- Ethereum fell by more than 55% in 14 months in the middle of the sustained pressure of the sale.

- The level of support of $ 1,800 is valid despite the lowering feeling and price volatility.

The descent of Ethereum (ETH) of a peak of $ 4,000 in February 2024 to just under $ 1,800 in April 2025 tells a story much deeper than a simple price crash.

There are signs that the worst can be behind us

After 14 months of continuous sales pressure, the Ethereum market seems to approach a turning point.

A recent cryptocurrency analysis highlights a significant optimistic divergence emerging under the surface. Although the price of Ethereum fell on low several months, several measures indicate that the sellers lose its momentum.

A key factor is the Netleur of Ethereum (NTV) volume. Historically deeply negative, the NTV culminated at $ 360 million, reflecting intense and prolonged sales pressure. However, this pressure is busy now.

Recently, NTV began to form higher stockings despite the downward price of Ethereum, signaling a conventional bullish model often observed at the main inflection points on the market.

This divergence suggests that sellers lose control, referring to a potential change in market power dynamics and the possibility of a trend reversal.

Volume breakdowns only add to this evolving story

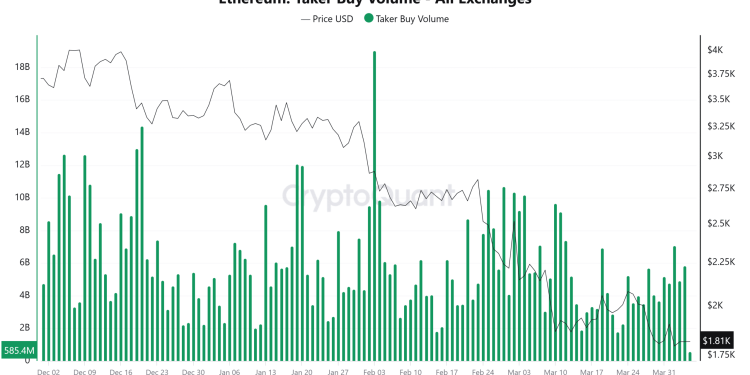

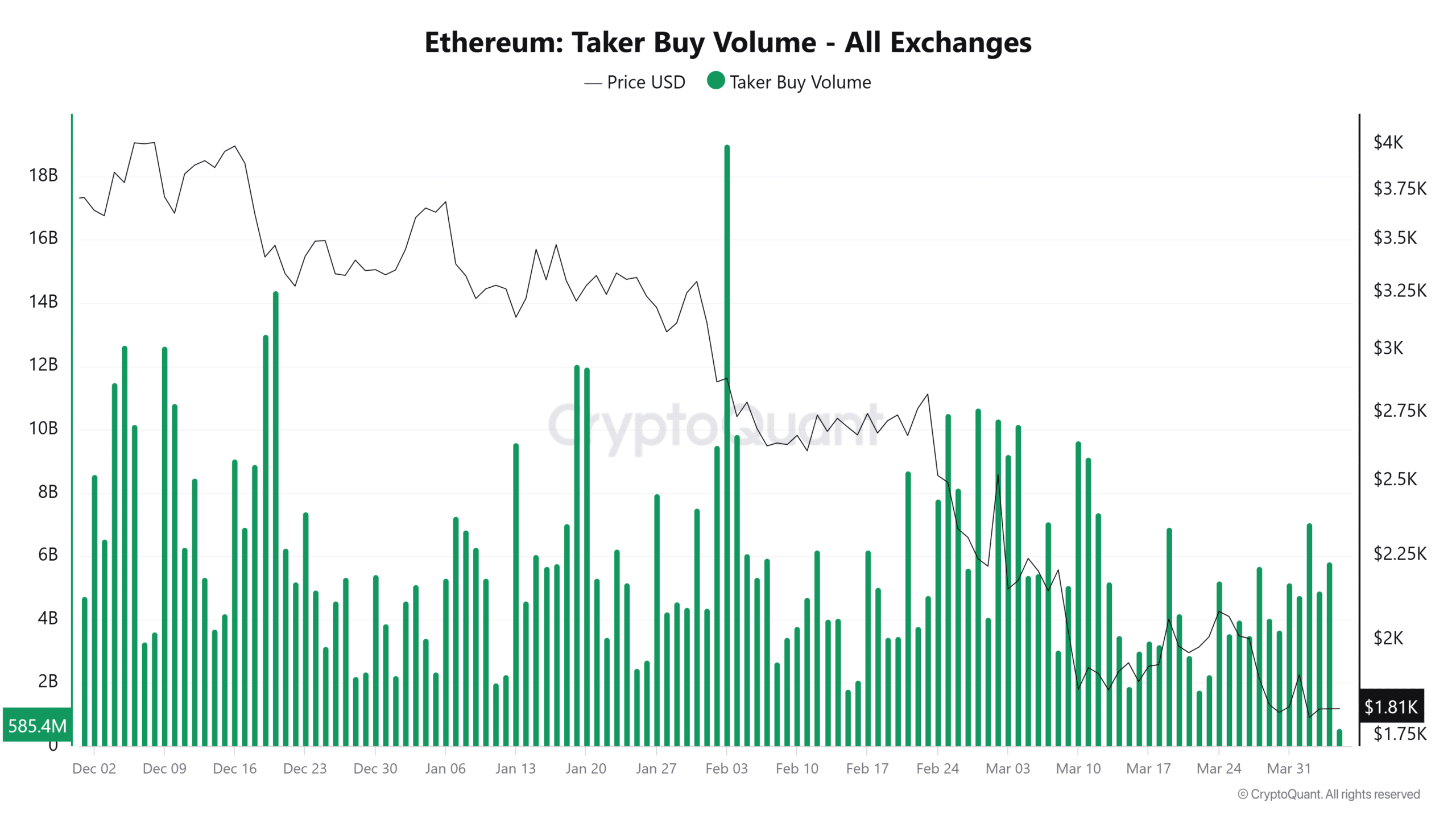

Between December 2024 and April 2025, the volume of purchase of the Ethereum lessee saw irregular but significant overvoltages.

Source: cryptocurrency

For example, on February 3, the lessee’s purchase volume reached $ 19 billion while the ETH was over $ 2,882.93.

Although the price has not been rallied, the tip reflects buyers who try to absorb the pressure of the sale. On April 1, this volume fell to $ 4.75 billion, with an ETH at a price of $ 1,905.17.

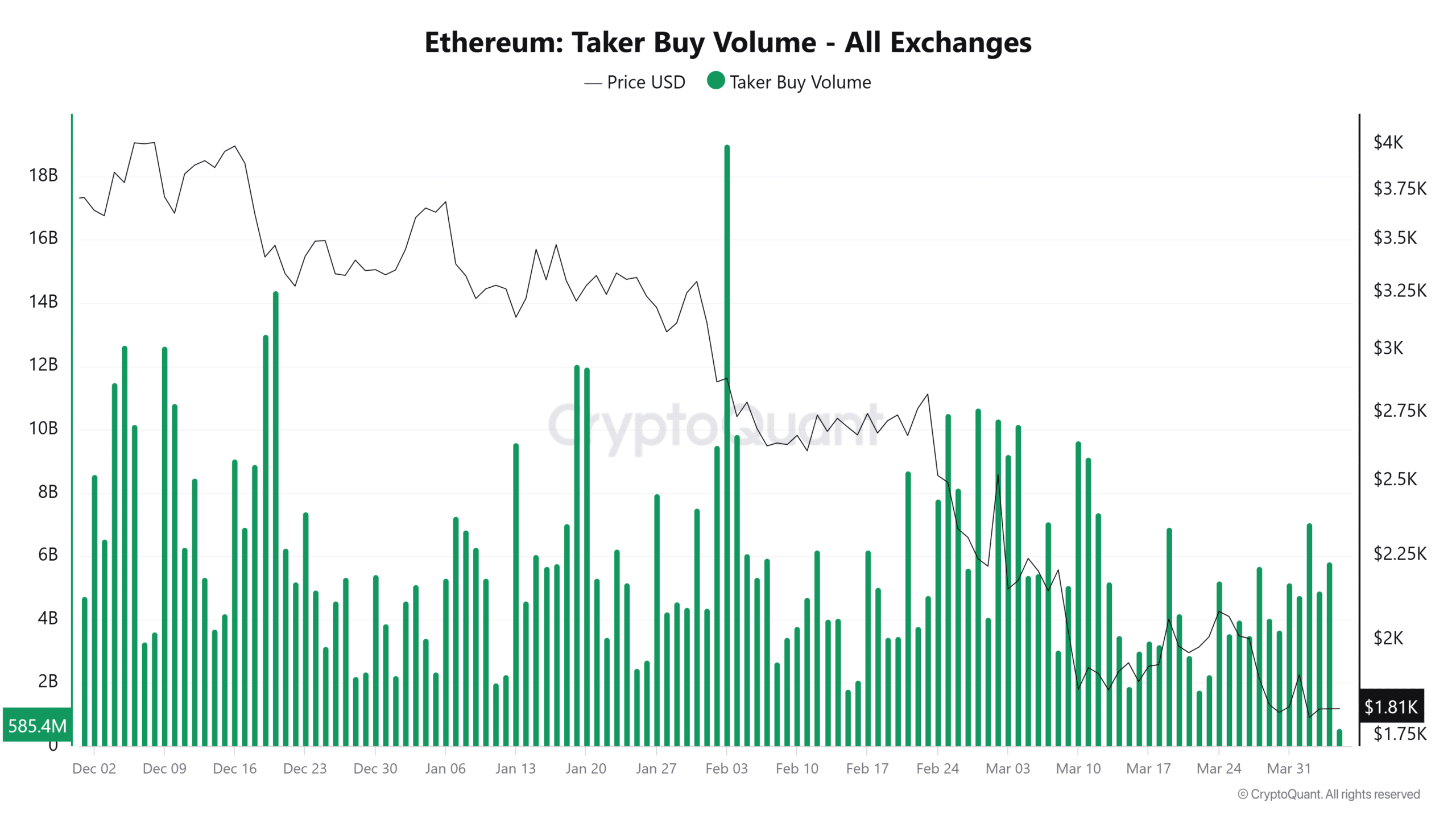

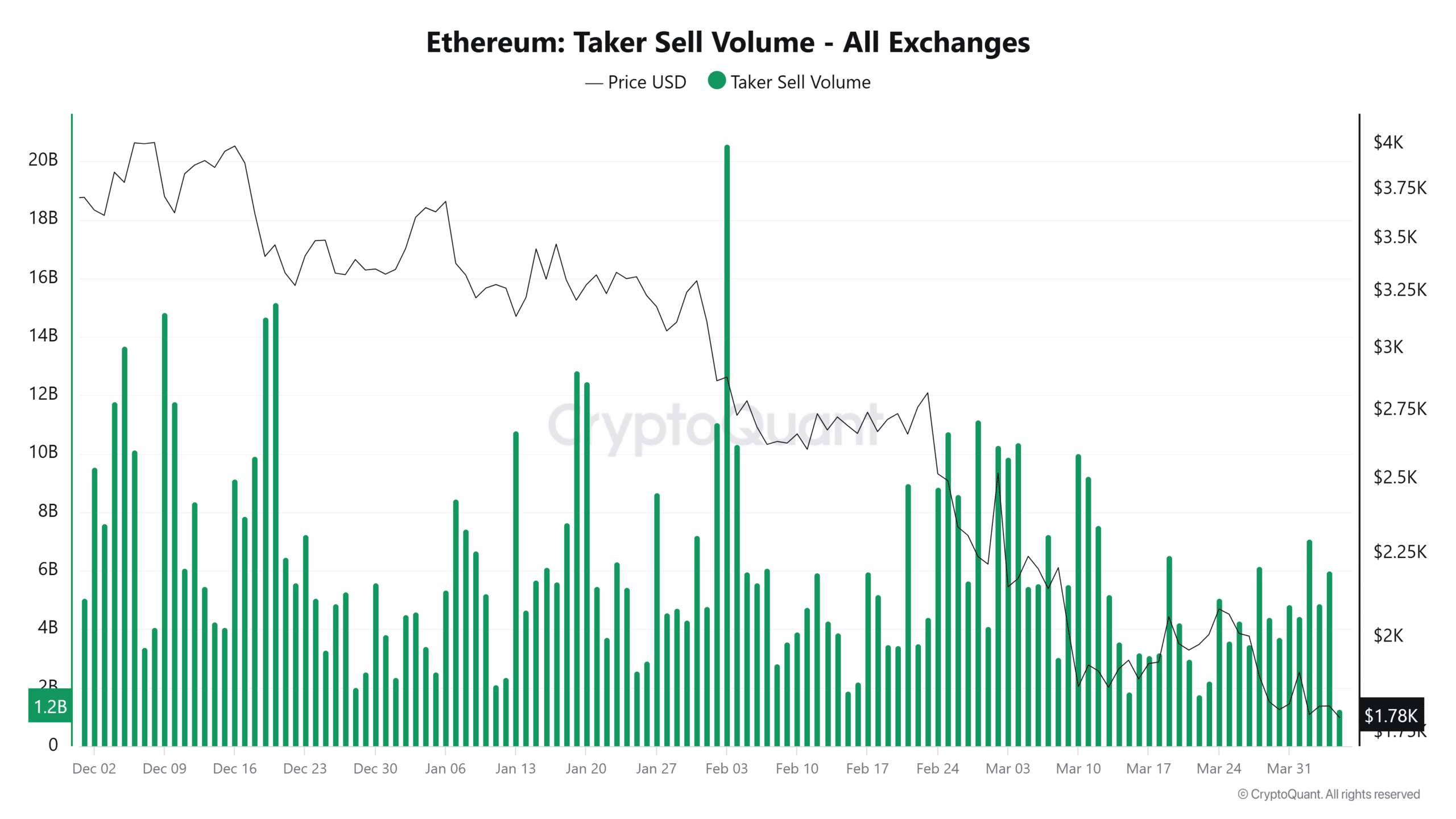

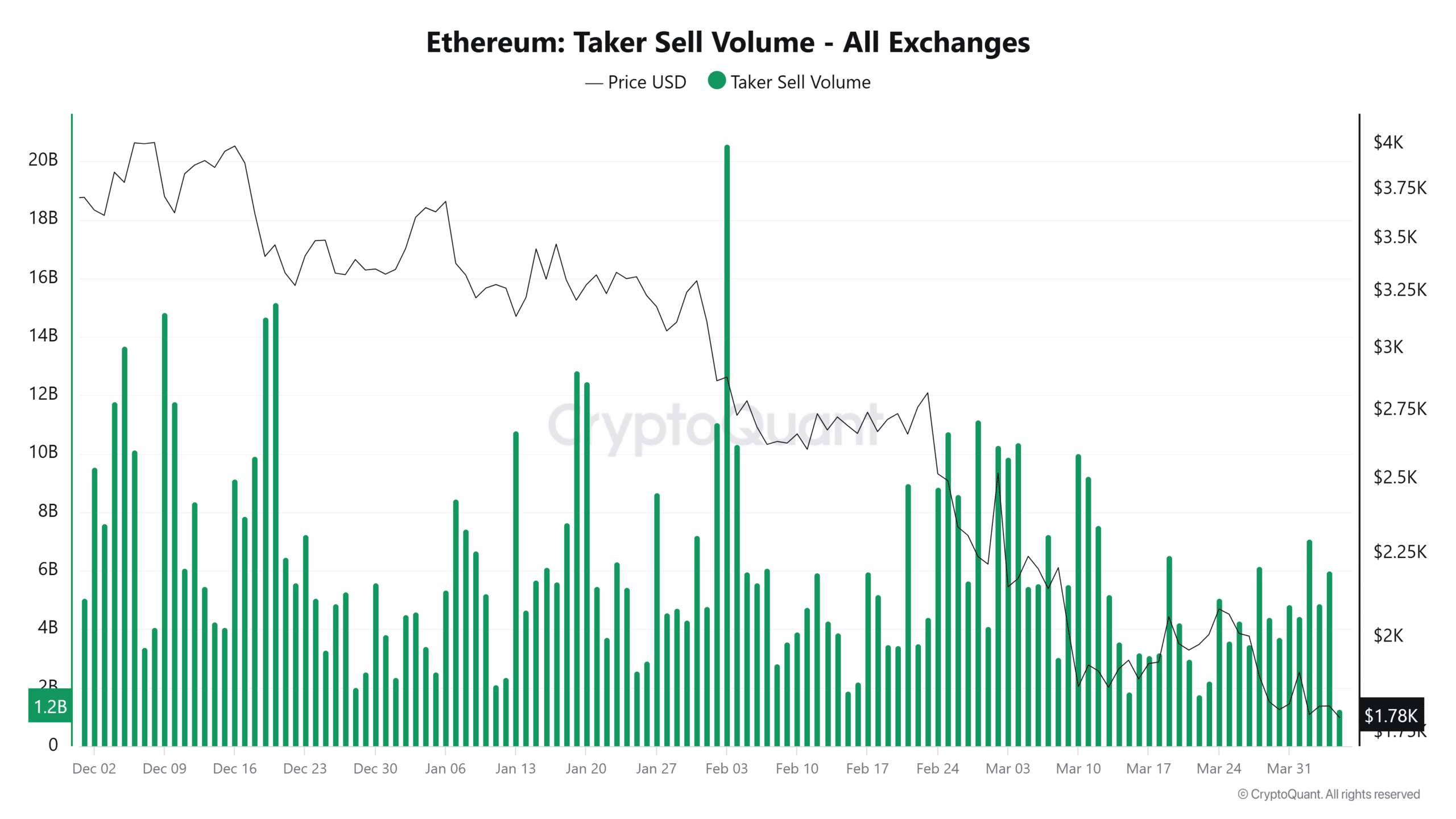

Meanwhile, the sales volume of takers was also tapered.

Source: cryptocurrency

The sales volumes for Ethereum reached $ 601.6 million in late December and increased to $ 17.6 billion in early February. However, on April 1, they were considerably cooled at around $ 4 billion, indicating a drop in panic sales.

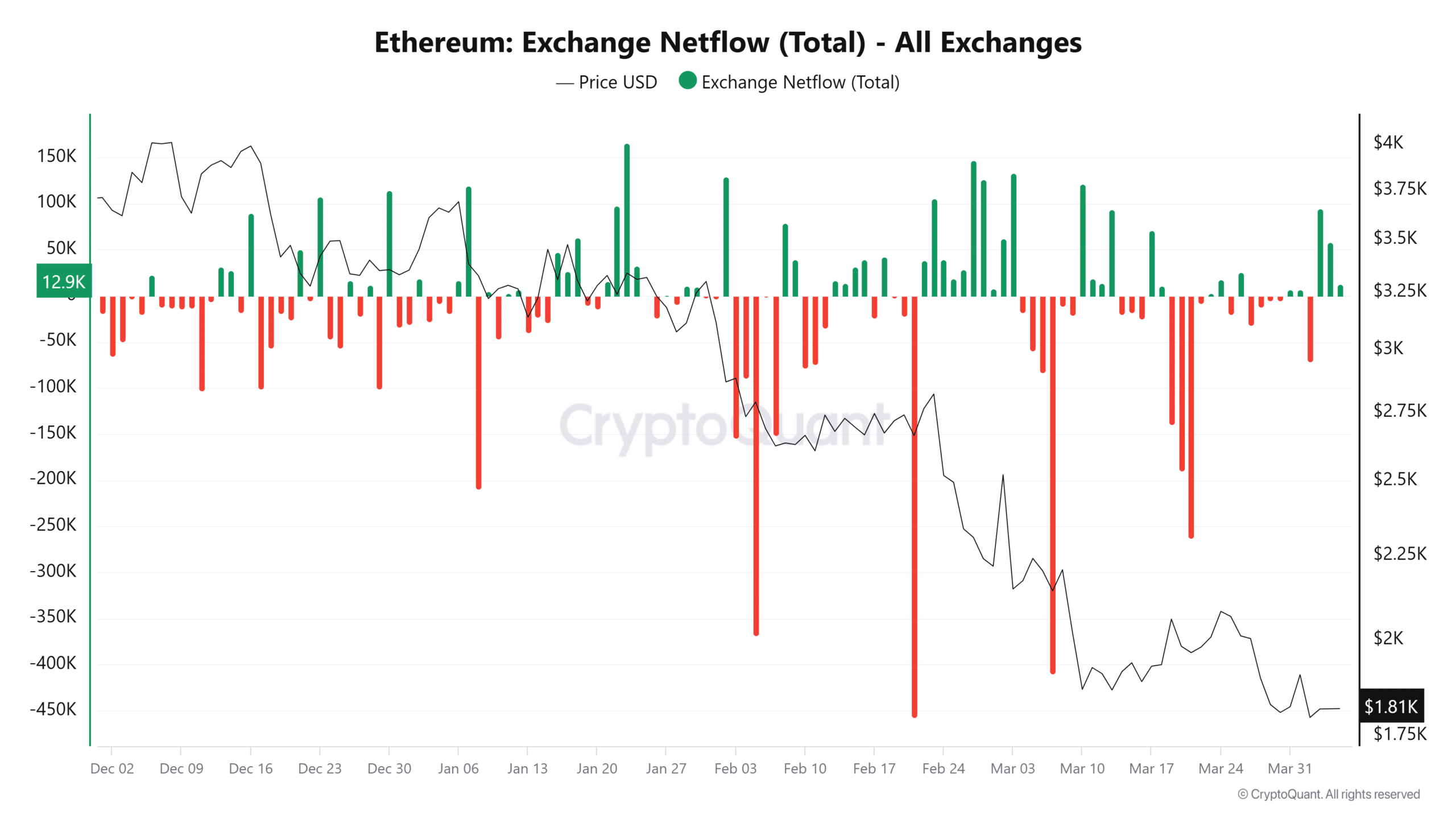

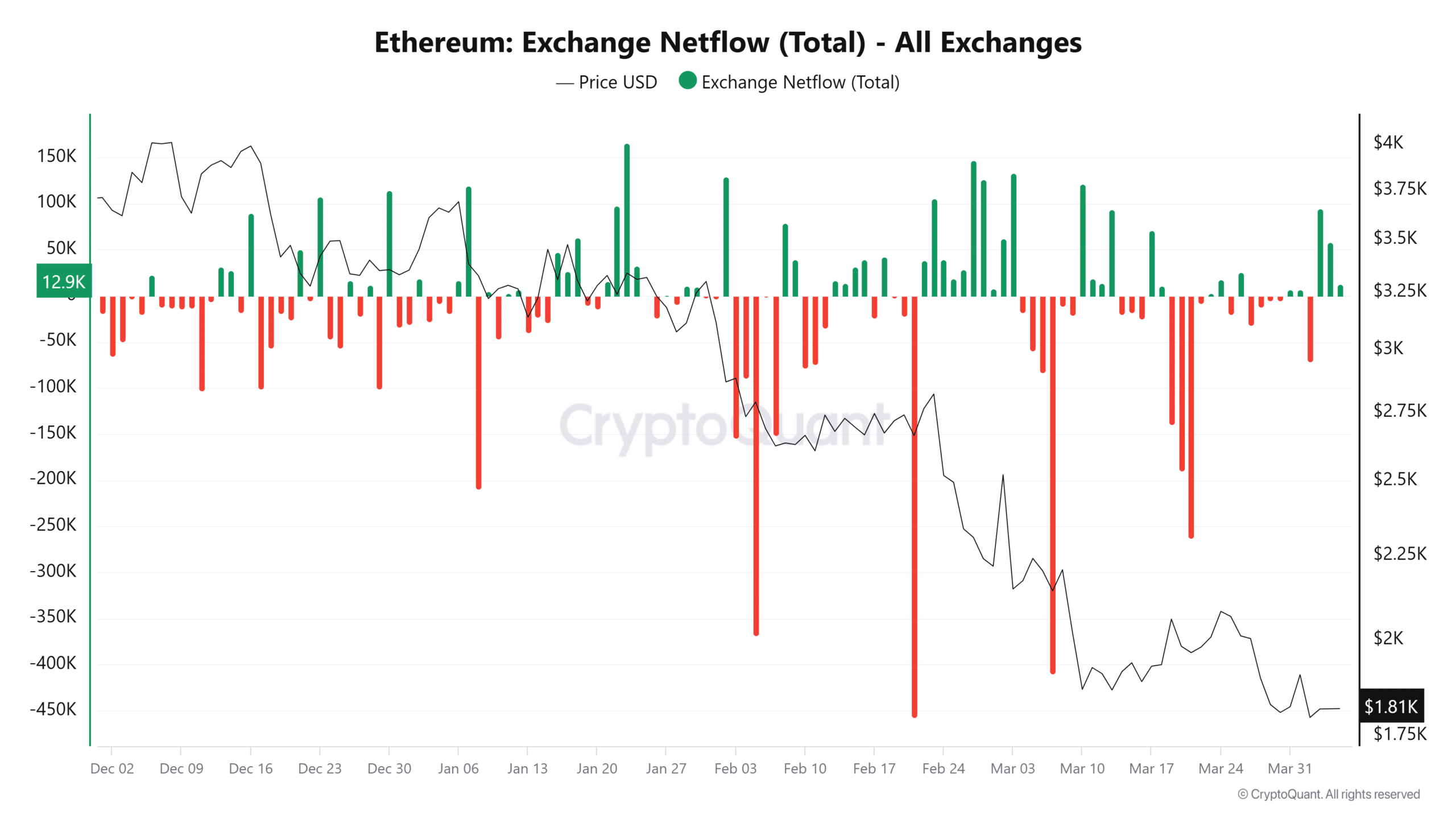

In addition, Ethereum exchange netflows provide additional information on changing market dynamics.

Source: cryptocurrency

From December to March, while ETH fell 45%, from $ 3,278 to $ 1,810 – Exchange credits increased.

For example, February 21 saw a net release of 257,700 ETH, the price located at $ 2,661.

That said, there was a notable exception.

On March 10, 120,900 ETH rushed into the scholarships when the price fell to $ 1,866, which represents short -term traders liquidating.

However, the broader trend is leaning towards a strategic accumulation

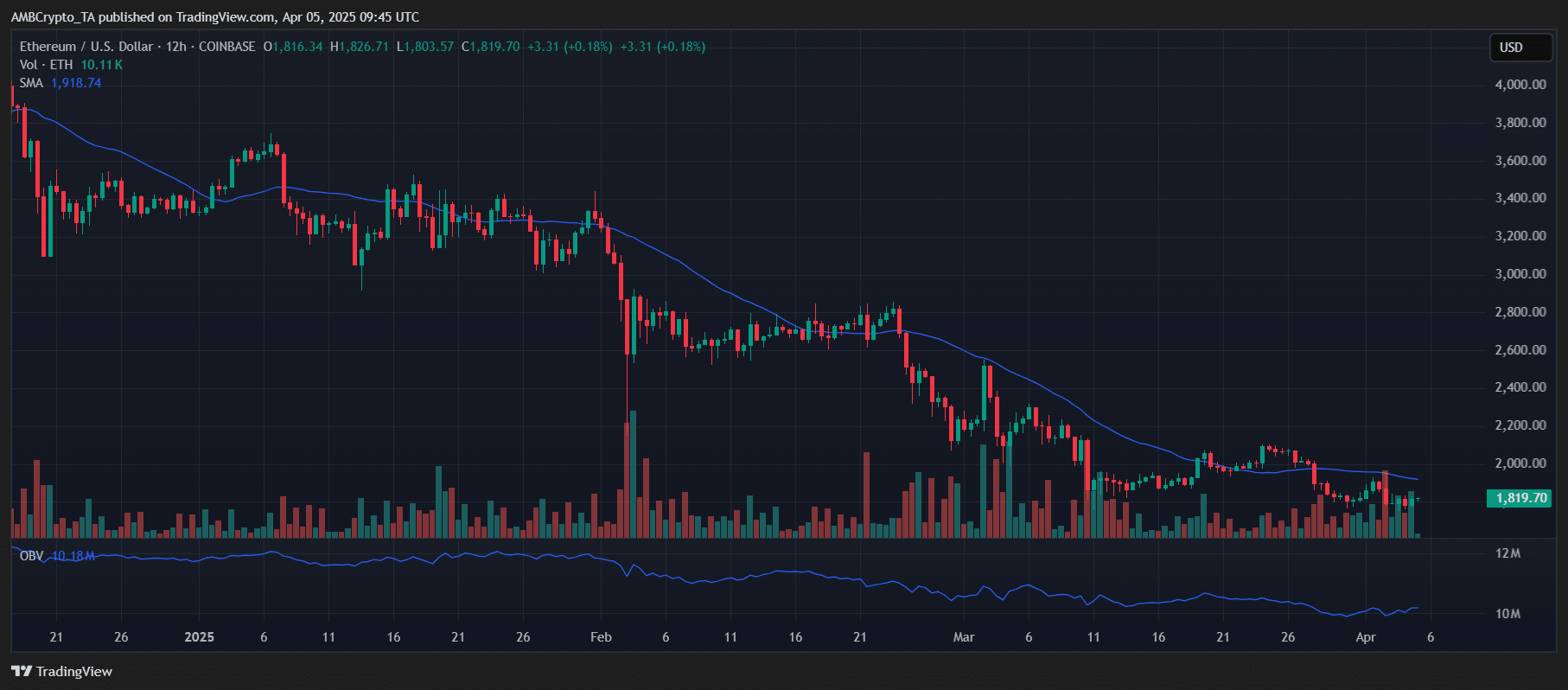

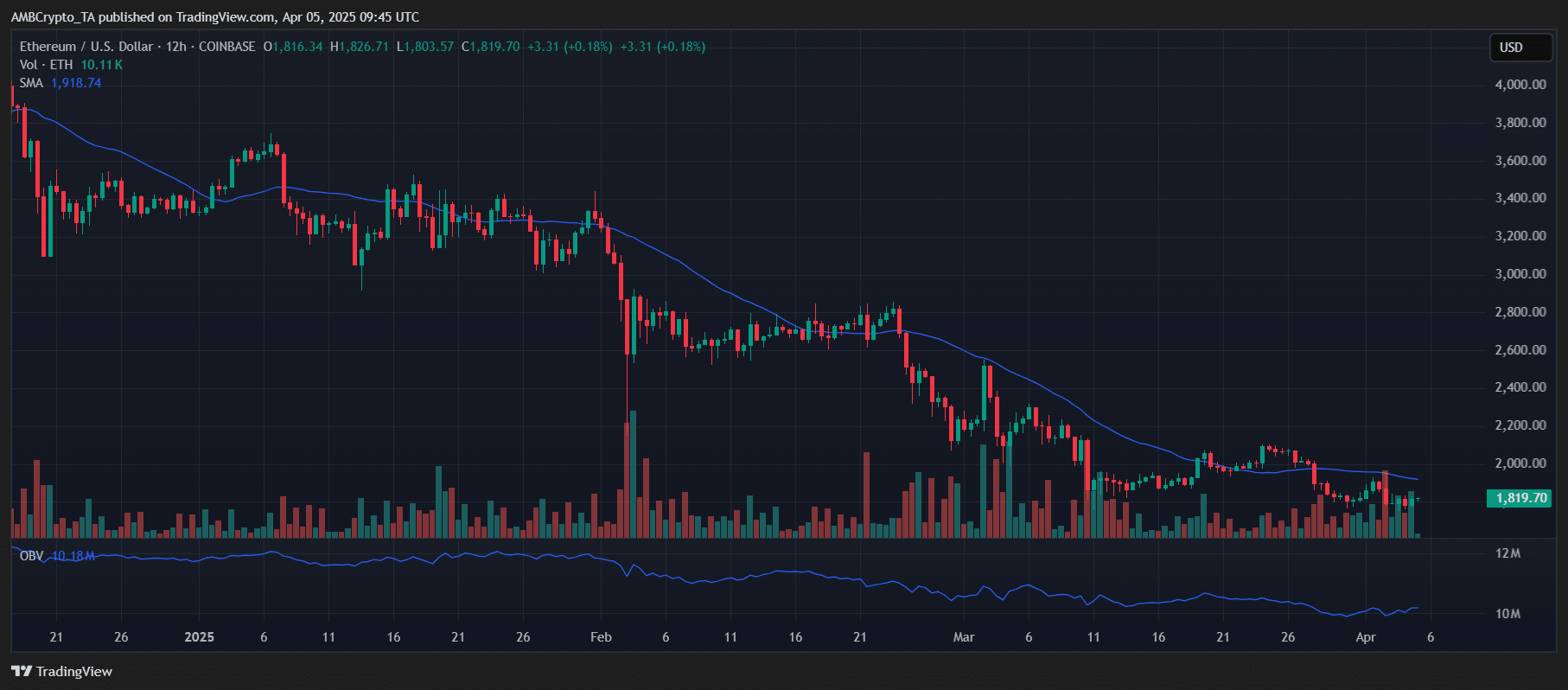

From a technical point of view, Ethereum remains rooted in a downward trend.

The action of prices continues to tighten the underside of its simple mobile average (SMA), which has acted as a dynamic resistance since January 2025.

Several failed rallies – notably at $ 2,700 in February and $ 2,000 in March show a persistent general cost.

Source: tradingView

However, there is a twist.

Ethereum systematically held the support area of $ 1,800 during several tests in March and April. Each rebound in this level, combined with a decrease in volume during price reductions, indicates that sellers can lose momentum rather than increasing their efforts.

Key factors such as Rev, exchange outlets and the sales volume of freshness, suggest that $ 1,800 could turn into a critical accumulation area.

If Ethereum recovers the range from $ 2,000 to $ 2,200, this could point out a trend reversal. For the moment, $ 1,800 remain the central battlefield, balancing between downward continuation and upward accumulation.