Bitcoin Whales Load Their Bags: $1.7 Billion in BTC Flows Off Exchanges

Bitcoin’s price – and the market in general – started the week with one of the biggest drops it’s seen in 2024. While this general market downturn has led to widespread fear and panic among cryptocurrency enthusiasts, it appears that many investors have taken the opportunity to amass more of the low-priced digital asset.

According to the latest on-chain data, significant amounts of Bitcoin have left cryptocurrency exchanges. The question here is: what does this mean and how does it affect the BTC price?

Do investors think the uptrend will continue?

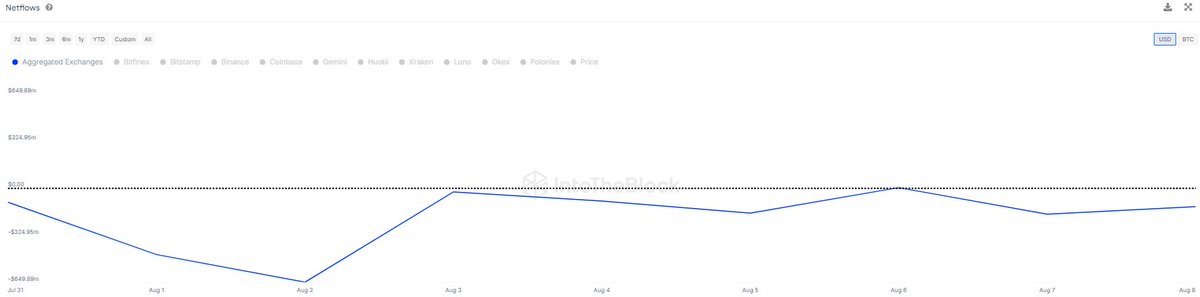

According to recent data from IntoTheBlock, over 28,000 BTC (worth over $1.7 billion) have been moved off of cryptocurrency exchanges over the past week. This on-chain revelation is based on changes in the Netflows metric, which tracks the amount of a particular cryptocurrency sent in and out of centralized exchanges.

An increase in the value of net flows (or when it is positive) indicates that more funds are entering cryptocurrency exchanges than leaving them. On the other hand, when the value of the metric falls below, it implies that more cryptoassets are leaving exchanges than entering them.

Source: IntoTheBlock

As seen in the chart above, the Netflows metric for Bitcoin has been trending downward for the past few days, implying that large investors have been moving their assets away from centralized exchanges. According to IntoTheBlock, the $1.7 billion worth of BTC withdrawn over the past seven days is the largest outflow seen during this period so far in 2024.

While it’s hard to pinpoint the reason for this mass exodus, cryptocurrency movements of this magnitude away from centralized exchanges typically indicate a shift in investor sentiment. This suggests a change in holding strategy or even new accumulation by large investors, showing their confidence in Bitcoin’s long-term promise.

Additionally, the decline in the availability of the leading cryptocurrency on trading platforms could lead to a supply crisis. Ultimately, this decline in the BTC exchange reserve could trigger a surge in the Bitcoin price.

Bitcoin Price Overview

After a sharp drop from over $64,000 to $48,000 on Monday, August 5, Bitcoin price has shown great resilience over the past week, forcing its way back above the $62,000 level.

At the time of writing, the flagship cryptocurrency is hovering around $60,400, reflecting a 1% price drop over the past 24 hours. Meanwhile, data from CoinGecko shows that BTC is still down over 3% this week.

The price of Bitcoin hovering around the $60,000 mark on the daily timeframe | Source: BTCUSDT chart on TradingView

Featured image from iStock, chart from TradingView