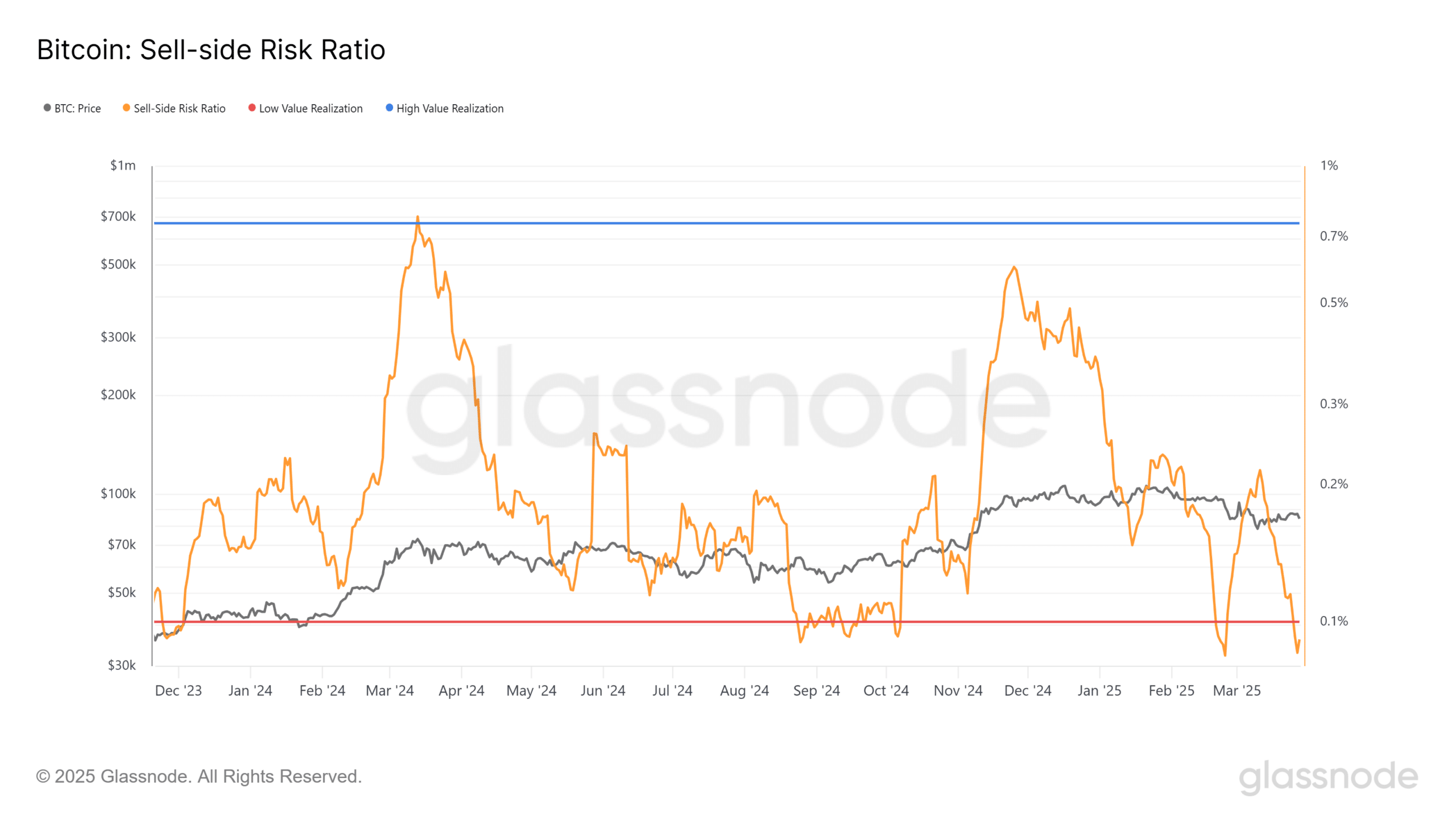

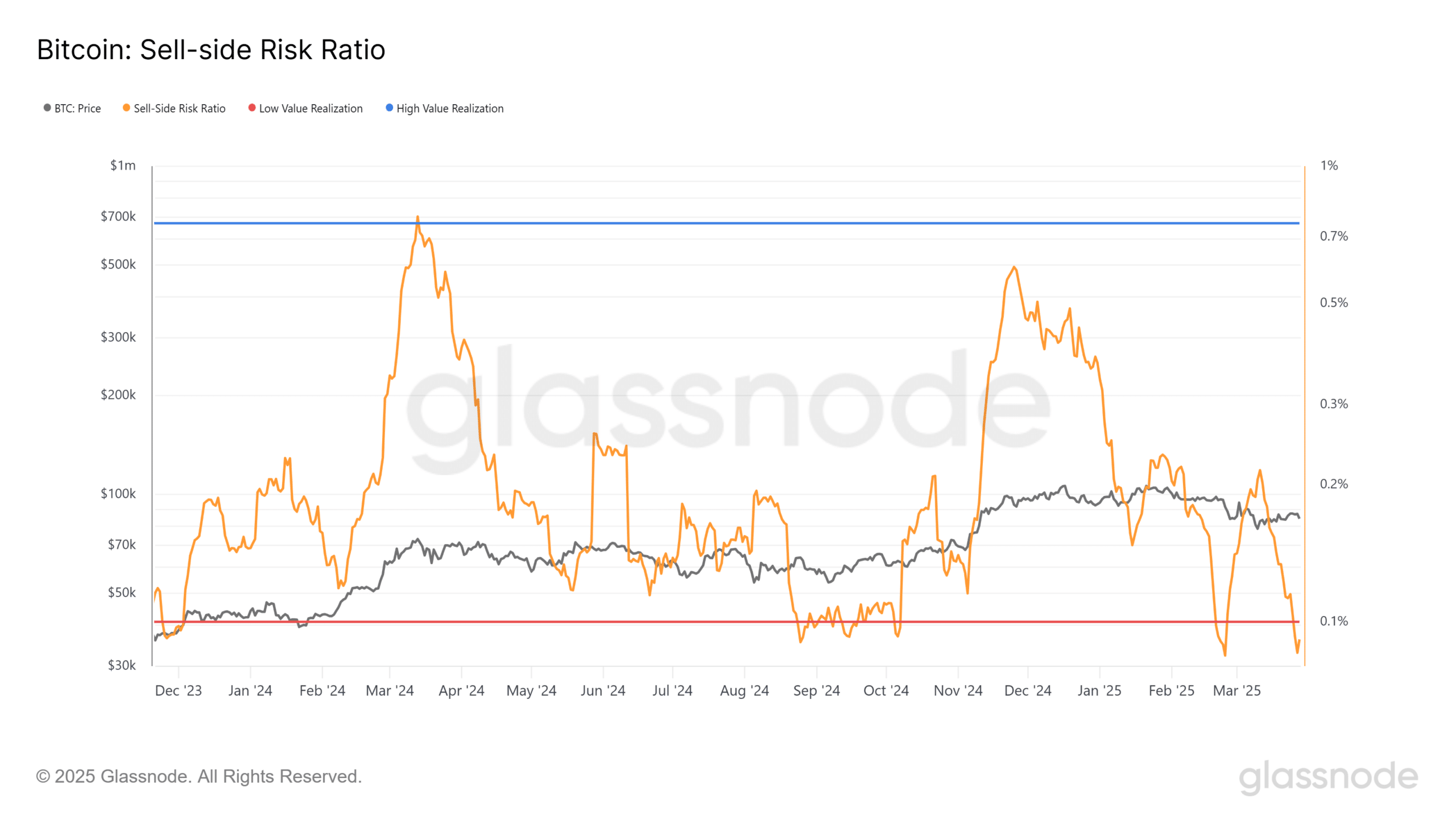

- The Bitcoin sales risk ratio drops to 0.086%, historically a level preceding major rebounds.

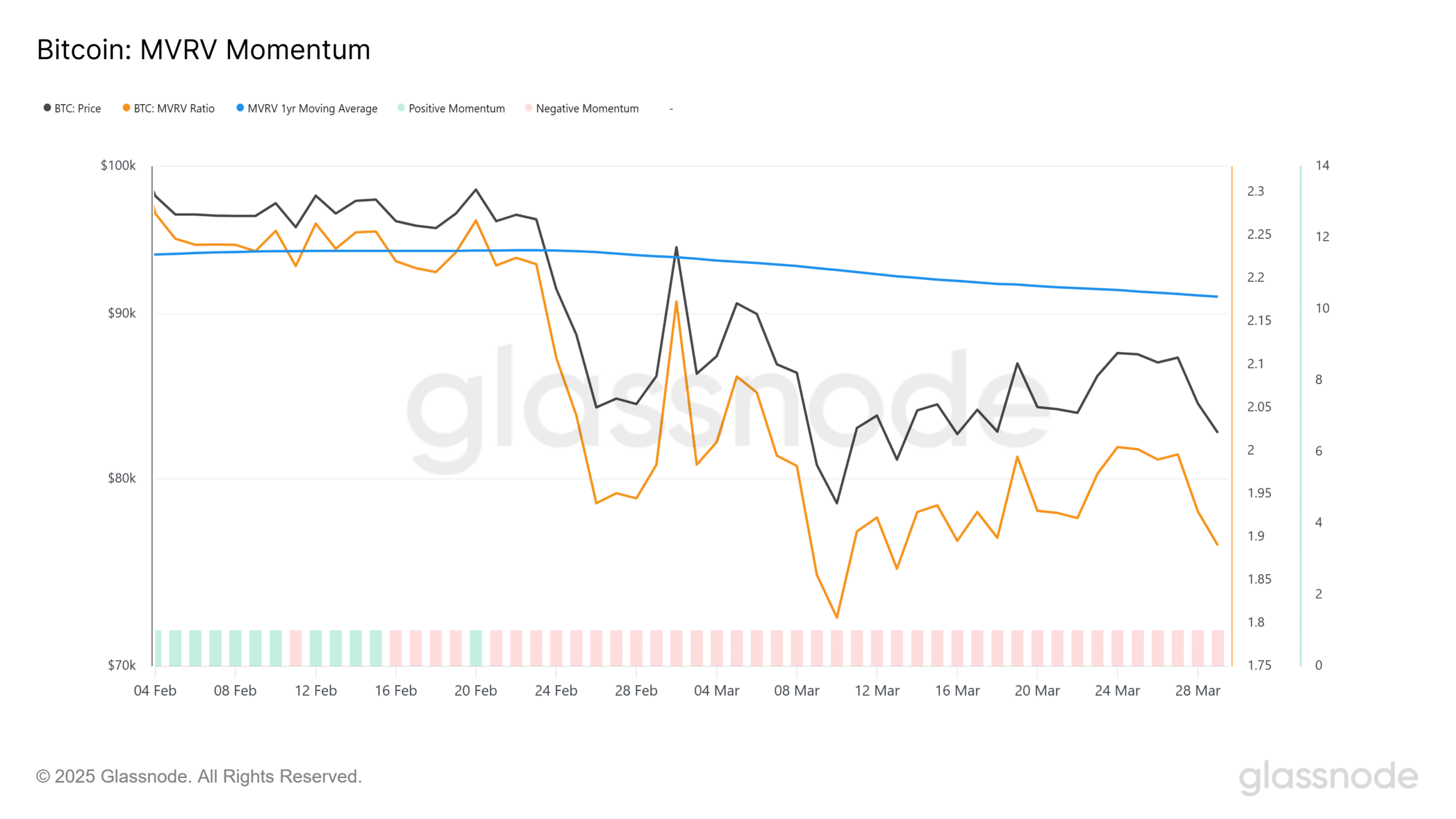

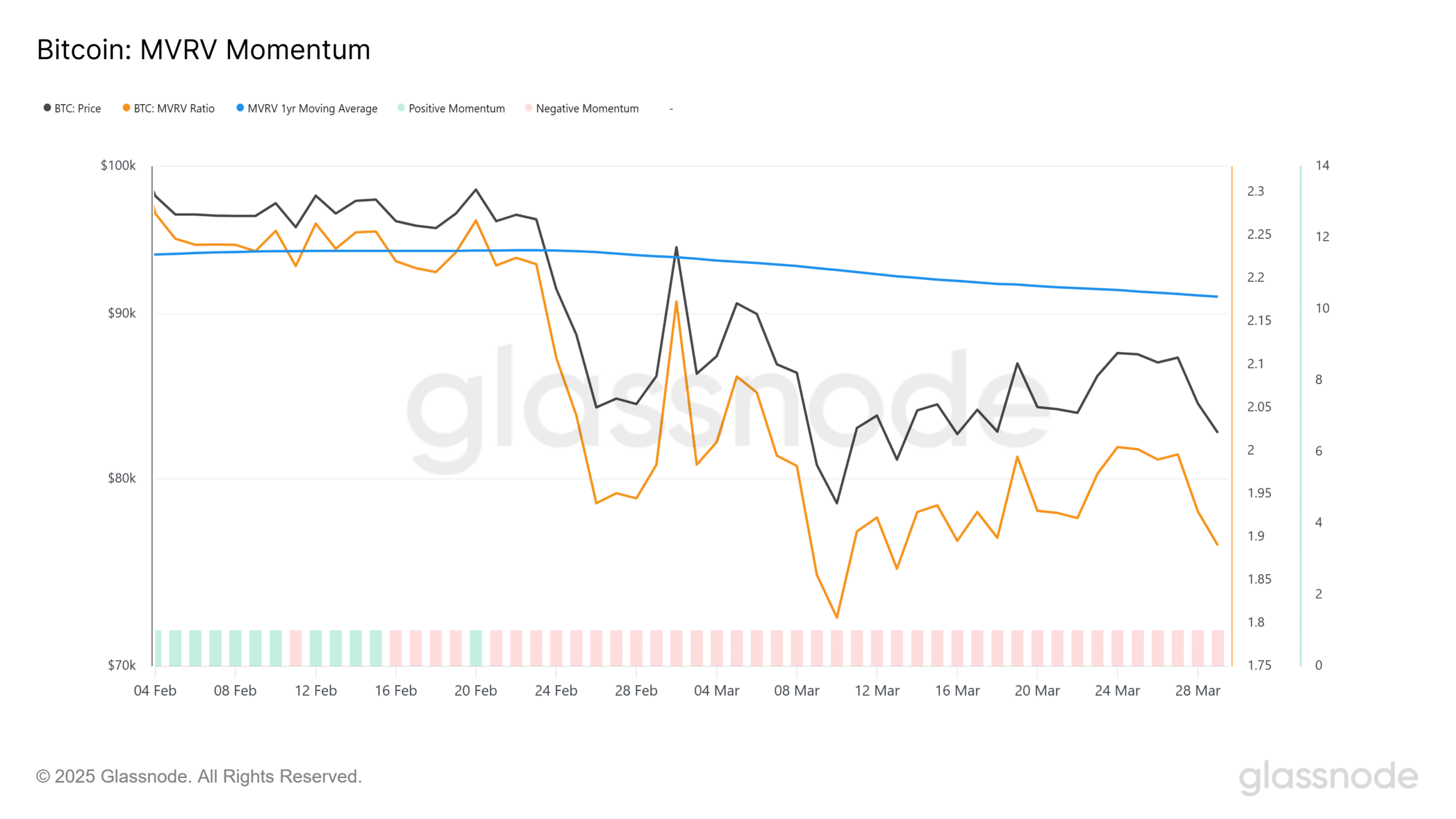

- The MVRV Momentum can return bruise if the ratio crosses its mobile average to 70 days.

Bitcoin (BTC) could prepare for a new rally, with two key indicators on a flashing chain of historical inversion signals.

The last drop in risk ratio on the sales side and a potential optimistic crossing in the MVRV momentum bring optimism on the market.

Diving under the historic rebound area

Bitcoin’s SSELL side report dived 0.086%, its lowest level in months.

Historically, this metric falling below 0.1% marked solid rebound areas, reflecting the profits made abolished compared to market capitalization.

Source: Glassnode

These low -risk periods often coincide with the hesitation of investors for sale, reducing the pressure of general costs on the price.

The last time the ratio fell below this level, it was during Bitcoin correction in September 2024, just before setting up a recovery to new heights in the fourth quarter.

Currently, the ratio again indicates a limited risk of profit, preparing the land for a possible reversal if the purchase of return.

Bitcoin MVRV near the Haussier crossing

The 70 -day MVRV momentum is about to exceed its mobile average, a crossing that has historically confirmed background training.

The MVRV report, which compares the market value to the value achieved, is often used to identify the undervaluation areas.

Source: Glassnode

The Bitcoin MVRV ratio remained less than the average of 70 days for weeks, reflecting the pre-Bulline configurations observed in late October and January.

A confirmed break could act as the final confirmation of a background, in particular while the wider macro environment stabilizes.

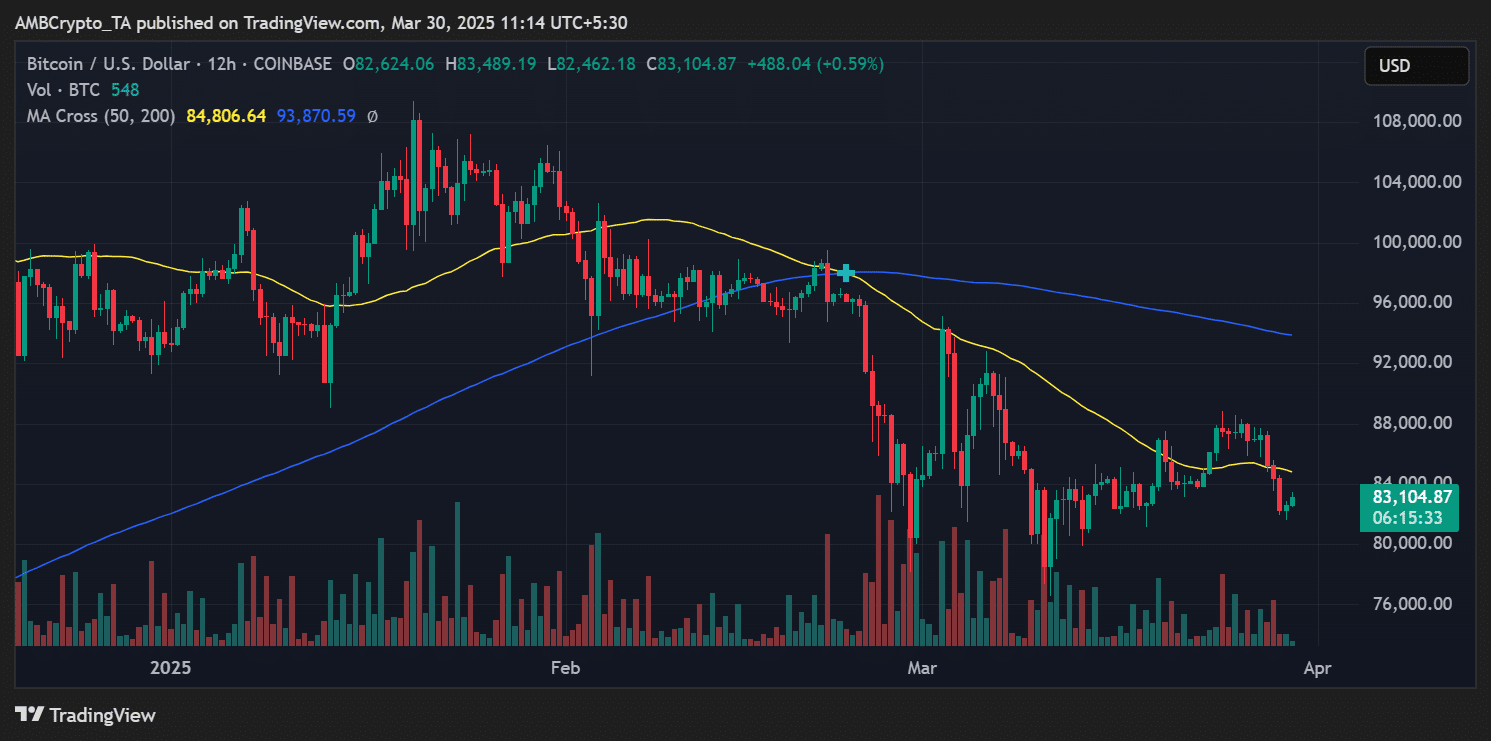

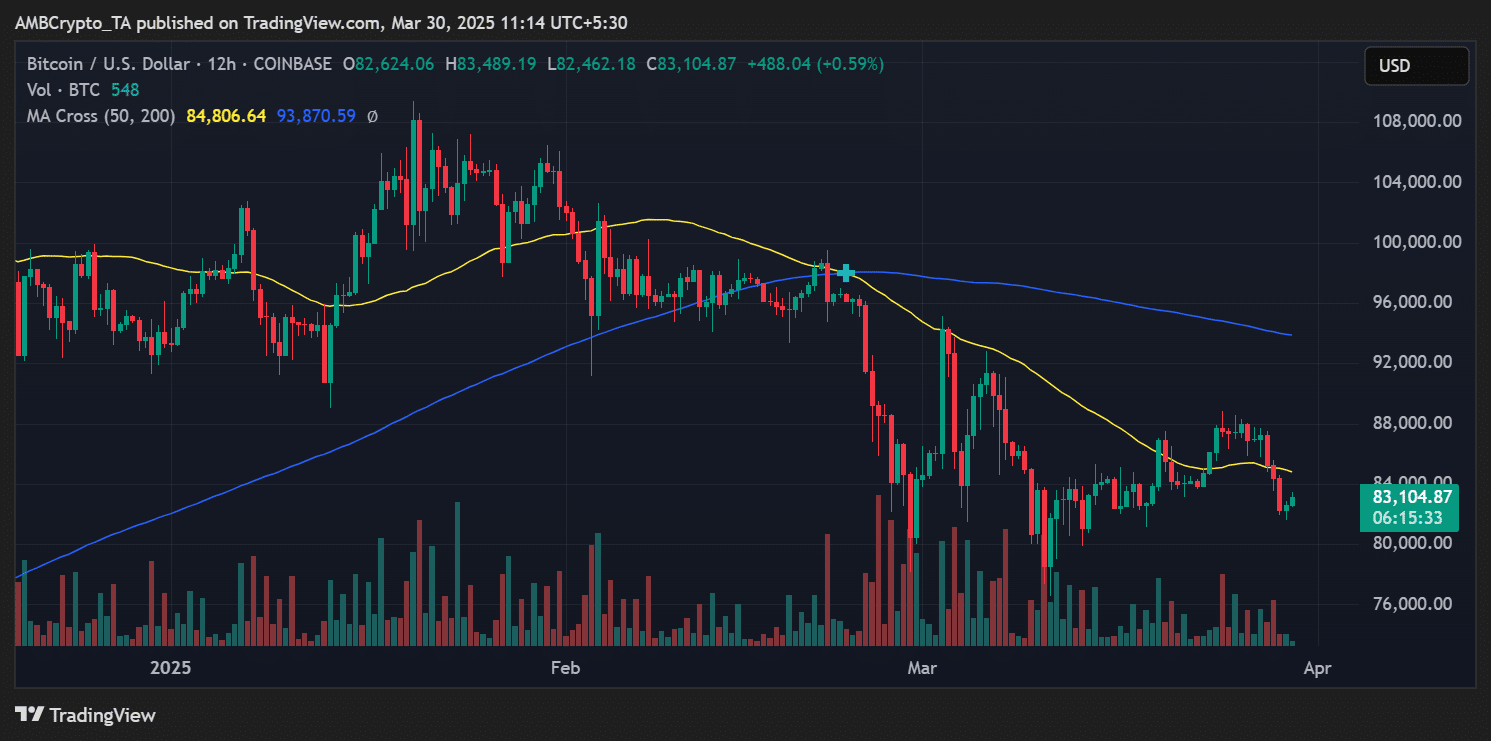

Bitcoin price fights under the medium of key moving

Bitcoin exchanged about $ 81,100 at the time of the press, with the medium -sized medium -sized days and 200 days at $ 84,934 and $ 93,916, respectively.

Source: tradingView

The inability to recover MA of 50 days remains a short -term concern. However, the technical configuration and the measures on the chain suggest that the sellers are exhausted and the accumulation is gradually returning.

If BTC recovers $ 85,000, it could unlock an optimistic momentum to the $ 90,000 psychological barrier. Until then, the market can go, the current configuration promoting accumulation strategies.