a long time at the start, but in April, short positions slipped up to 52.66%, while long -term interest dropped to 47.34%, which reduced the long / short ratio to 0.899 – its lowest reading of this week.

The impact is even clearer in the Liquidations Doge Futures

In addition, this divergence becomes clearer when the figures of the cash price and liquidation come into play.

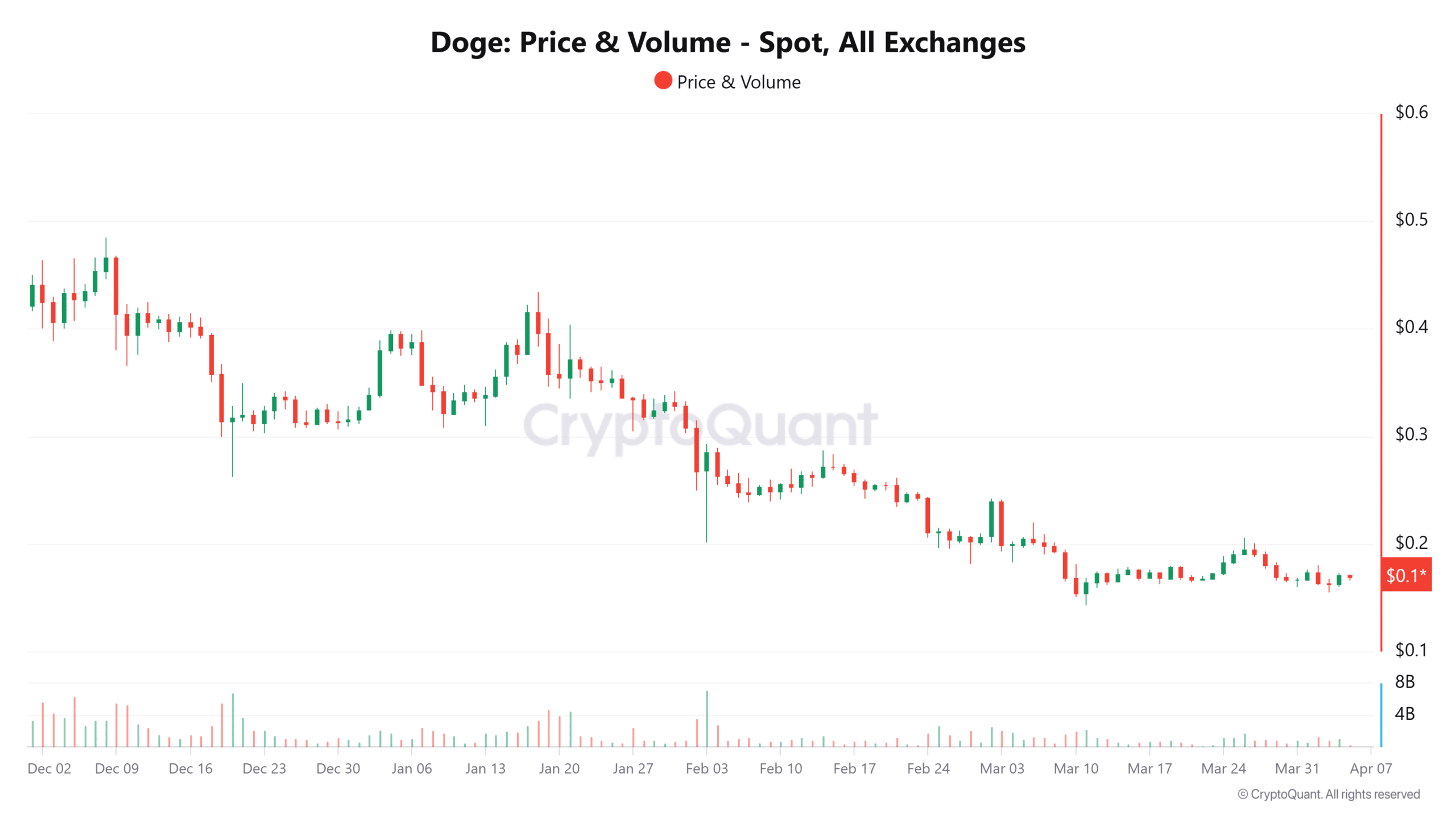

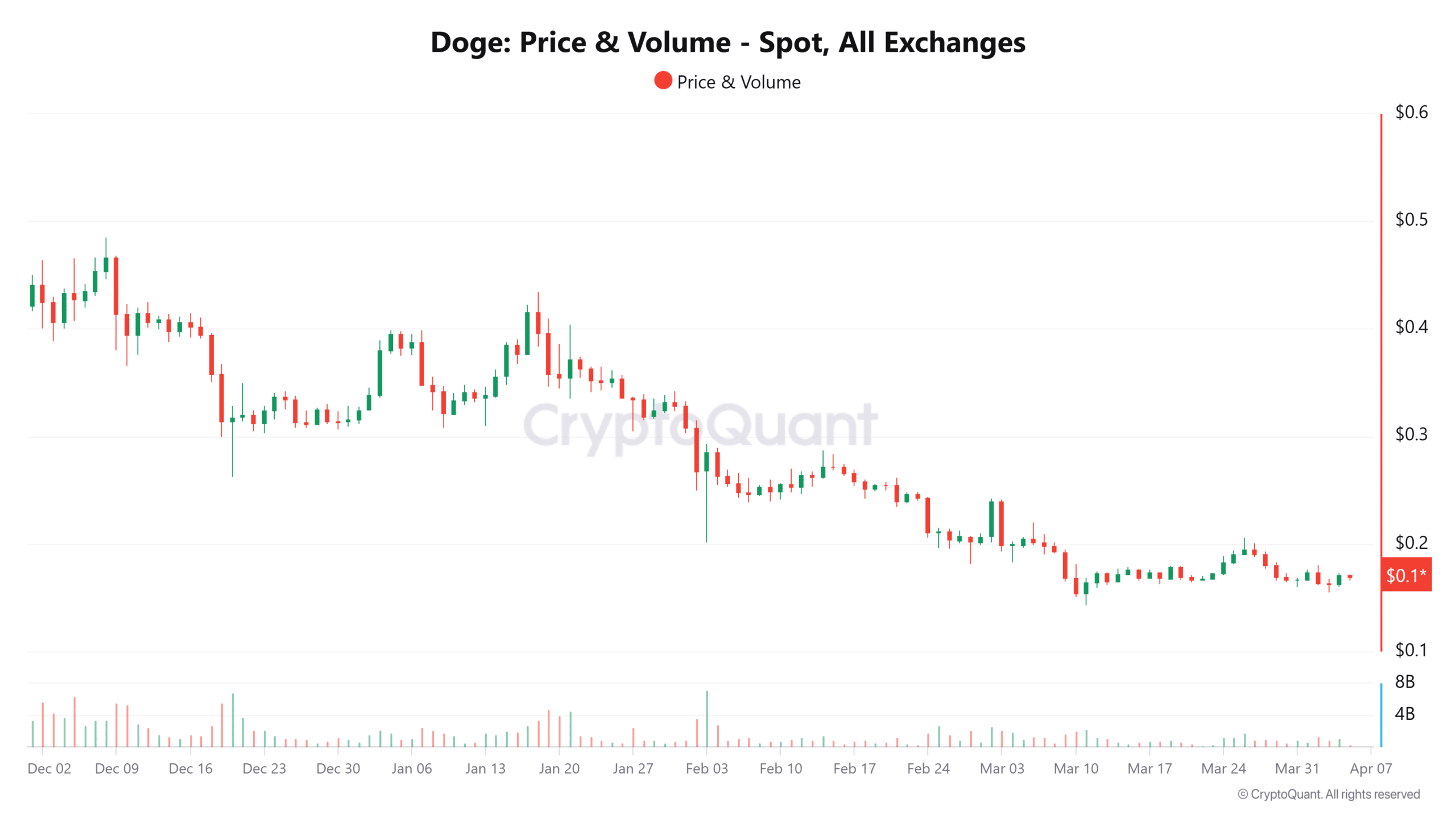

Between February and April, the Dogecoin price dropped by almost 32%, from $ 0.248 to $ 0.169, as shown by aggregated spot data.

In addition to this, the volume imploded of 7.18 billion tokens exchanged only 353 million. This 95% astonishing dive suggested the conviction on the cash market.

Source: cryptocurrency

More revealing is the drop in whale activity.

On January 21, when Doge oscillated nearly $ 0.42, there were 466 transactions greater than $ 100,000. On April 5, this figure dropped to only 19, even if the price was held around $ 0.169.

Of course, such a steep drop in major professions strongly implies that the institutions or participants in Haute Noue were unloaded. Or simply avoid Doge in the midst of smuggling prices. In addition, data on the chain project prudence.

Dogecoin metrics suggest that network health is also deteriorating

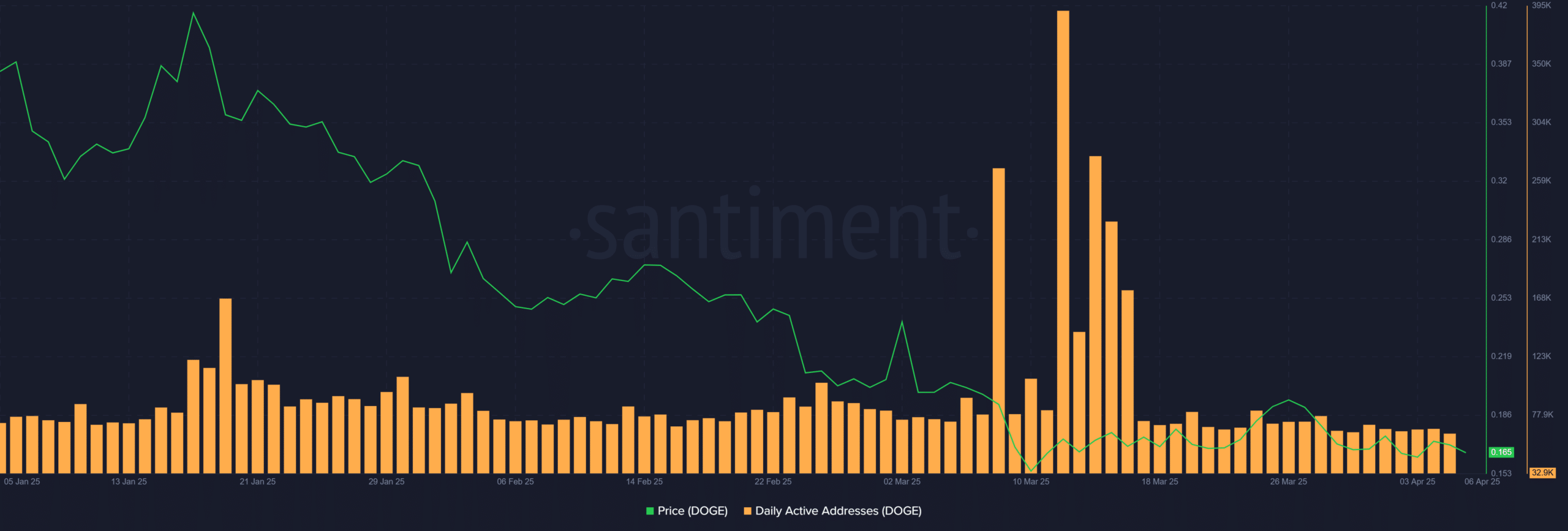

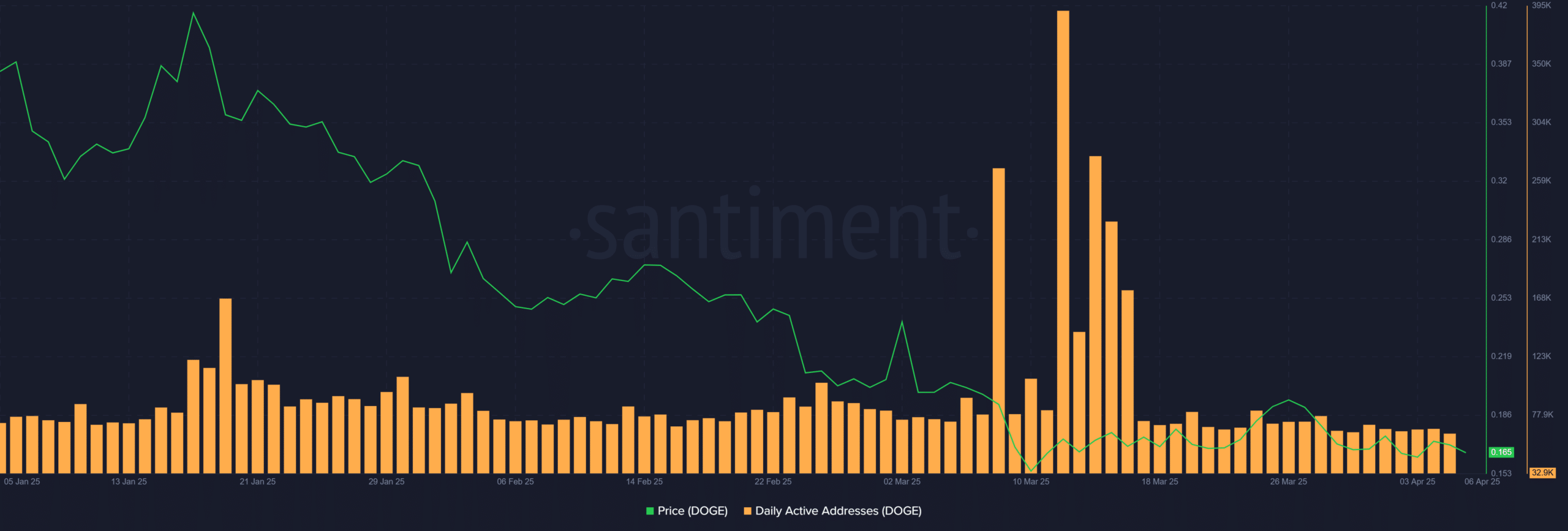

Daily active addresses (DAA) culminated at 81,861 on March 11. On April 5, this number increased to 63,736, a drop of 22%.

Source: Santiment

Interestingly, strong daily active addresses (DAA) were not always aligned with price increases.

In early April, despite the long -term merchants showing a strong preference for long positions, other indicators painted a different image. Whale transactions have decreased, cash volumes have decreased and network activity has weakened.

This reveals a gap between short -term speculative excitement and the wider hesitation on the market.

In addition, while the bullish feeling has temporarily strengthened optimism among Doge traders, the advantage remains fragile. The cash market and the chain data highlights decreasing interests, the lower participation of the main stakeholders and continuous price reductions.

Data represent a conflict market. A brief euphoria in long -term contrast trading with a prudent perspective in the longer term.