Since he reached a new summit of all time in January, Bitcoin (BTC) has struggled to establish a bull form, which has lasted a downward trend that lasted in the past two months. According to the eminent market analyst Egrag Crypto, the first cryptocurrency could probably remain in terms of correction for the coming months before launching a price rally.

The 231 -day Bitcoin cycle indicates Target $ 175,000 by September 175,000

After an initial price drop in February, Egrag Crypto applied that Bitcoin could undergo a price correction due to a CME difference before undergoing a price rebound. However, the lack of strong bullish convictions in recent weeks has forced the conclusion that the first cryptocurrency is stuck in a potentially long corrective phase.

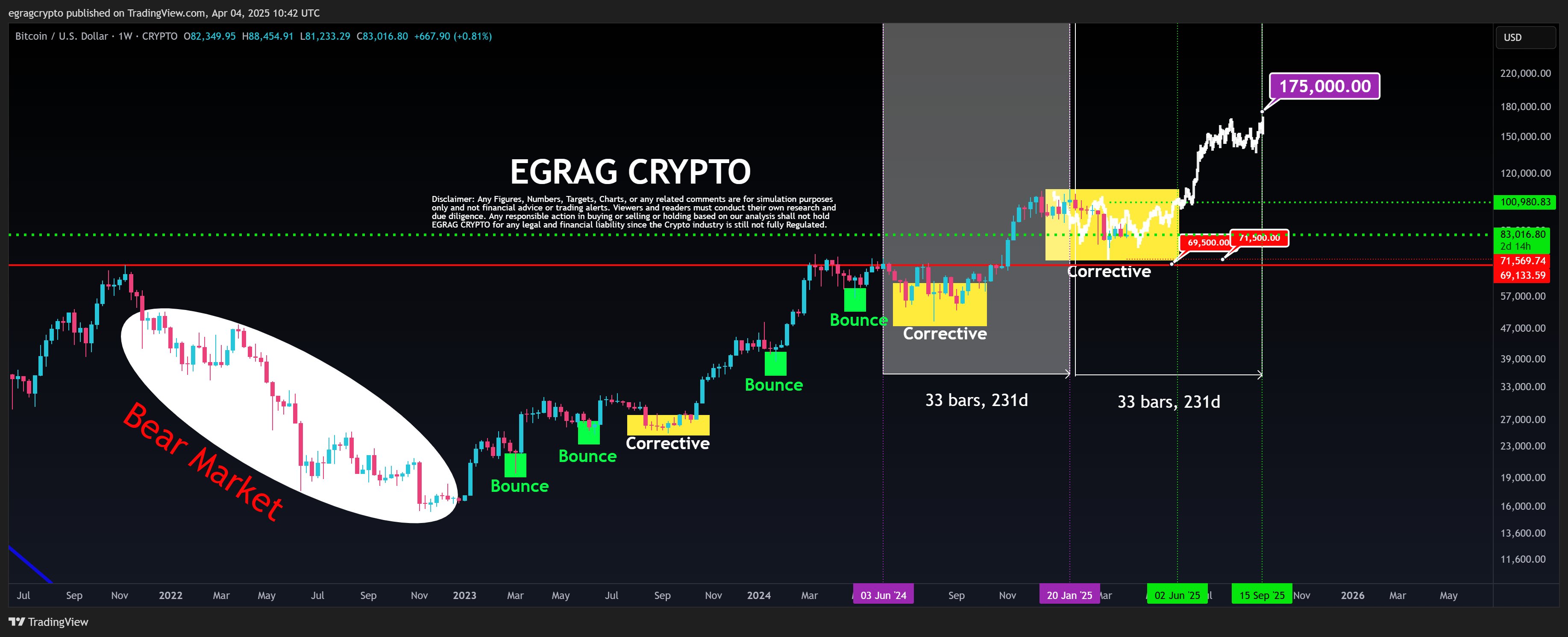

According to Egrag in a recent article, the continuous bitcoin correction aligns with a fractal model, that is to say a repetitive price structure which appeared over several deadlines. This model is based on a cycle of 33 bars (231 days) during which BTC goes from a corrective phase to an explosive price rally.

By comparing the preceding cycles to that in current development, Egrag predicted that Bitcoin could potentially burst from his recalibration by June. In this case, the analyst expects the cryptography market leader to reach a summit of $ 175,000 in September, referring to a potential gain of 107.83% on current market prices.

However, to light this price rally, market bulls must ensure an escape above the rigid price barrier at $ 100,000. On the other hand, any potential drop below the support price level from $ 69,500 to $ 71,500 could invalidate this current bullish configuration and possibly report the end of the current Taurus race.

BTC investors are waiting for the exchange activity to slow down

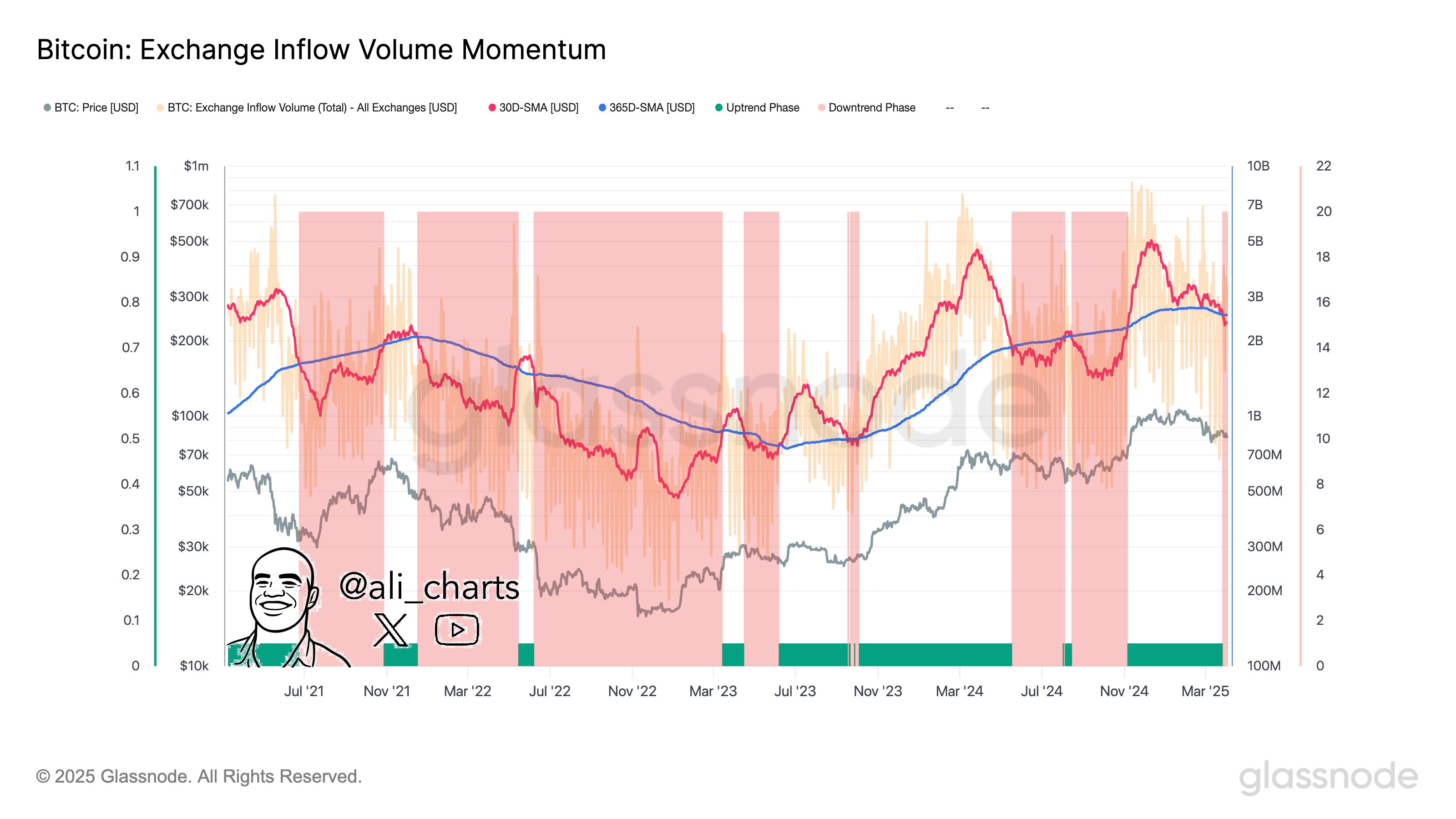

In other news, the expert in popular crypto Ali Martinez reported a drop in activity related to Bitcoin exchanges, which has reduced the interest of investors and the use of the network. This development suggests in particular that investors hesitate to deposit or withdraw bitcoin on exchanges, perhaps due to the uncertainty of the market on the immediate future trajectory of the asset.

According to Martinez, Bitcoin is now likely to undergo a change in trend while investors are waiting for the next market catalyst. In particular, Bitcoin showed commendable resilience despite the new prices imposed by the United States government on April 2. According to health data, the price of the BTC dropped only 4% in the hours that followed the ad – a softer reaction compared to previous market movements linked to prices.

Since then, BTC has produced price gains and has been negotiated at $ 83,805 while investors flock to the cryptography market, which recorded an entrance of $ 5.16 billion in the last day. Meanwhile, the commercial volume of BTC increased by 26.52% and is estimated at $ 43.48 billion.

Image in UF News, tradingView graphic

Editorial process Because the bitcoinist is centered on the supply of in -depth, precise and impartial content. We confirm strict supply standards, and each page undergoes a diligent review by our team of high -level technology experts and experienced editors. This process guarantees the integrity, relevance and value of our content for our readers.