Warren Buffett says famous to “be greedy when the others are afraid” and “when it rains gold, turn off the bucket, not the die”. The legendary good deals hunter is waiting for years for actions to crash as they did Thursday – but he might not yet buy.

President Donald Trump’s declaration of an almost universal 10% tariff on foreign goods, and even stronger import taxes for “worst delinquents” such as China, vaporized 2.4 billions of dollars or almost a market value of Nvidia by S&P 500 on Thursday. The reference stock market index fell on Friday.

Some of Buffett’s favorite actions have been spanked with Apple, American Express, Bank of America and Western Petroleum all more than 9%.

Buffett did not immediately respond to a request for comments.

The slowdown is likely to encourage the CEO of Berkshire Hathaway, since he is a value investor who seeks to buy companies at a discount on their value. He is also known to capitalize on crises, for example when he deployed a total of $ 26 billion in five transactions between 2008 and 2009.

Buffett wrote in his letter of shareholders of 2017 that net sales can create “extraordinary opportunities” for investors who take into account the words of the poet Rudyard Kipling of “keep your head when everything is losing theirs”.

However, increasing valuations have failed it for purchasing shares, acquiring businesses and even buying the actions of its own business in recent years.

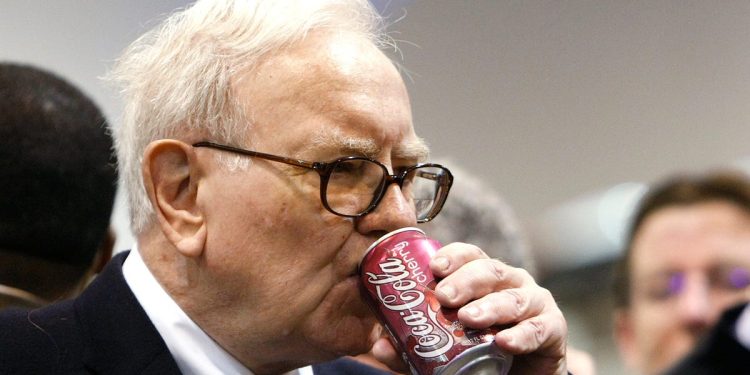

Buffett, 94, has also unloaded $ 158 billion in stocks in the past two calendar years. Berkshire’s cash battery is roughly tripled less than $ 110 billion in September 2022 to $ 321 billion at the end of 2024 – which is larger than the Coca -Cola market.

Armed with an overflowing war box, Buffett seems well placed to enter the rout of the market and collect cheap actions. Internet is certainly agree – social media are full of comments and memes on buffett seated pretty while the markets are in chaos.

Wall Street has also rewarded Buffett’s money hoarseness: Berkshire’s equity price is up around 15% this year, trading the drop by almost 11% of the S&P.

The sharp increase added $ 23 billion to the personal buffett fortune and passed it in front of Bernard Arnault from LVMH and Larry Ellison d’Oracle in fourth place on the Bloomberg Billionaires index.

However, the famous patient and the disciplined investor could wait longer before leaping.

“When prices drop, it certainly encourages Buffett to buy unless he sees new permanent damage higher than the awards ceremony,” Steven Check told Business Insider. He has supervised $ 2 billion in assets as CEO of Check Capital Management and has attended each annual annual meeting in person in Berkshire since 1996.

Actions can be cheaper than before, but Check said Buffett “will likely require a much greater drop to make significant purchases”.

Waiting game

Buffett subscribers will probably have to wait for the Berkshire meeting in May or its update of the second quarter portfolio in August to find out if the investor completed his assets this week.

Steve Hanke, professor of economics applied at Johns Hopkins University who has been teaching Buffet style assessment to students for decades, told Bi that he “looks at his next movement with the most prudent and anxious attention” because she “will tell us a lot about the place where he thinks.

“If he dives on the market and begins to buy, it will indicate that he thinks that Trump prices were nothing more than a minor economic discomfort that created wonderful purchasing opportunities,” he said. Hanke is a former economic advisor to President Ronald Reagan and the president of Toronto Trust Argentina when it was the world’s most powerful investment fund in 1995.

If Buffett is held, Hanke said that it would suggest that he kept in mind the prices of Smoot-Hawley in March 1930, which “broke the back of the stock market and helped dive into the great depression”.

Hanke’s “provisional assumption” is that Buffett’s knowledge of economic history will lead him to “stay on the sidelines, at least for a while” until the scope of what it becomes becomes clearer.

If the frantic sale on the markets continues, the moment of buffett could happen as soon as possible.

businessinsider