Bitcoin climbs above $67,000: will BTC cross $100,000 this time?

- The price of Bitcoin has increased by more than 10% in the last seven days.

- BTC was testing resistance and a breakout could trigger another bull rally.

Bitcoin (BTC) surprised investors last week as its price rose by double digits. The trend sparked excitement in the market as expectations of BTC reclaiming $70,000 grew.

In fact, if we consider the most recent data, this possibility does not seem remote.

Will Bitcoin repeat history?

CoinMarketCap data revealed that the price of BTC has increased by more than 10% over the past seven days, allowing it to hover above $67,000.

At the time of writing, the king of cryptos was trading at $67,115.81 with a market cap of over $1.32 trillion.

While BTC’s price action has favored the bulls, Titan of Crypto, a popular crypto analyst, recently published a Tweeter highlighting an interesting development.

According to the tweet, BTC was targeting the upper line of its realized price. If this translates into reality, investors could see BTC surpass $100,000 in the coming weeks.

The possibility of this happening was likely, as similar episodes have occurred in the past. To be precise, Bitcoin has touched the upper line of its realized price during every cycle in the past.

Things in terms of on-chain metrics also looked rather bullish for Bitcoin.

Analysis by AMBCrypto of CryptoQuant data revealed that BTC net deposit on exchanges was declining, hinting at low selling pressure.

Its MPI was green, meaning mining companies were selling fewer securities than the one-year average. However, at press time, BTC’s aSORP was red, suggesting more investors were selling for profit.

In the midst of a bull market, this can indicate a market top.

Source: CryptoQuant

What to expect in the short term?

Besides aSORP, a few other measures have also raised red flags. For example, AMBCrypto’s analysis of Glassnode data found that BTC’s accumulation trend score had a value of 0.0107.

The Accumulation Trend Score is an indicator that reflects the relative size of entities actively accumulating coins on-chain in terms of their BTC holdings.

A value closer to 0 means investors are distributing or not accumulating BTC.

Source: Glassnode

Apart from this, BTC fear and greed index had a value of 72. This meant that the market was in a “greed” phase, which often results in price corrections.

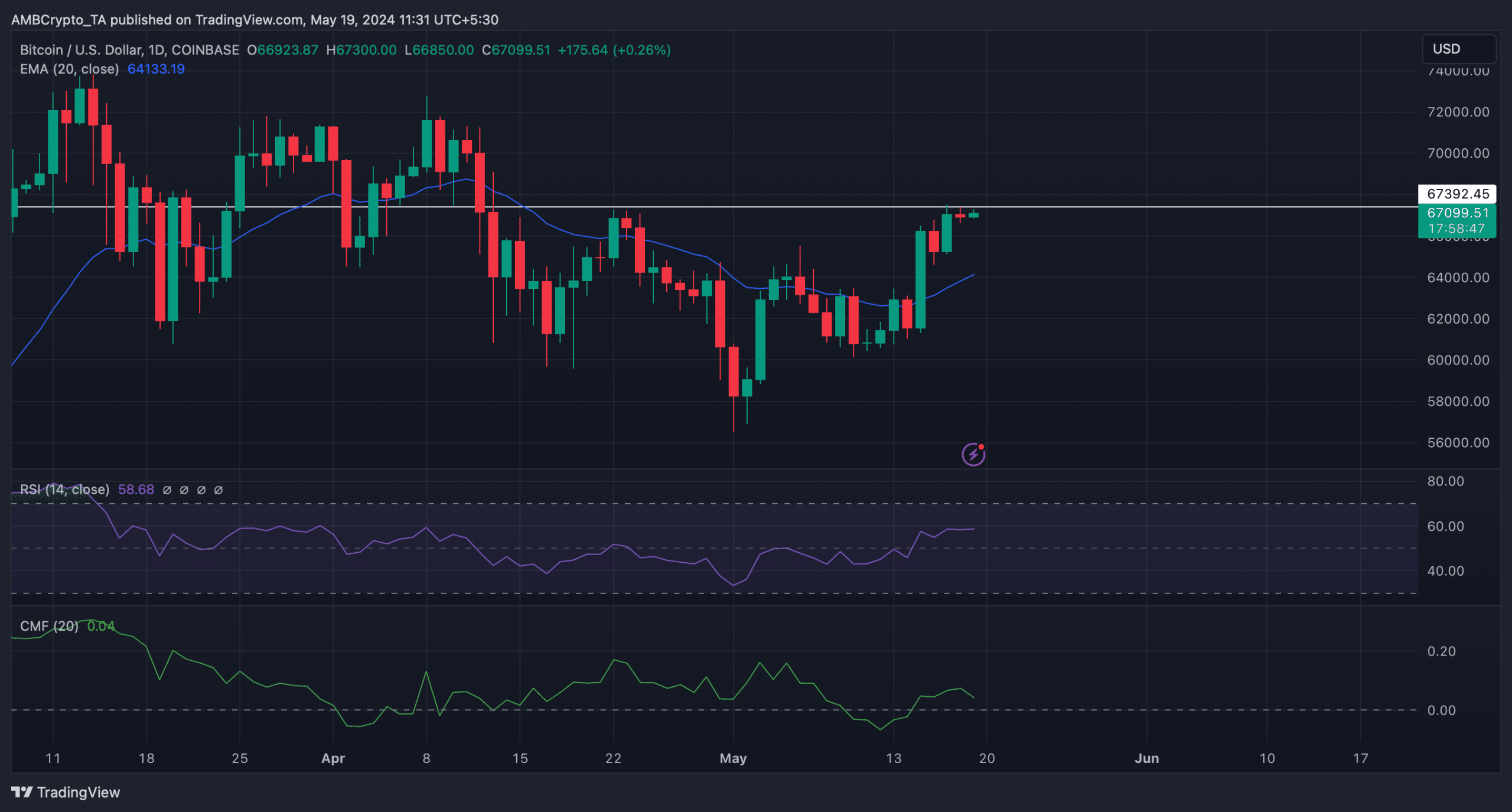

So, AMBCrypto analyzed the daily chart of BTC to see which direction it was heading in the short term. We saw BTC testing resistance at $67.3k at press time.

Likewise, its price remained above its 20-day exponential moving average (EMA).

Read Bitcoin (BTC) Price Prediction 2024-25

Additionally, its relative strength index (RSI) also saw an uptick, suggesting that BTC could turn its resistance into support. If this happens, things will remain optimistic in the short term.

Nevertheless, the Chaikin Money Flow (CMF) has headed south, suggesting an upcoming price correction.

Source: TradingView

News Source : ambcrypto.com

Gn bussni