Bitcoin Selloff in Germany: With $551 Million Worth of BTC Sold, Is the King’s Crown Slipping?

- The price of Bitcoin has increased by more than 3% in the last 24 hours.

- The German government has once again transferred millions of dollars in BTC.

Bitcoin (BTC) Bitcoin has finally shown signs of recovery, as after weeks of decline, the daily chart of the king of cryptocurrencies has turned green. Thanks to this, the price of BTC has surpassed $57,000.

However, not everything was working in BTC’s favor, as a few major players, such as the German government, sold BTC as its price skyrocketed.

Bitcoin turns bullish

CoinMarketCap data revealed that the price of Bitcoin has fallen by more than 9% in the past seven days.

But things have improved in the last 24 hours, as the king of cryptos has increased in value by more than 3%, giving hope for a further price rise.

At the time of writing, BTC was trading at $57,290.27 with a market cap of over $1.129 trillion. As BTC price gained bullish momentum, a few of the major players in the crypto space chose to sell their holdings.

Recent articles from Lookonchain tweet revealed that the German government has once again transferred 9,634 BTC, worth over $551 million, to Kraken, FlowTraders, Coinbase, Bitstamp, Cumberland, and B2C2Group.

According to the tweet, the German government has transferred 24,304 BTC, worth $1.44 billion since June 19, and still held 28,988 BTC at press time, worth $1.66 billion.

Apart from this, a whale also deposited a substantial amount of BTC. Another tweet Lookonchain pointed out that a whale deposited 809 BTC, worth $45.18 million, on Binance.

This increase in selling pressure from a whale and the German government could negatively impact the coin’s price action and could lead to the end of BTC’s recently launched bull rally.

Will the BTC bull rally end soon?

As some players were exerting selling pressure, AMBCrypto checked CryptoQuant’s positions data to better understand the general state of the market.

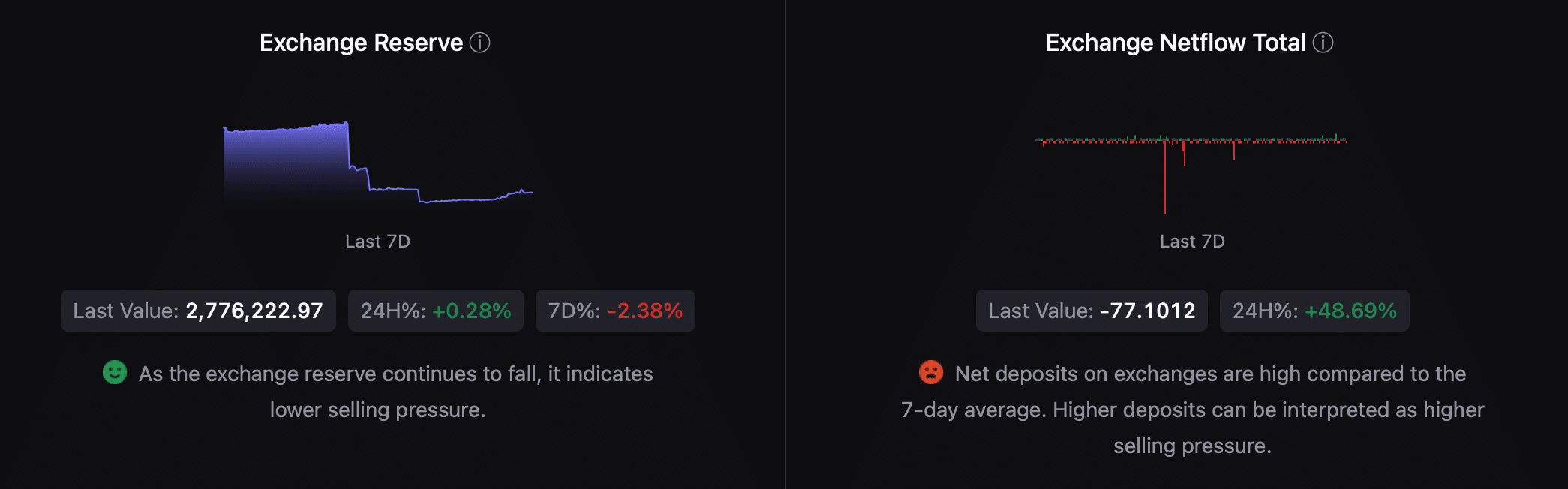

We noticed that the BTC exchange reserve was decreasing, indicating low selling pressure.

However, the net deposit of BTC on exchanges was high compared to the average of the last seven days, meaning that selling pressure was increasing.

Moreover, selling sentiment was also dominant among US investors, as evidenced by its red Coinbase premium.

Source: CryptoQuant

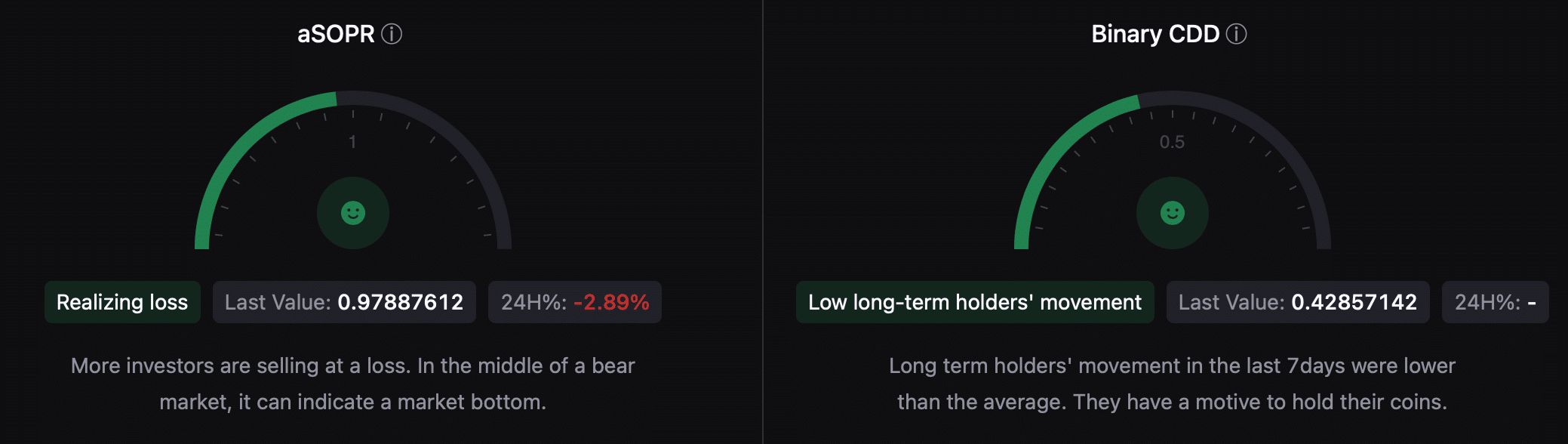

However, a few other indicators seem optimistic. For example, BTC’s aSORP revealed that more investors were selling at a loss. In the midst of a bear market, this can indicate a market bottom.

Its binary CDD was also green, meaning that the long-term holders’ movements over the last seven days were below average. They have a reason to hold on to their coins.

Source: CryptoQuant

Read Bitcoin (BTC) Price Prediction 2024-2025

We then looked at the BTC daily chart to see if the indicators are pointing to a continuation of the rise. The Chaikin Money Flow (CMF) technical indicator has registered an increase, pointing to a continued rise in price.

But the Money Flow Index (MFI) has started to decline, which, along with the latest transfer from the German government, could put an end to bitcoin’s rise.

Source: TradingView

News Source : ambcrypto.com

Gn bussni