- Bitcoin recovered $100,000, albeit briefly, with internal and external factors signaling a possible breakout in the first quarter.

- History tells us that the crypto market has a knack for defying prevailing predictions.

The latest economic data has put the Fed in a difficult situation. No surprise, the crypto market was quick to react. With a 4% increase in market cap, major coins are back in the green and Bitcoin quickly reclaimed $100,000, albeit briefly – a level it hasn’t seen in over a week . Coincidence or strategy? This push seemed perfectly in sync with Trump’s upcoming inauguration.

Obviously, the stage is set. With all these factors at play, is it still too bold to predict Bitcoin’s new all-time high by the end of the month?

If anticipation trumps execution…

The crypto market’s reaction to the latest inflation data is no accident. Core CPI inflation in December fell to 3.2%, beating forecasts of 3.3%. This unexpected drop sparked optimism for a rate cut, as evidenced by the 4% jump.

This could be the turning point investors have been waiting for. With inflation slowing, the Fed may rethink reducing borrowing costs. Lower interest rates could make leverage cheaper for traders, potentially flooding the crypto market with new capital.

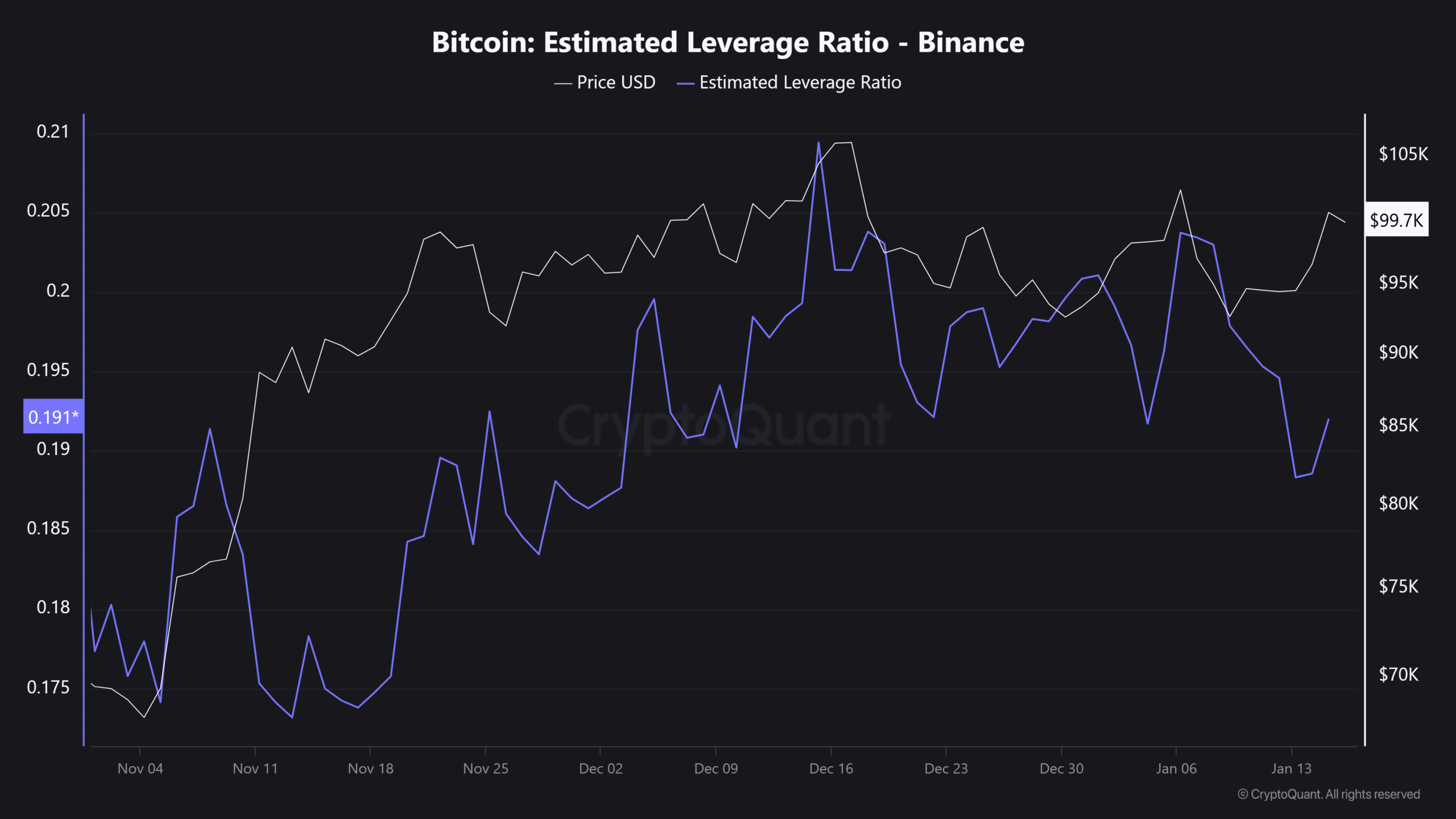

Open Interest (OI) now sitting above $64 billion speaks volumes. With the leverage ratio on Binance increasing, we could see even more action if the Fed pulls the trigger – something you’ll want to watch closely in the coming days.

Source: CryptoQuant

However, here’s the catch: Bitcoin’s 3.61% rise, just as the report fell, was not based solely on inflation data. It’s a mix of “anticipation” about possible rate cuts, Trump’s proposal to overhaul the crypto-friendly SEC, and his upcoming return to the White House.

Together, these factors pave the way for a potential $102,000 breakout for BTC. However, hitting a new all-time high isn’t just about anticipation. This requires real “execution”. As we’ve seen time and time again, the market loves to defy mainstream expectations. Could this be another one of those moments?

A Look at the Other Side of Bitcoin

To break its all-time high, Bitcoin would need a 10% increase from its press-time price of $99.8k. Last year, during the Trump campaign, BTC jumped 9% in a single day. But this time, the stakes are much higher.

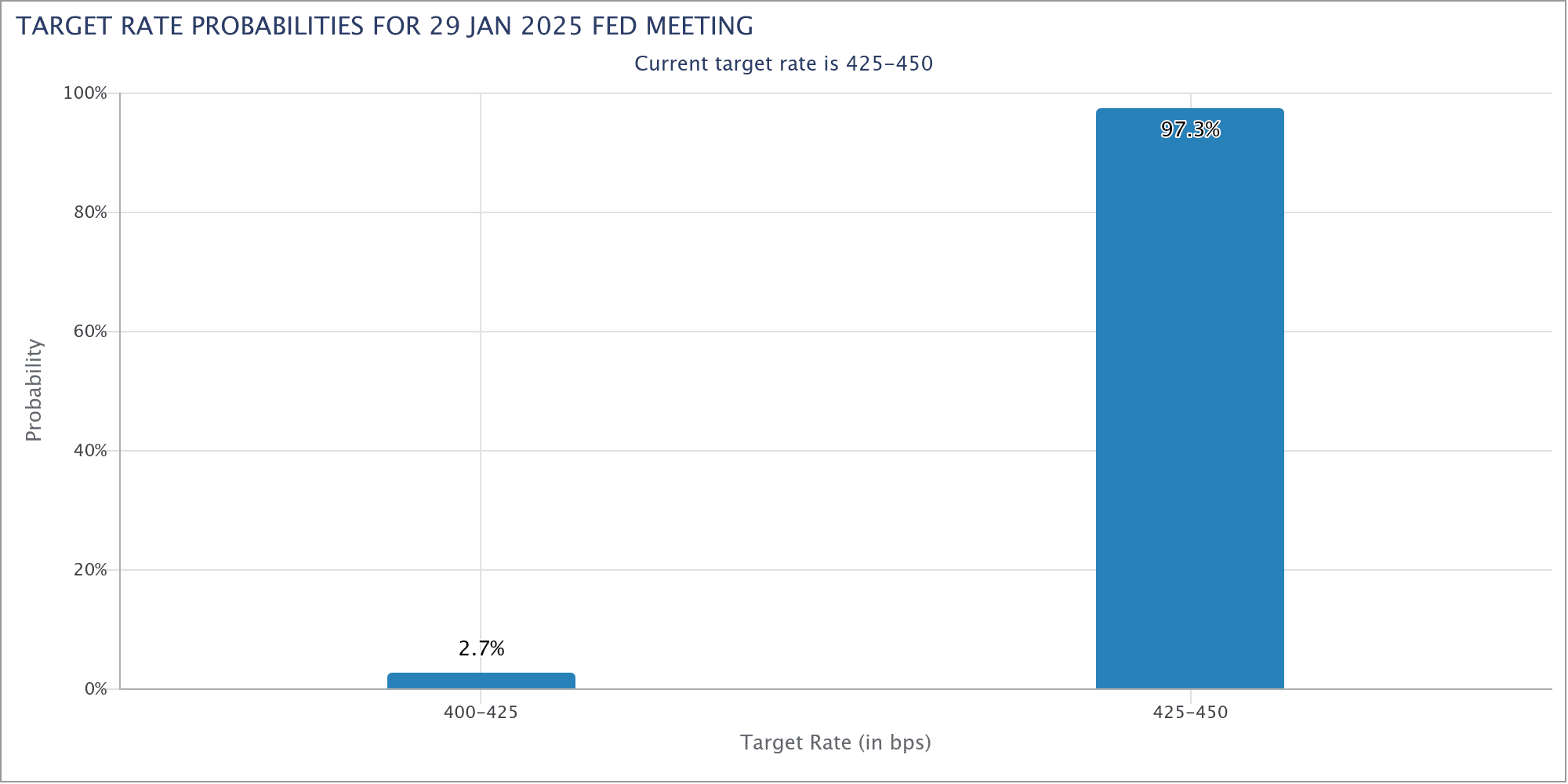

The next FOMC meeting is in just 13 days and could shape the entire landscape for 2025. The market is holding its breath, with a 97.3% chance that a rate cut is in play. Will the Fed be will it measure up or will investors’ hopes be dashed once again?

Source: FedWatch

Even though a 10% rise seems within reach, prepare for high volatility in the days to come. Short-term traders will likely focus on quick profits rather than long-term holds. Add to that Trump’s new push for tariffs on countries like Denmark and Canada and it’s easy to see why the Fed might be hesitant to cut rates.

Read Bitcoin (BTC) Price Prediction 2025-26

With so many unpredictable factors at play, the road ahead could be rocky for Bitcoin, making it crucial for investors to remain vigilant. The coming days will determine whether market optimism remains strong – or whether it falters.