- Bitcoin domination showed cooling signs after breaking a key resistance area.

- Are alternative assets ready for a resurgence of investor portfolios?

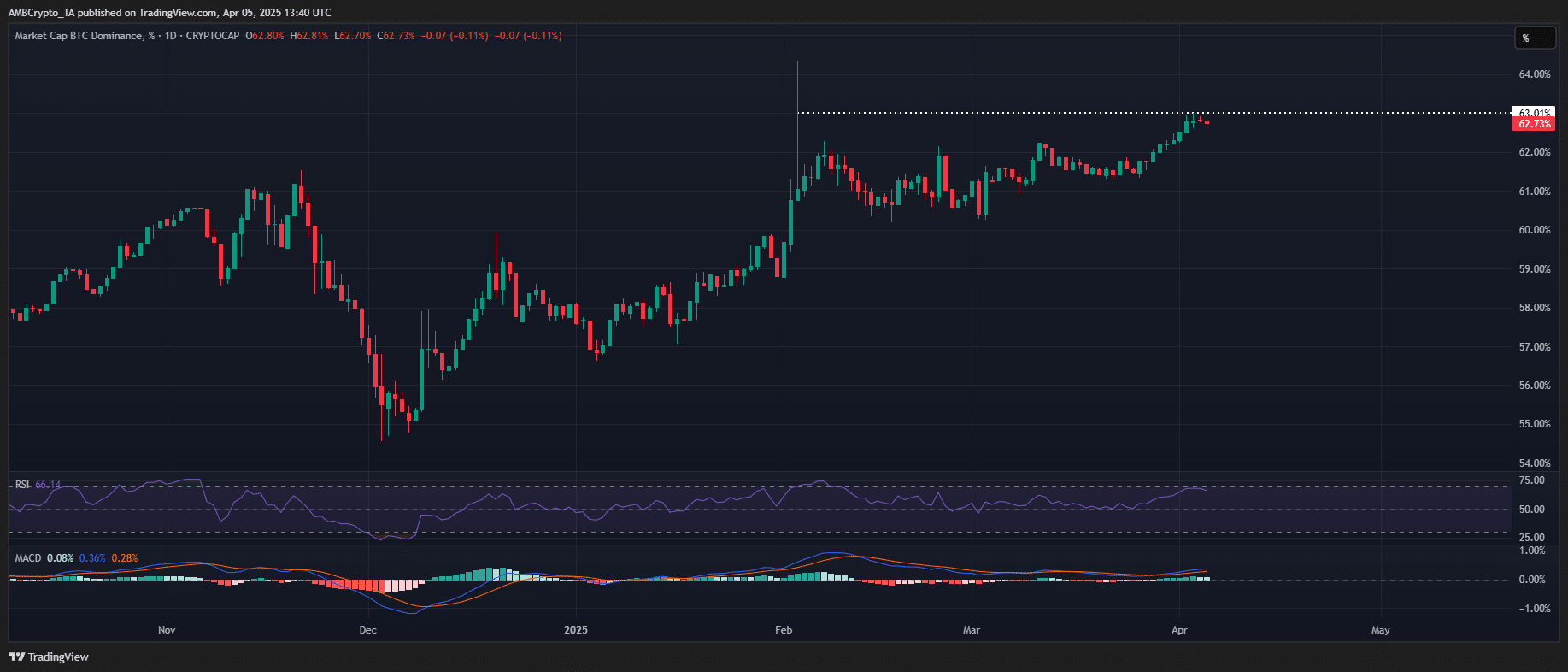

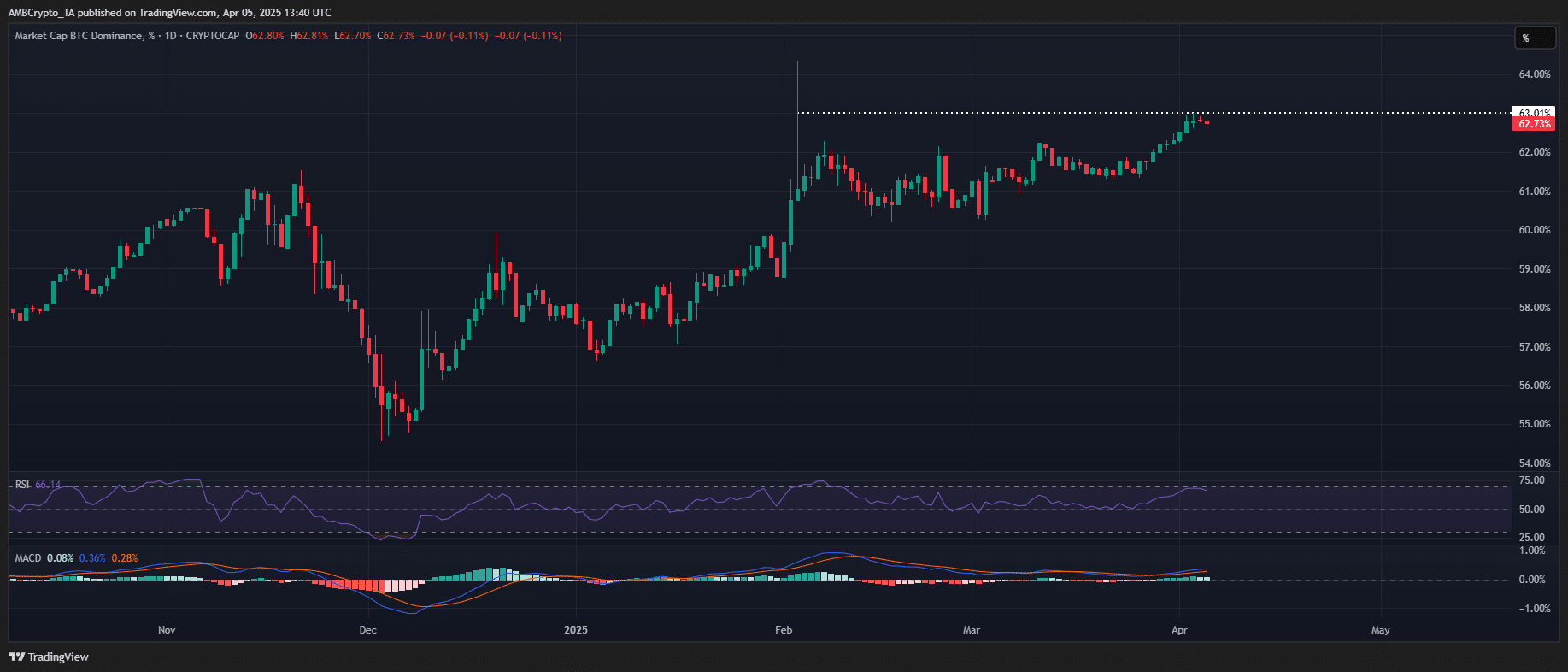

After a strong rally, the Bitcoin dominance (BTC.D) began to show signs of exhaustion.

At the time of the press, the relative resistance index (RSI) was deeply exaggerated, increasing the probability of a corrective retirement, while the MacD lowering crossing reported a momentum by BTC.D tests the level of key resistance of 63%.

Historically, such technical conditions preceded capital rotations in risk assets, suggesting a potential resurgence of Altcoin if BTC.D is starting to relax.

Source: tradingView (BTC.D)

However, confirmation of a local summit remains elusive. While Bitcoin has demonstrated structural resilience in the middle of macro opposite winds, large capitalization altcoins remain very volatile with failed support reestes.

Solana (ground) is an excellent example – despite his eight -month hollow, the asset has twice recovered $ 115 in March. However, he failed to establish a firm support base, leaving it structurally weak and sensitive to new distribution cascades.

The same scheme extends to most altcoins, strengthening a fragile market structure. Consequently, reduce the probability of a sustained rotation of capital despite the overheated techniques of BTC.D.

Altcoins ready to decade from the domination of Bitcoin

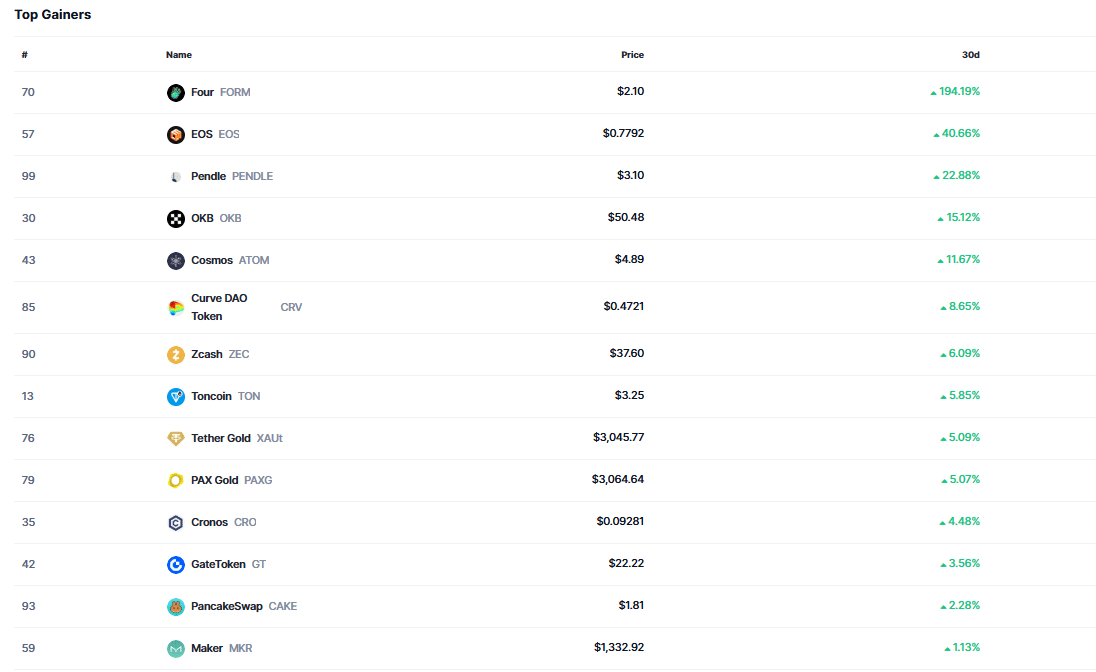

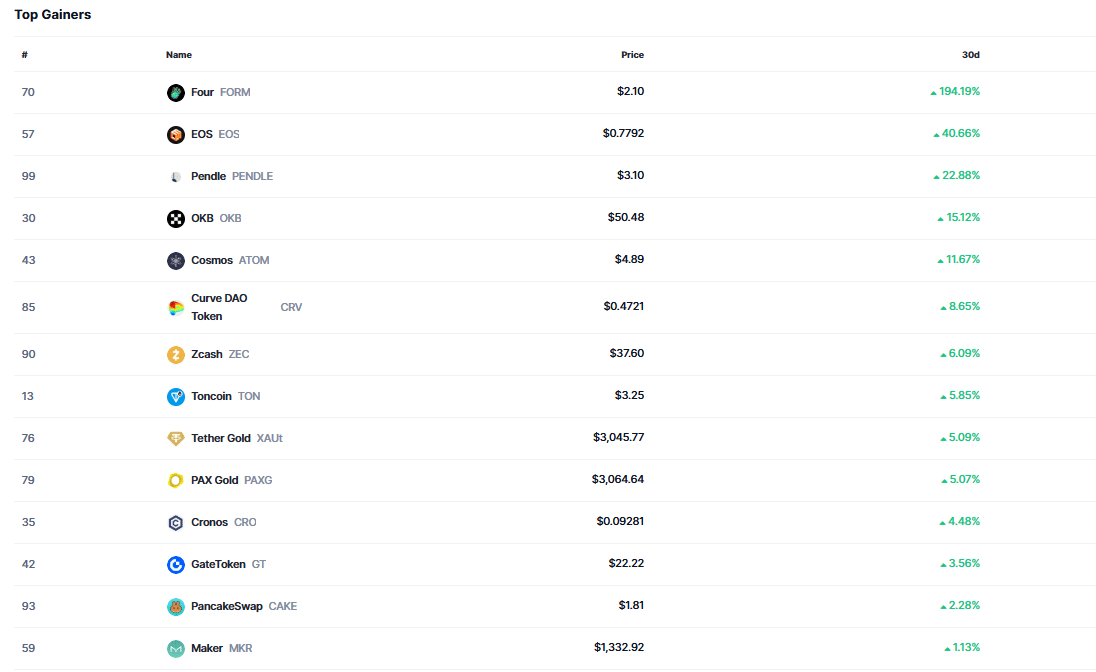

The monthly CoinMarketCap graph underlines a decisive rotation of low and medium altcoins capital.

The classification is four (form), an asset with low capitalization which posted a rally of 194.19% to $ 2.10, reporting a speculative and increased influx.

Mid-cap active ingredients such as EOS (EOS), OKB (OKB) and Cosmos (ATOM) have also displayed notable gains, each now a market capitalization of more than $ 1 billion, signaling wider market participation beyond Bitcoin domination.

Source: CoinmarketCap

On the other hand, large capitalization altcoins continue to deal with the distribution pressure. Despite certain exchanges at levels of less than $ 1, their request decreased as BTC Dominance Pics.

In particular, no assets with large capitalization has reached the list of the best winners, Cardano (ADA) leading the disadvantages, recording a monthly raft of 30%.

As leaders of the Altcoin market, their inability to establish a Haussier dynamic disturbs the dynamics of capital rotation.

This structural divergence underlines why, despite the domination of Bitcoin, the conditions of overchat, a sustained Altcoin season remains improbable.