Decoding Ethereum L2 Price Rise Starknet: Did ETH Help STRK Rise?

- STRK price has resisted a significant decline after millions of tokens were traded.

- Indicators suggest that the value could decline amid falling volume and increasing volatility.

Two of the largest holders of Starknet (STRK) could have put the price at downside risk, but data showed that STRK appears to be holding up well.

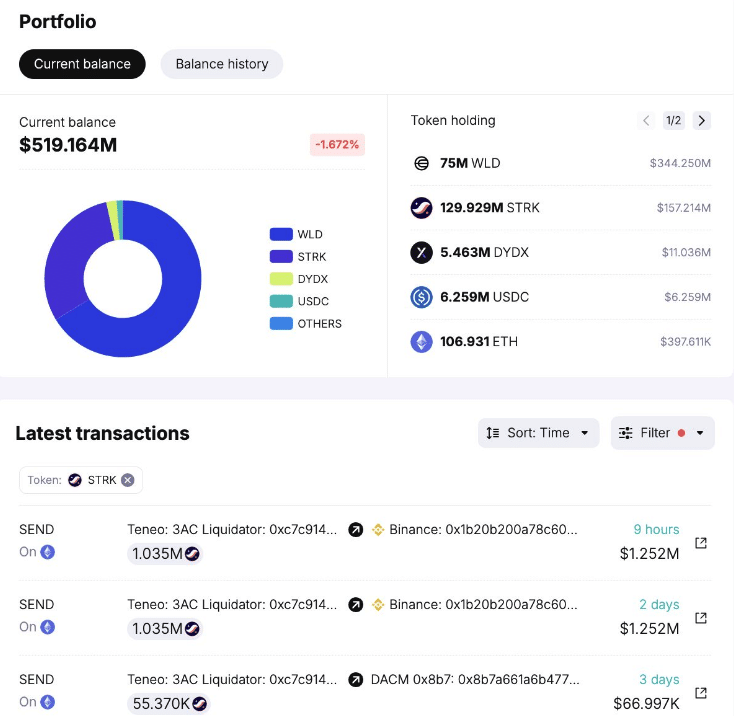

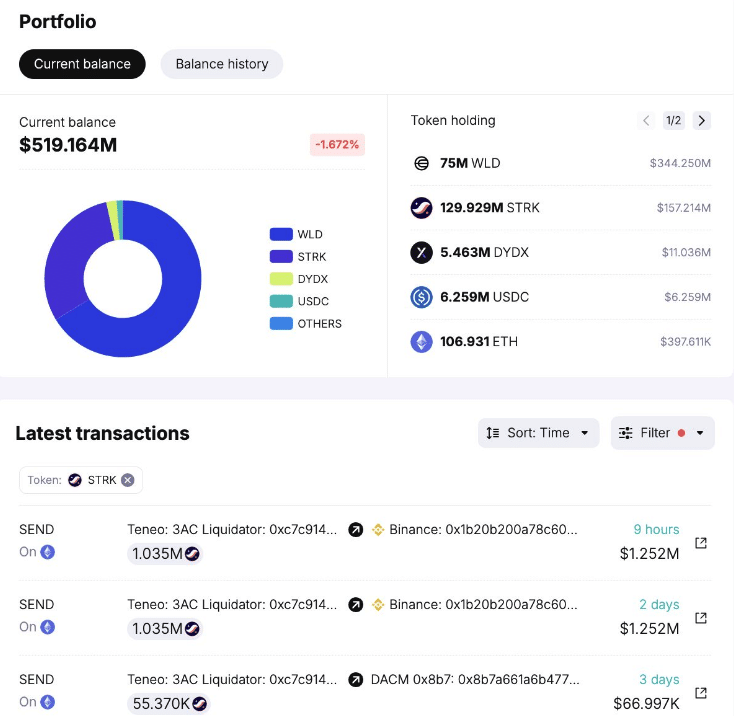

On May 25, AMBCrypto discovered via Spot On Chain that Tenoe, a liquidator of Three Arrows Capital (3AC), had deposited 2.18 million STRK on Binance.

How ETH ensured the freedom of STRK

Large foreign exchange deposits like this are believed to precede a fall in prices. But the Starknet token didn’t move.

At press time, the cryptocurrency’s price was $1.25, representing an increase of 4.06% over the past 24 hours.

Prior to the Teneo deposit, Ethereum (ETH) co-founder Vitalik Buterin claimed his airdrop of 845,000 STRK, worth $1.07 million. This action affected the value of the token which fell by 6%.

Source: Spot on the channel

However, it appears that Starknet has not reacted in kind due to the US SEC’s approval of Ethereum spot ETFs. Before and after the confirmation, ETH, including the native tokens of layer 2 projects under its blockchain, was pumped.

For the uninitiated, Starknet is one of the notable Ethereum L2s.

As such, it appears that bullish sentiment around the ecosystem is the main reason why the latest selloff did not send STRK diving.

Where is the next step? $1.06 or $1.50?

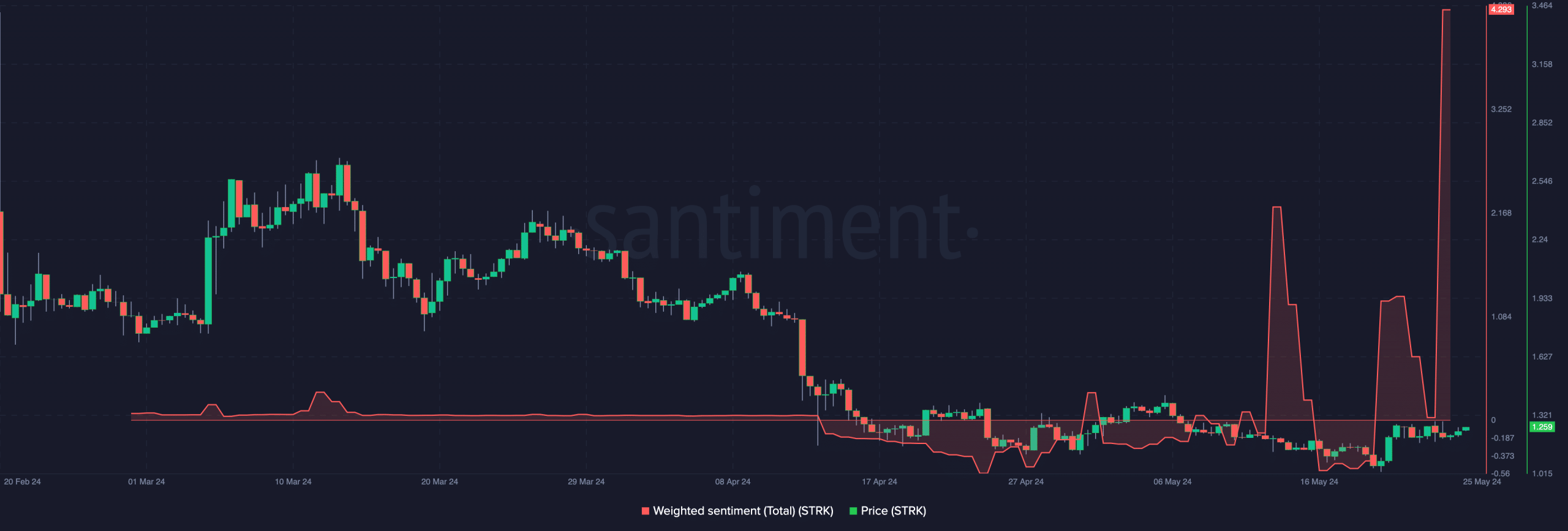

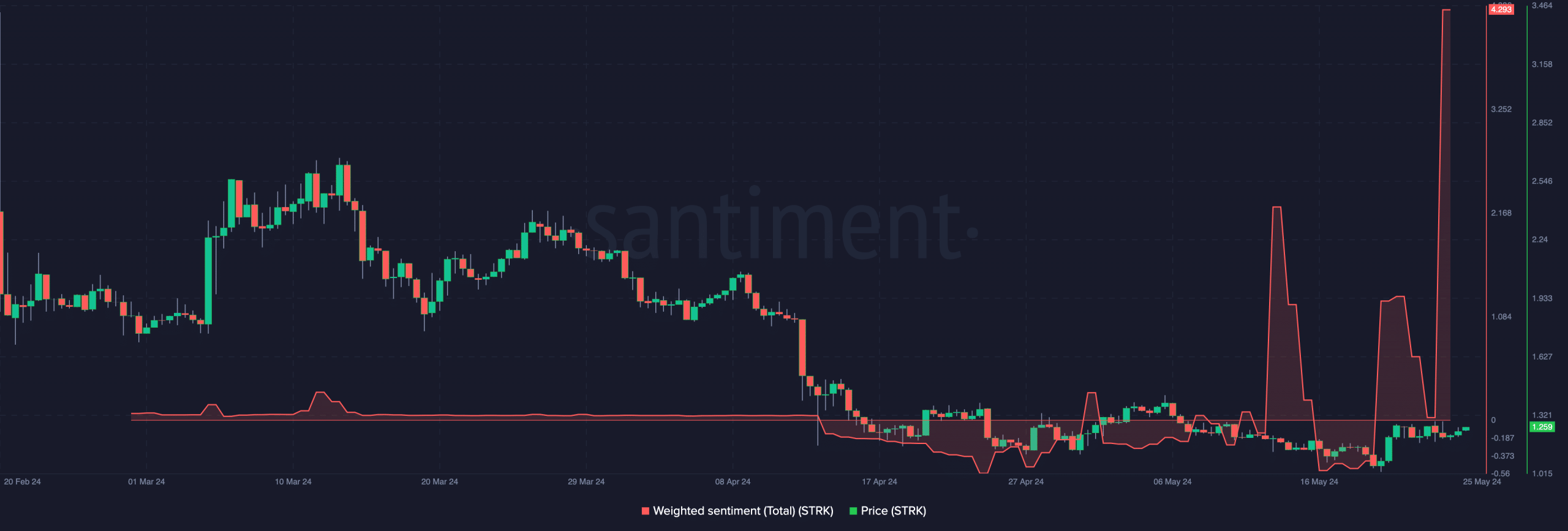

Additionally, AMBCrypto looked at the weighted sentiment around Starknet. At press time, the metric had risen to 4.293. Weighted sentiment measures positive/negative comments about a cryptocurrency.

Therefore, the reading implied that for every negative mention of STRK, there were four more supporting a bullish cause. If sentiment remains optimistic, the token’s price could continue to rise.

In a very bullish case, the value of STRK could reach $1.80. However, a return to the bearish phase could push STRK to $1.06.

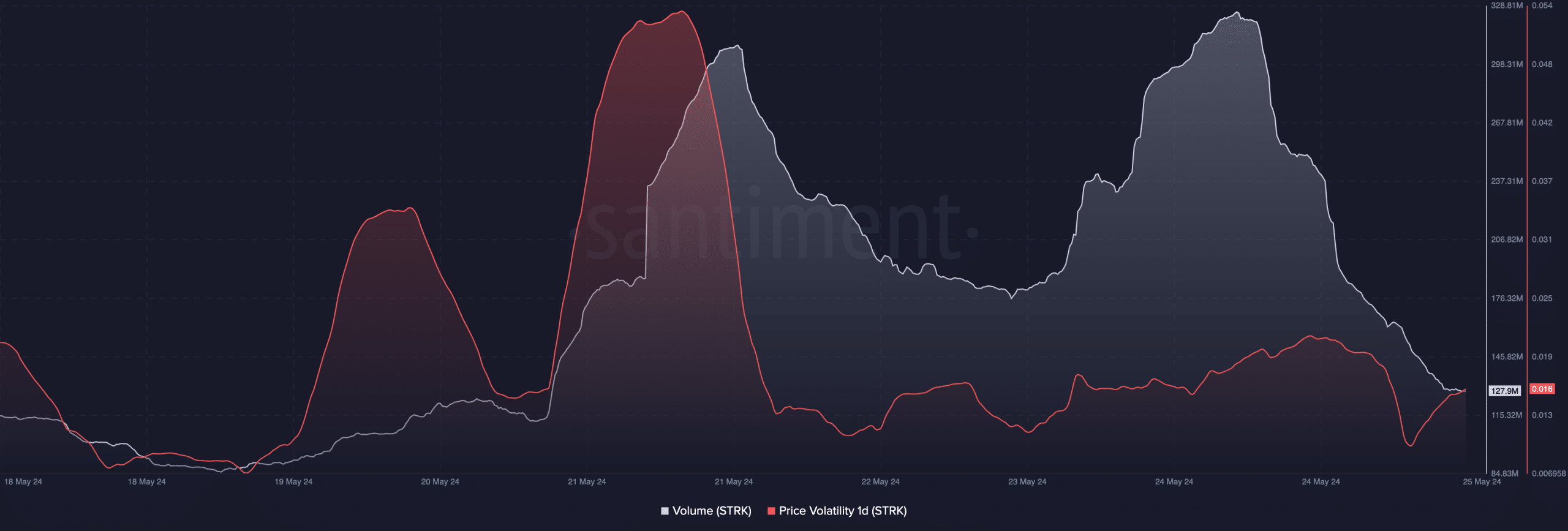

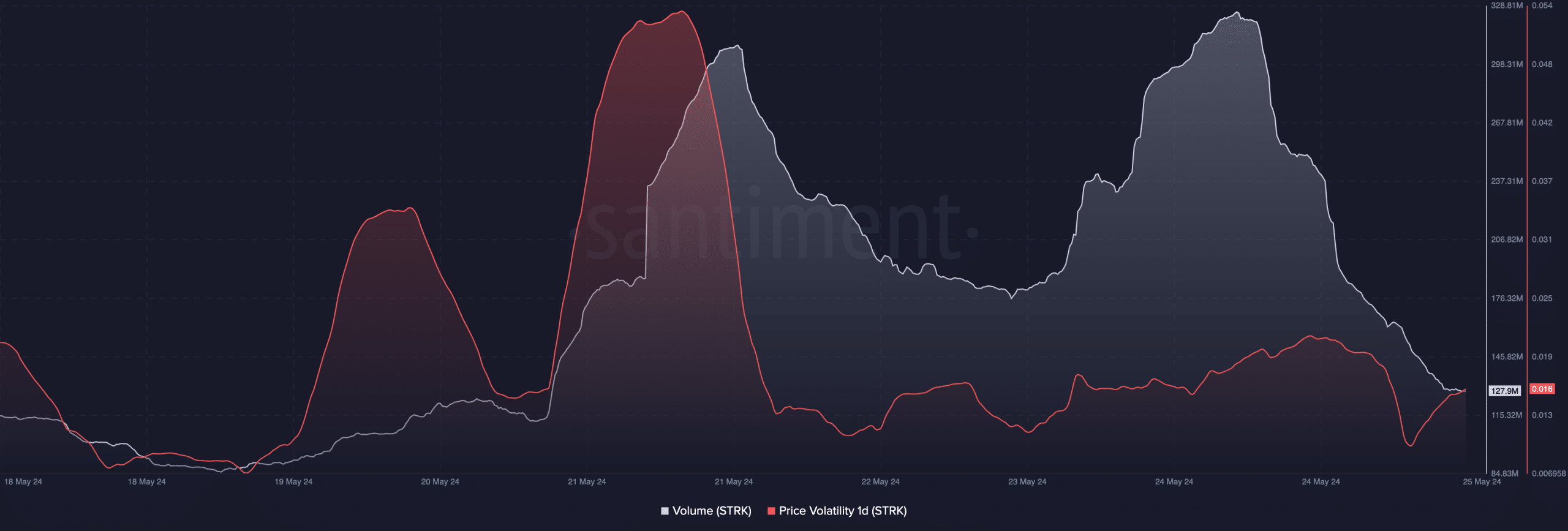

Source: Santiment

However, the bullish price prediction could be invalidated based on volume signals. At the time of writing, STRK’s volume was $127.90 million.

This is a notable drop from the May 24 figure. Volume can be a sign of interest in a token and market strength. Therefore, increasing volume is considered a healthy measure of price.

So, Starknet’s volume decline while prices rise suggests the recovery may not last. Validation of this prediction could cause the price of the token to fall and the drop to $1.06 could come true.

Meanwhile, volatility around the cryptocurrency has increased, suggesting notable price swings.

But according to Santiment, this figure showed that it might not be enough to spark a move that saw STRK surpass $1.50 a few weeks ago.

Source: Santiment

Realistic or not, here is the market cap of STRK in terms of ETH

Regardless of on-chain signals, market participants may need to keep an eye on ETH.

If the prediction that ETH could reach a new high comes true, STRK could follow in the same direction. But if the altcoin fails to recover, its beta could also be in trouble.

News Source : ambcrypto.com

Gn bussni