- On-chain data shows renewed buying interest and a decline in supply on Binance, leading to the recent Bitcoin price increase.

- Open interest and active addresses also suggest stronger market participation and potential for additional gains.

Bitcoin (BTC) has been on a volatile trajectory since the start of the year. After an initial rally, the cryptocurrency faced a sharp correction that left many investors uncertain about the cryptocurrency’s development. market direction.

However, a recent rally on January 20 pushed the price of Bitcoin to a new all-time high, briefly surpassing $109,000.

Although the asset saw a slight pullback, trading at $107,945, it remained up 3.5% over the past 24 hours, reflecting a double-digit gain over the past week.

Amid this price activity, analysts are closely monitoring key on-chain metrics.

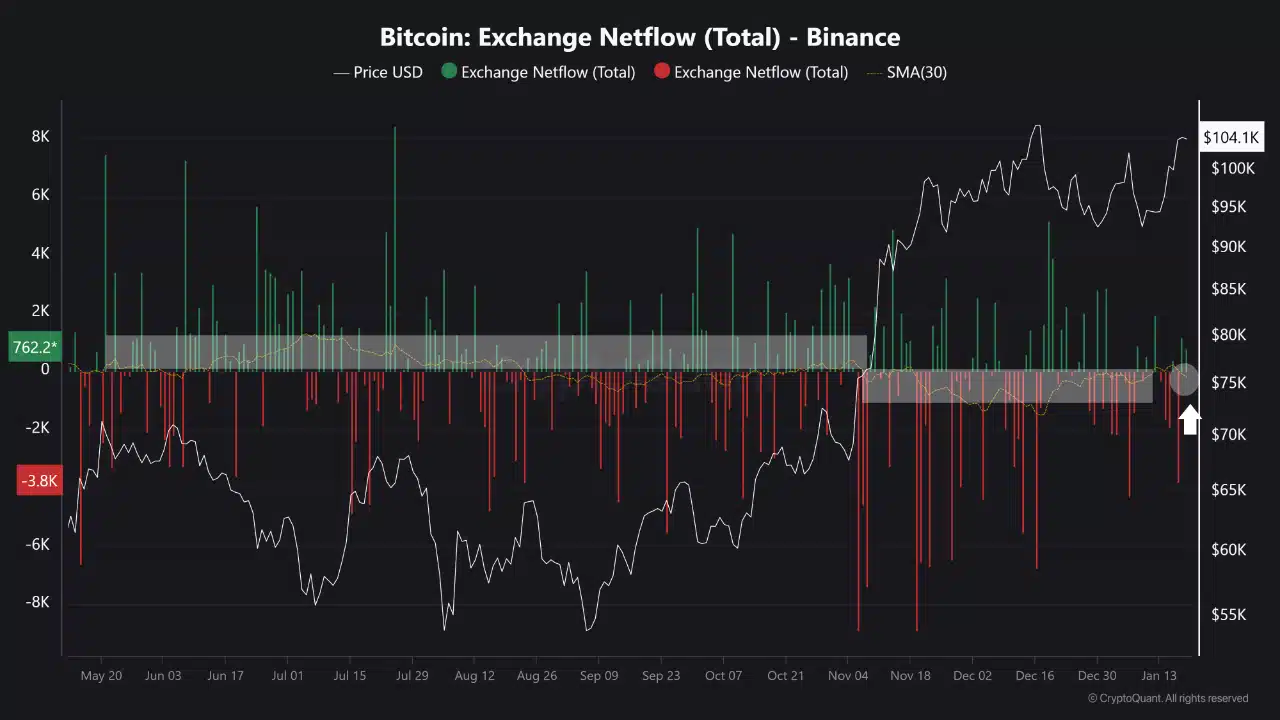

According to a CryptoQuant analyst, the Binance Netflow SMA30 – a 30-day moving average of net flows on Binance – offered valuable knowledge on market sentiment and pricing trends.

The analyst points out that changes in this metric are often correlated with notable price movements, indicating that the current rally may have more room to run.

Bitcoin Net Flow Trends and Market Dynamics

The Binance Netflow SMA30 metric has always been a useful indicator for anticipating the near-term price direction of Bitcoin.

When the metric enters positive territory, it often signals increased selling pressure as more Bitcoin flows into Binance.

For example, in May 2024, a positive SMA30 Netflow coincided with a decline in Bitcoin price from $71,000 to $50,000, highlighting a period of high supply and bearish sentiment.

Source: CryptoQuant

Conversely, when the SMA30 Netflow turns negative, it generally indicates reduced spot supply and stronger bullish momentum.

This trend was evident in November 2024, when the metric turned negative and Bitcoin rose from $74,000 to $108,000.

On January 17, the SMA30 returned to negative territory, settling at -207.85, suggesting renewed buying interest and raising the possibility of another rally towards a new all-time high.

Additional information

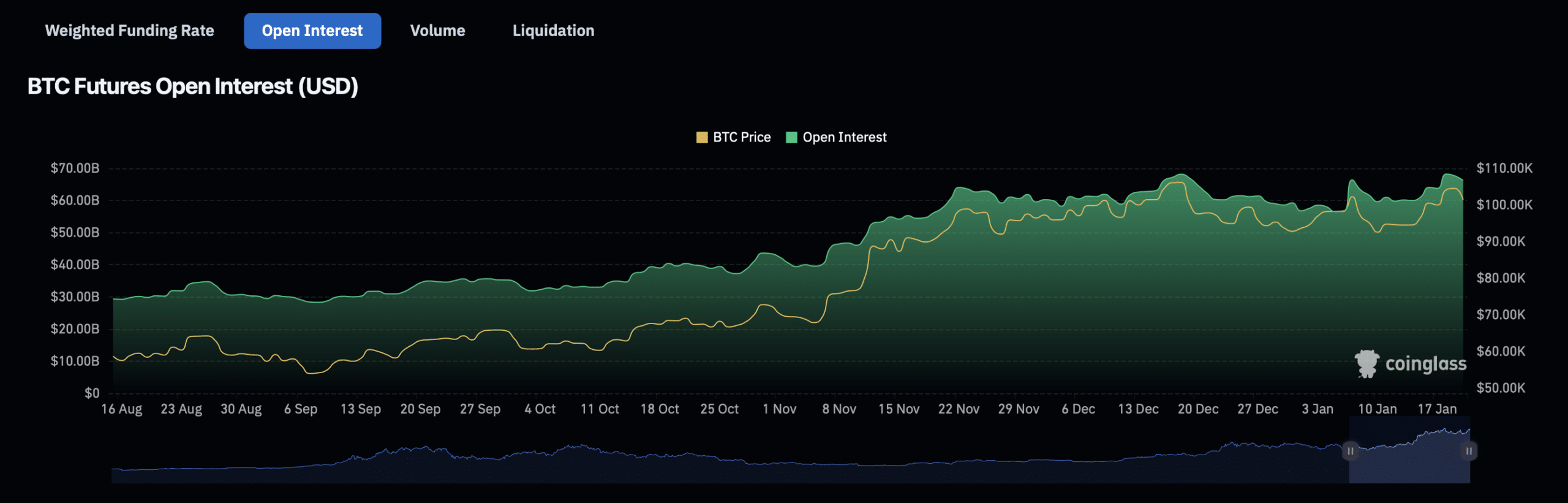

Beyond the Binance Netflow SMA30, other indicators have provided a broader perspective on Bitcoin’s near-term outlook.

Coinglass Open Interest Data watch an increase of 4.61% in the last 24 hours, reaching a valuation of $71.21 billion.

Source: Coinglass

Open interest volume also increased by 156.60% during the same period, reaching $179.14 billion.

These increases reflect growing trader engagement and potential derivatives market dynamics, which may influence the Bitcoin spot price.

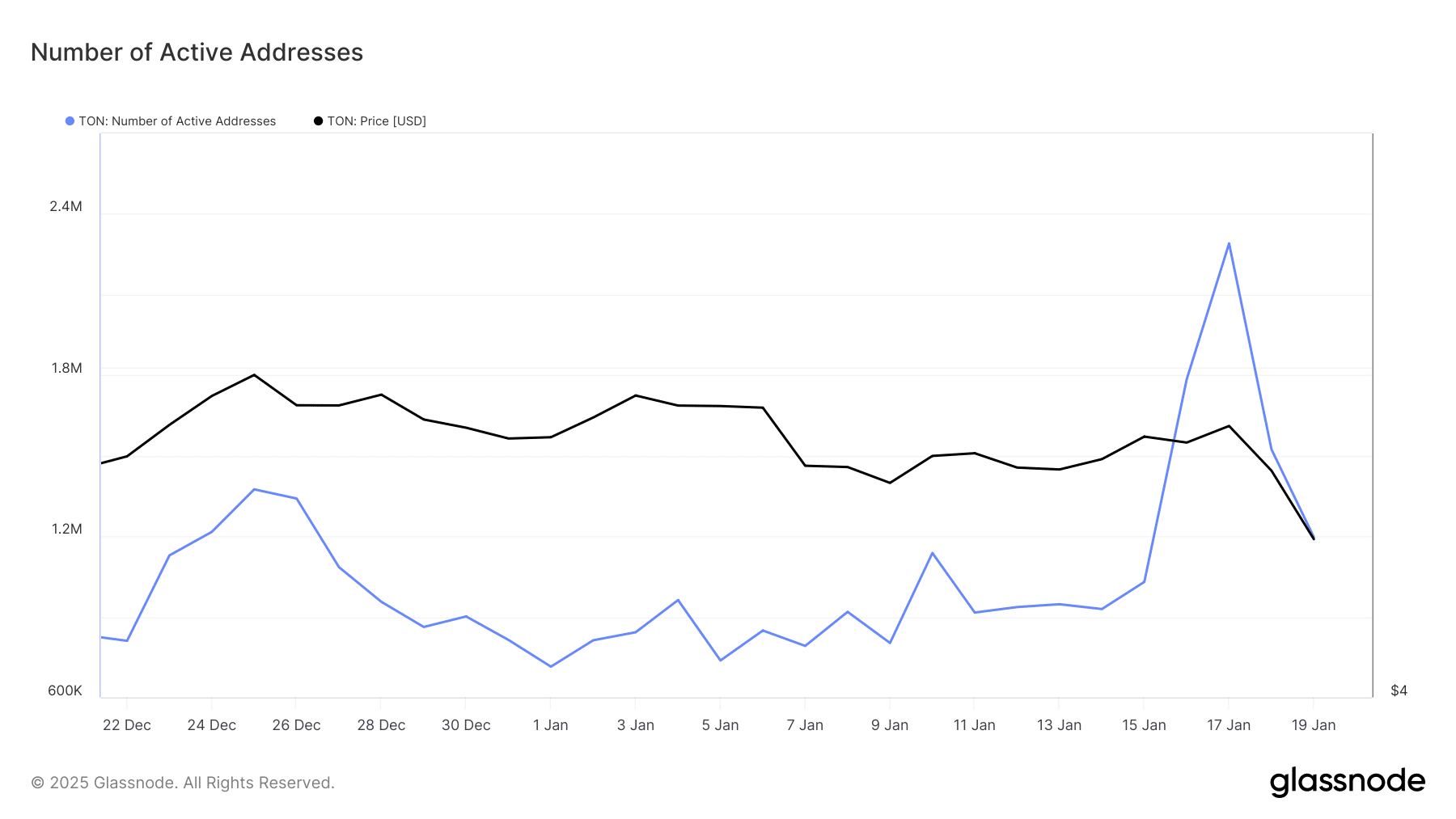

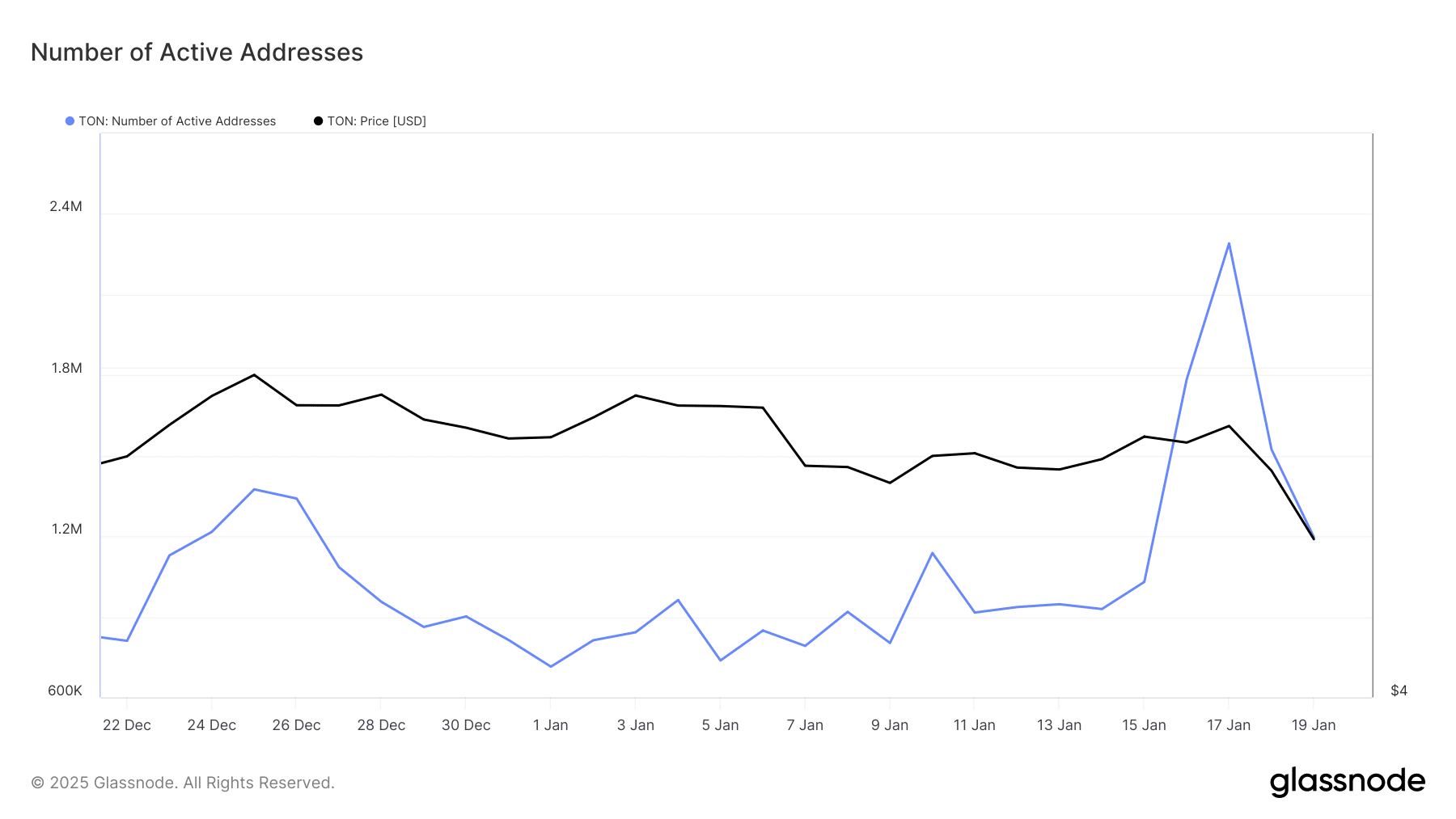

Additionally, Glassnode data on active addresses (an indicator of retailer participation) revealed recent spikes in user activity.

Read Bitcoin (BTC) Price Forecast 2025-2026

The number of active addresses increased from less than a million at the start of the month to 2.2 million on January 17, before falling to 1.1 million on January 19.

Source: Glassnode

Although the fluctuation in active addresses indicates variability in retailer interest, the overall increase from earlier this month suggests more participants are engaging with the Bitcoin network.