Reason to trust

Strict editorial policy which focuses on precision, relevance and impartiality

Created by industry experts and meticulously revised

The highest standards in the declaration and publishing

Strict editorial policy which focuses on precision, relevance and impartiality

Morbi Pretium Leo and Nisl Aliquam Mollis. Quisque Arcu Lorem, quis pellentesque nec, ultlamcorper eu odio.

Este Artículo También is respondable in Español.

While Bitcoin (BTC) has reached a new summit of all time (ATH) of $ 111,980 on Binance Crypto Exchange yesterday, technical data suggest that the last BTC rally is dominated by buyers. If this trend continues, the BTC can see a new assessment of short -term prices.

Buyers regain control of the Bitcoin cash market

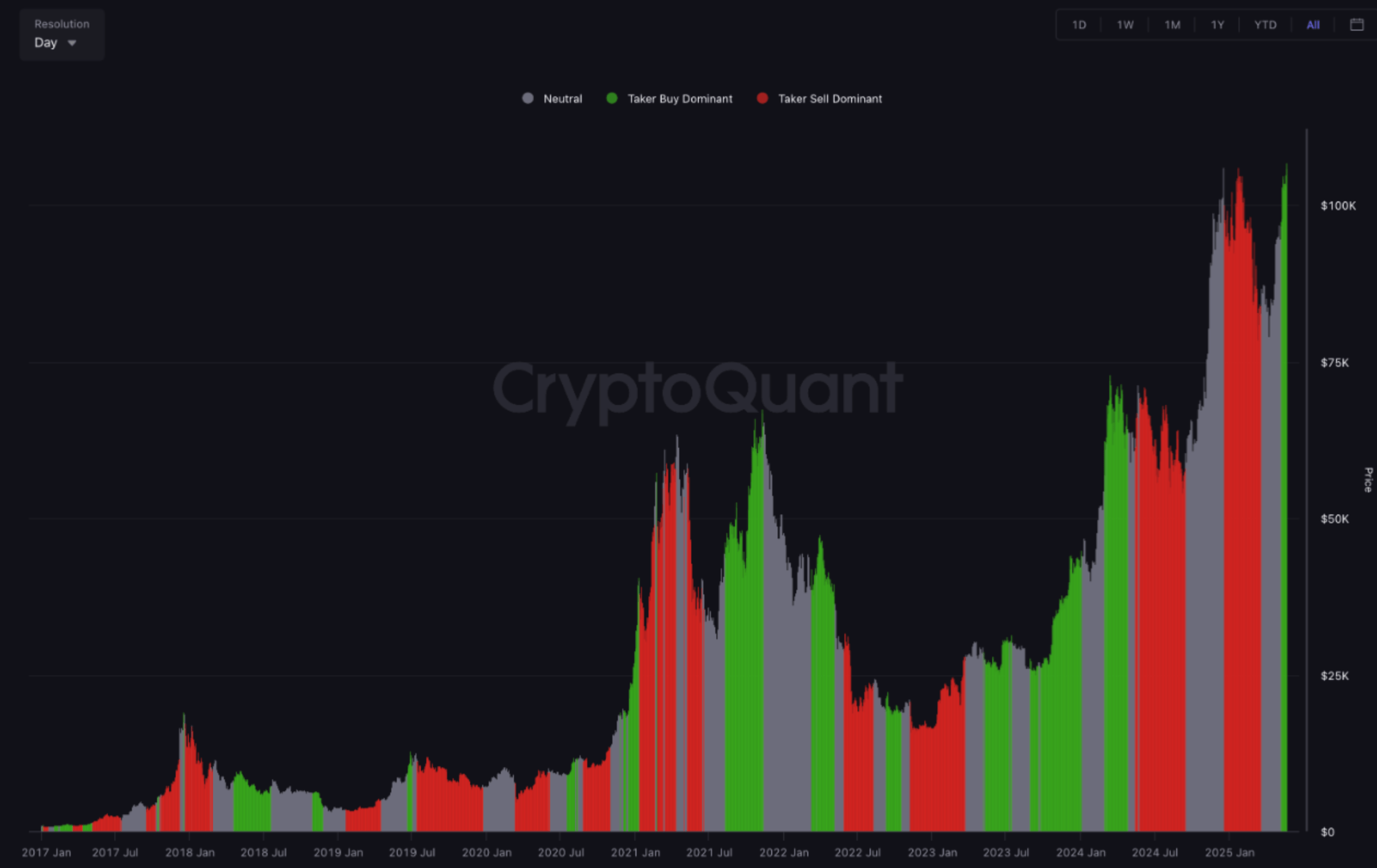

According to a recent post of Cryptoque Quicktake of Crypto Ibrahimcosar analyst, buyers seem to dominate the BTC cash market. The analyst observed that the cumulative volume of Bitcoin Cumulative Volume (CVD) is returned to the green territory.

For uninitiated CVDs, Bitcoin Spot Taker measures the difference between the purchase of takers and the volumes of sale of takers on the exchanges of spots over time. A CVD of growing spotlights indicates that aggressive buyers dominate the market, signaling a potential optimistic momentum.

Related reading

BTC Spot Taker CVD Turning Green is significant. In particular, this means that purchase orders resumed domination after a long period during which sales orders led the market. A higher volume of purchase commands over time suggests that the current bitcoin bullish momentum may persist.

As shown in the graph shared by Ibrahimcosar, the MCV remained mainly red for the majority of the T1 2025 – indicating strong sales pressure. This sales behavior aligned with the action of BTC prices, which saw the asset fall from its previous ATH in January to a hollow of about $ 76,000 in April.

The fact that the BTC Taker Taker Taker CVD has become green while the asset defines fresh ATHS makes this trend particularly remarkable. This indicates that buyers are ready to accumulate BTC even at historically high prices, probably in anticipation of the workforce.

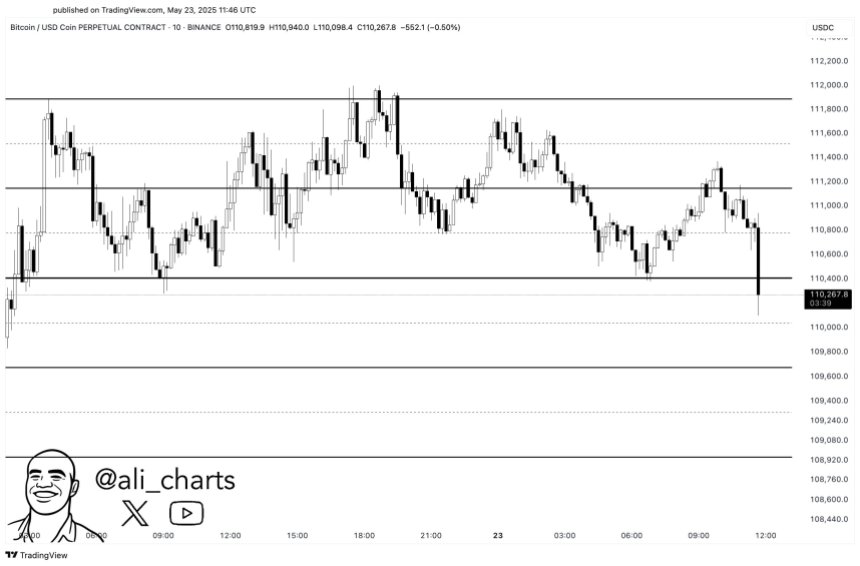

That said, the action of recent prices could temporarily interrupt the momentum of BTC. In a post X, the Crypto Ali Martinez analyst suggested that BTC could soon break down from its current range from $ 110,400 to $ 111,100.

Another type of rally

As a general rule, the BTC striking a new ATH generally comes up against a wider market euphoria, leading to a sharp drop in prices that catches most of the investors off guard. However, experts believe that the current rally is different from previous cycles.

Related reading

Recent analysis by the cryptocurrency contributor Crazzyblockk suggest These new and short-term investors of the BTC are seated on substantial profits not made and showed no sign of panic sales in the middle of the prices of the cryptocurrency at new heights.

Likewise, the reaction of whales with btc bruise price trajectory was mixed. While the new whales have made major profits during the current rally, the old whales have resistant Sell their assets, showing a minimum sales activity.

Finally, neutral financing rates on the BTC long -term market to strenghten The idea that the current rally is more organic and less motivated by speculation than those of the past. At the time of the press, BTC is negotiated at $ 108,553, down 2.6% in the last 24 hours.

Felash star image, cryptochant, x and tradingView.com graphics