- BTC formed an interesting accumulation model observed before the rallies in 2024.

- Long -term holders took 150k BTC in April, while the liquidity of the US dollar recovered.

Bitcoin (BTC) Flirted with the level of $ 97,000 for the first time since February, which has only distanced him from 3.5% from the $ 100,000 mark. Interesting, more Channel metrics suggested that $ 100,000 was at hand.

Especially cryptocurrency highlighted that the trend of accumulation of short -term holders (1 day to 1 week) in T2 2025 reflected models which sparked price rallies at the beginning and at the end of 2024.

Source: cryptocurrency

The graph has shown that whenever the accumulation of short-term holders made a higher higher level, it was followed by a BTC price wave at the Q1 and Q4 2024. By crypto,

“If this trend continues in the short term, Bitcoin can be on the right track to exceed $ 100,000 and enter a strong ascending phase.”

Bitcoin bruise clues

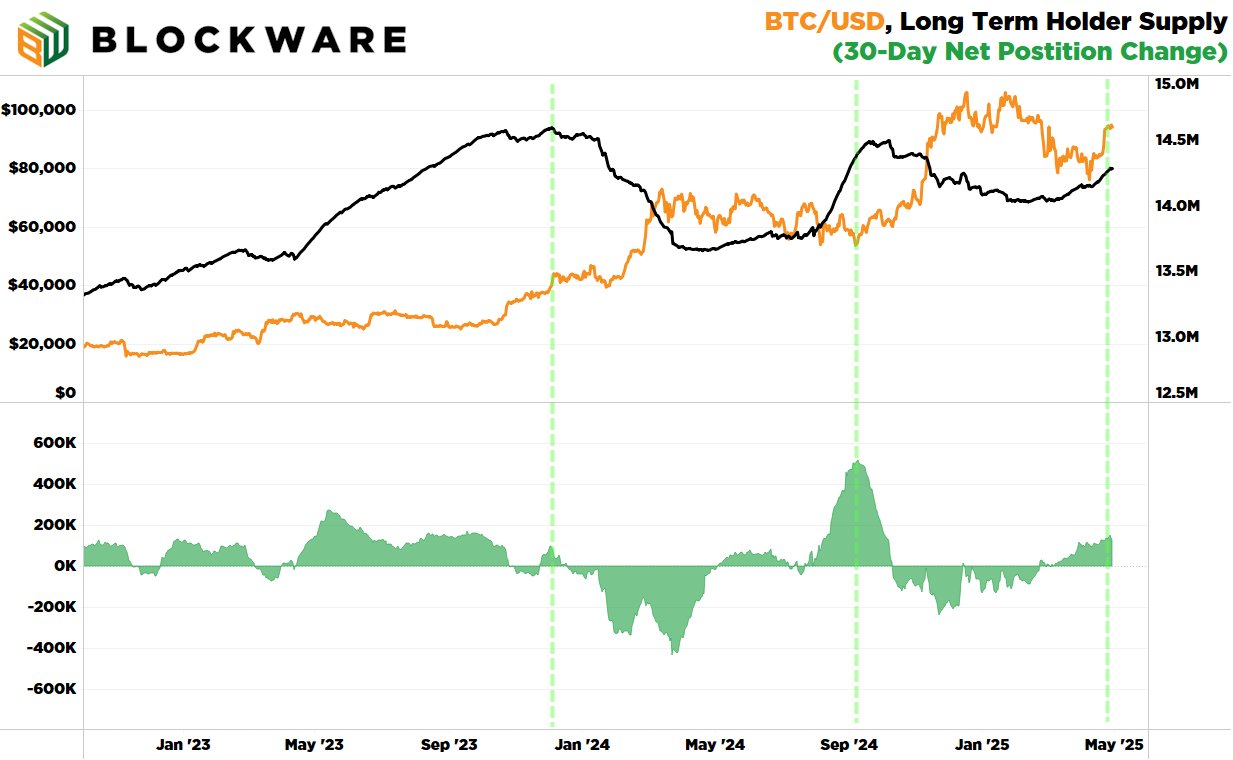

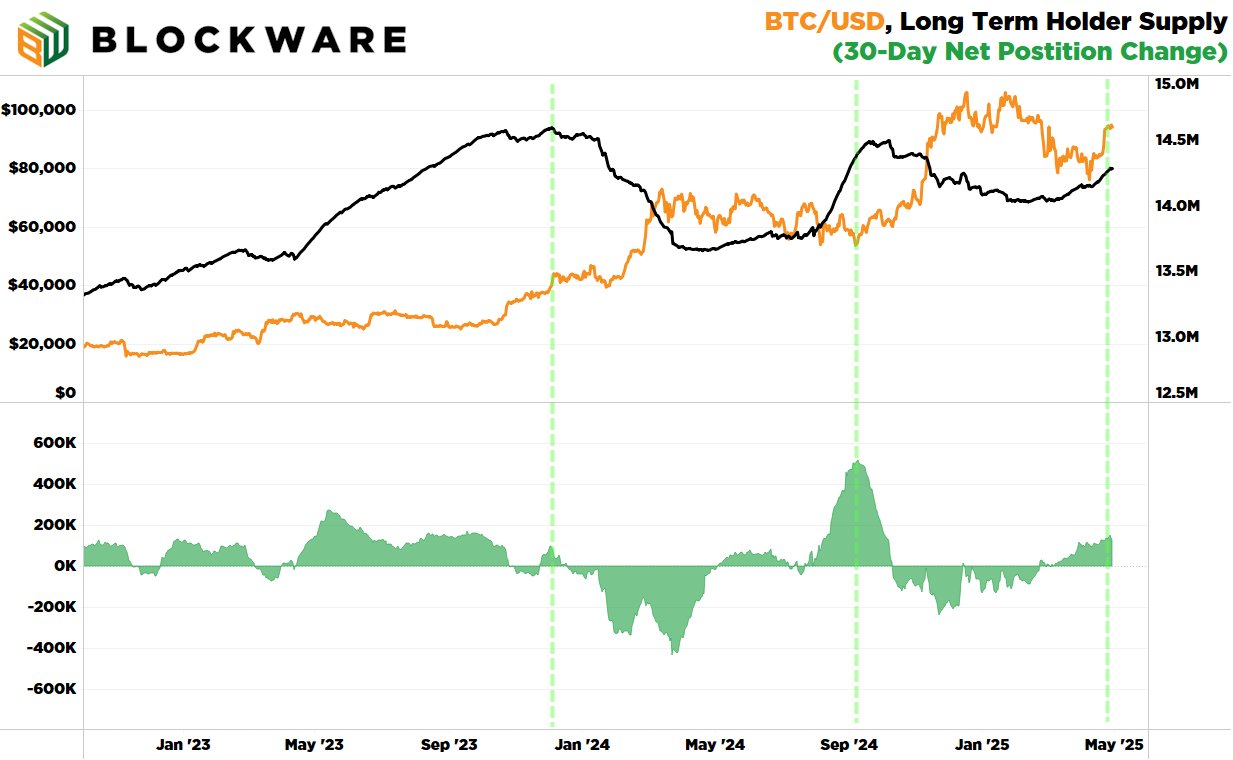

The supplier of Bitcoin extraction systems, blockware, shared a similar upward perspective. The company noted that the long -term holder supply increased.

This meant that the main sales pressure of profitable long -term holders (held the BTC for more than 6 months) sucked. In fact, the BTC analyst Robert Breedlove said,,

“In the past 30 days, long -term holders have acquired around 150,000 BTC more. Bitcoin lacks sellers in the range of $ 80,000 to $ 100,000. ”

Source: software

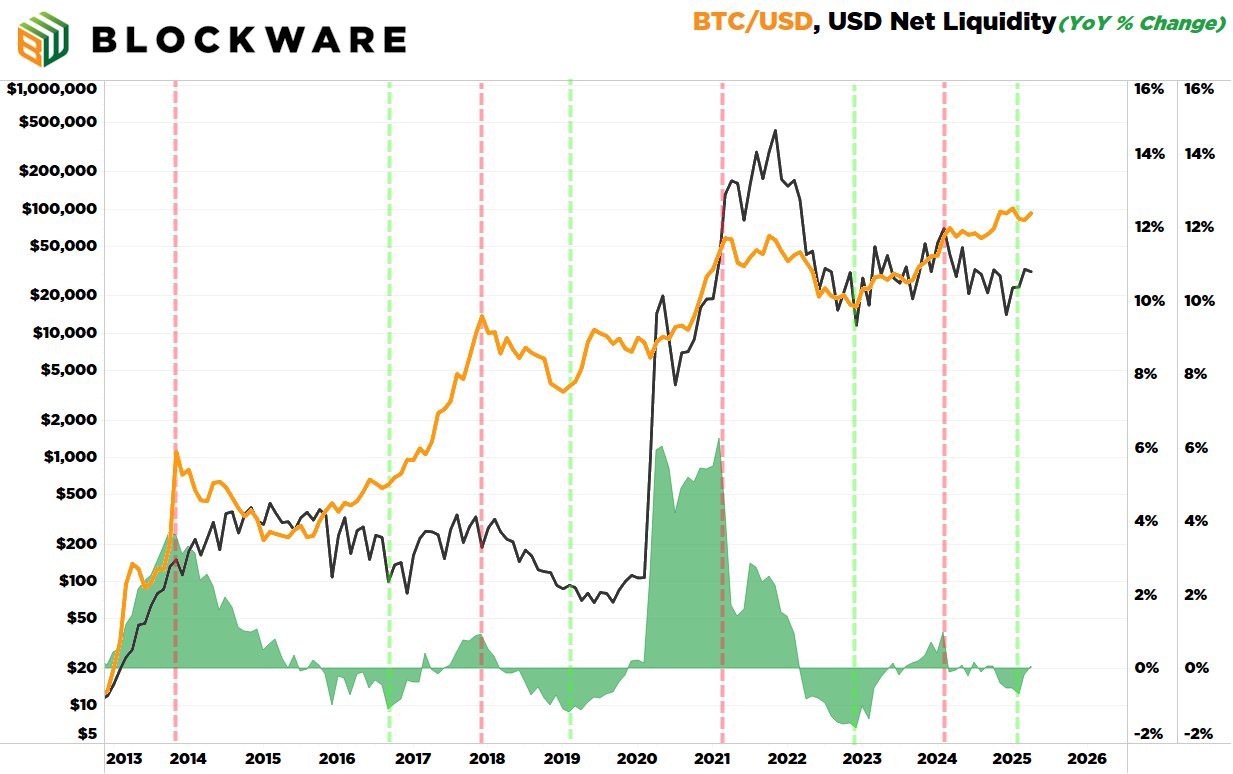

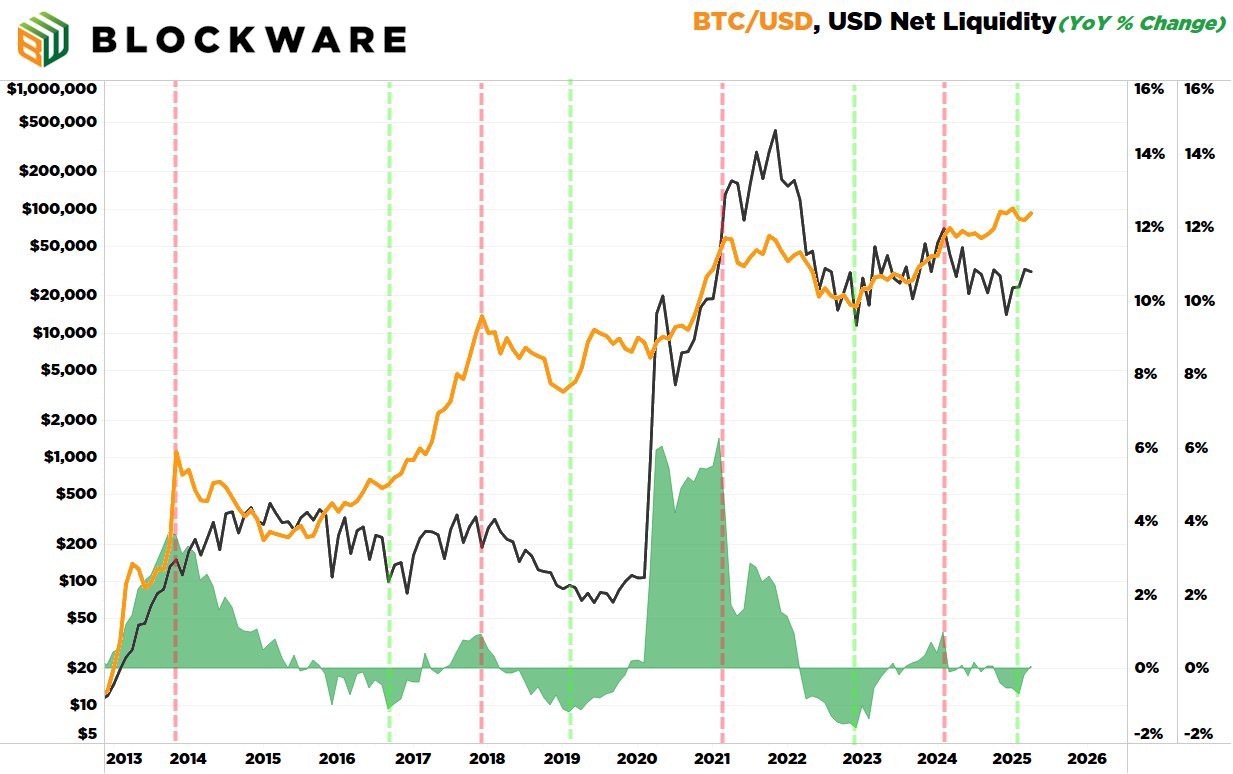

But the most crucial request factor was perhaps the rebound in the liquidity of the US dollar. The block software table has shown a positive correlation between the liquidity of the BTC and the United States.

For example, the massive peak of liquidity of the US dollar in 2020-2021 led to the massive BTC rally at $ 69,000 of $ 3.5,000.

Source: software

The liquidity contracted at the end of 2024 and at the beginning of 2025, but seemed to bounce back to T2 2025. If the liquidity trend continues, it could increase BTC offers and further feed the momentum.

On the price table, the 4 -hour super trend indicator was in “Buy” mode at the time of writing. In addition, prices’ action was above key mobile averages, suggesting that bulls had the advantage of the market.

Source: BTC / USDT, tradingView

Taken together, chain and technical indicators are based on the side of the Bulls, and an additional $ 100,000 rally could be likely in the short term.