Bitcoin at a Crossroads: Miner Capitulation and Signs of Market Stability

- At press time, Bitcoin was trading near the $59,000 range.

- There appears to have been some capitulation by the miners, but the big miners have still been accumulating

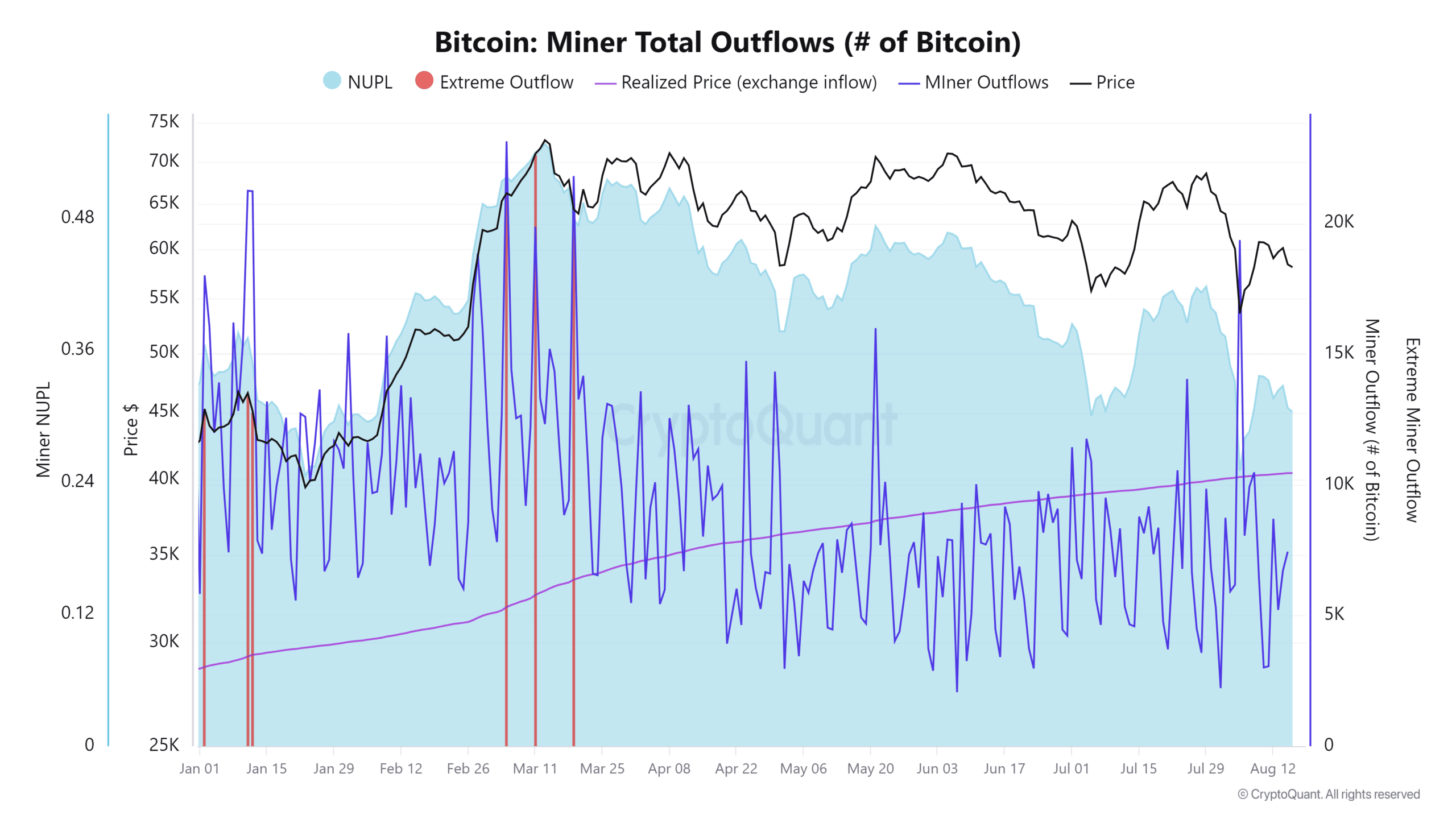

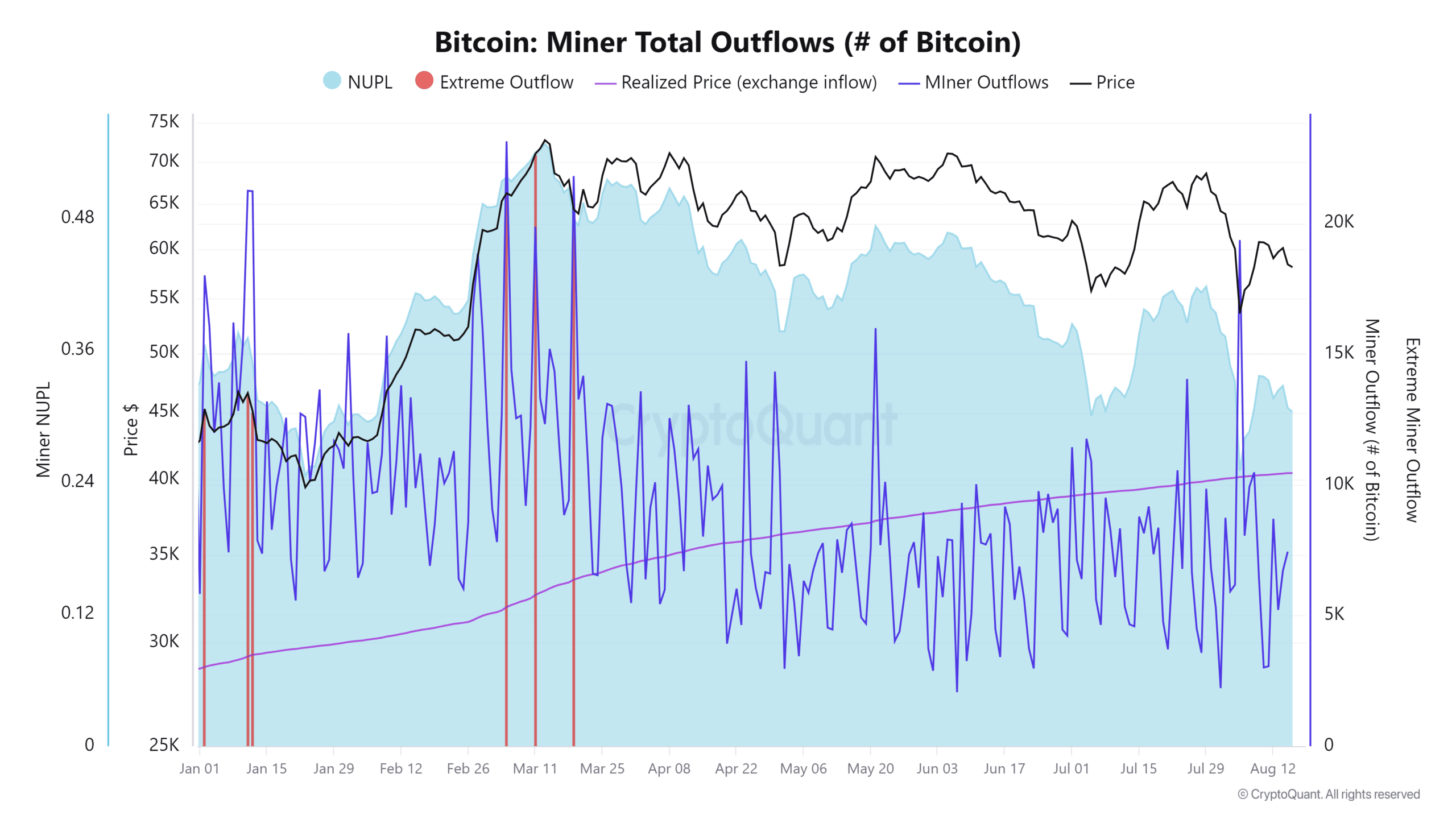

Bitcoin faced a major miner capitulation last week as its price plummeted, leading to an increase in miner outflows. This came in parallel with an increase in mining difficulty, which reached its highest level in years and put additional pressure on miners. However, recent metrics indicate that this capitulation may be coming to an end as Bitcoin has shown signs of stabilizing.

Bitcoin Sees Miner Capitulation

Data from CryptoQuant revealed that Bitcoin experienced a major miner capitulation last week, with its price dropping to $49,000. On August 5, daily miner outflows surged to 19,000 BTC, the highest level since March 18.

The selloff came as mining companies’ profit margins have narrowed further, falling to 25%, their lowest level since January 22.

Source: CryptoQuant

The analysis also indicated that some miners sold some of their reserves, realizing a loss of $22 million, the largest daily loss since May 29. A sharp increase in hash rate and network difficulties caused this wave of capitulation.

The indicators hit new all-time highs last week, putting a strain on miners’ operations. These difficult conditions forced miners to liquidate their assets to cover their costs, underscoring the pressure they have faced during this period.

Current status of minors’ assets

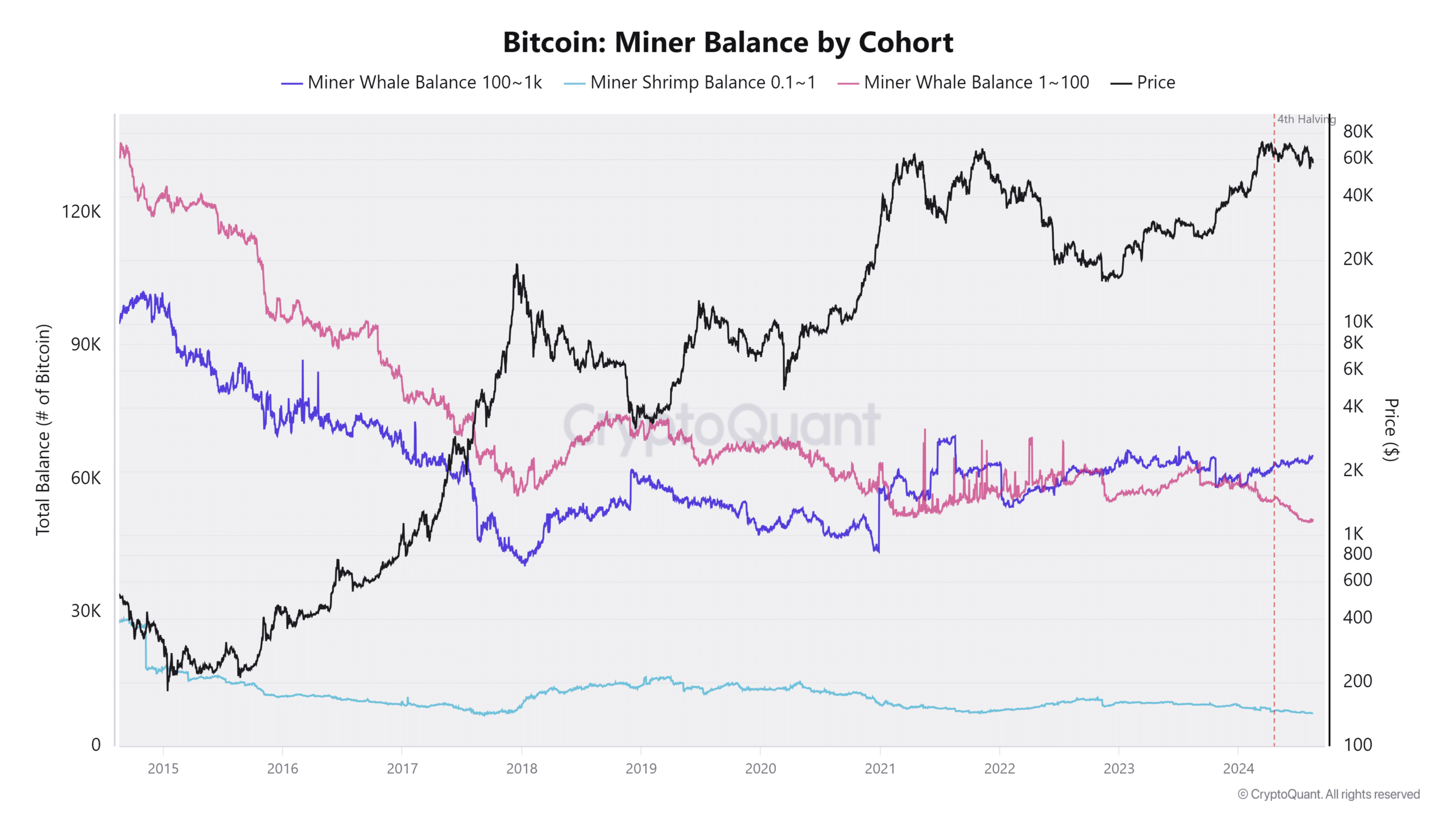

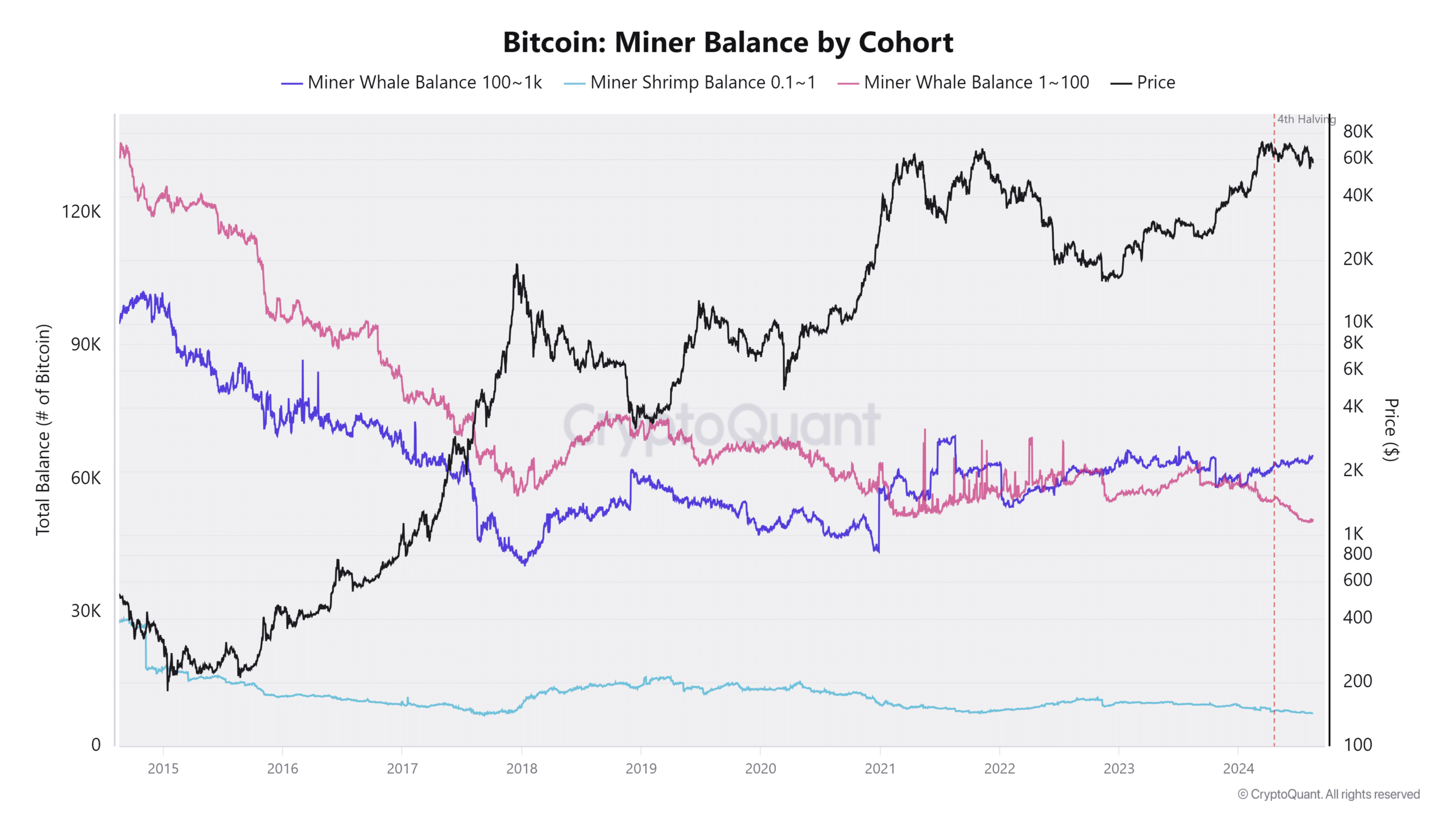

That’s not all. Small miners’ holdings have hit a low point due to the recent capitulation in the Bitcoin market.

Miner Balance by Cohort data revealed that even before this latest capitulation, small miners (pink line) were experiencing a steady decline in their Bitcoin holdings – a trend that intensified after the halving event in Q2.

Source: CryptoQuant

On the contrary, the largest miners have increased their holdings. According to the aforementioned analysis, the largest miners (purple line) have continued to accumulate bitcoins, with their total holding now standing at 66,000 BTC.

This accumulation by the largest miners has contributed to a decline in the overall Bitcoin capitulation. Especially as the BTC price is seeing a slight recovery.

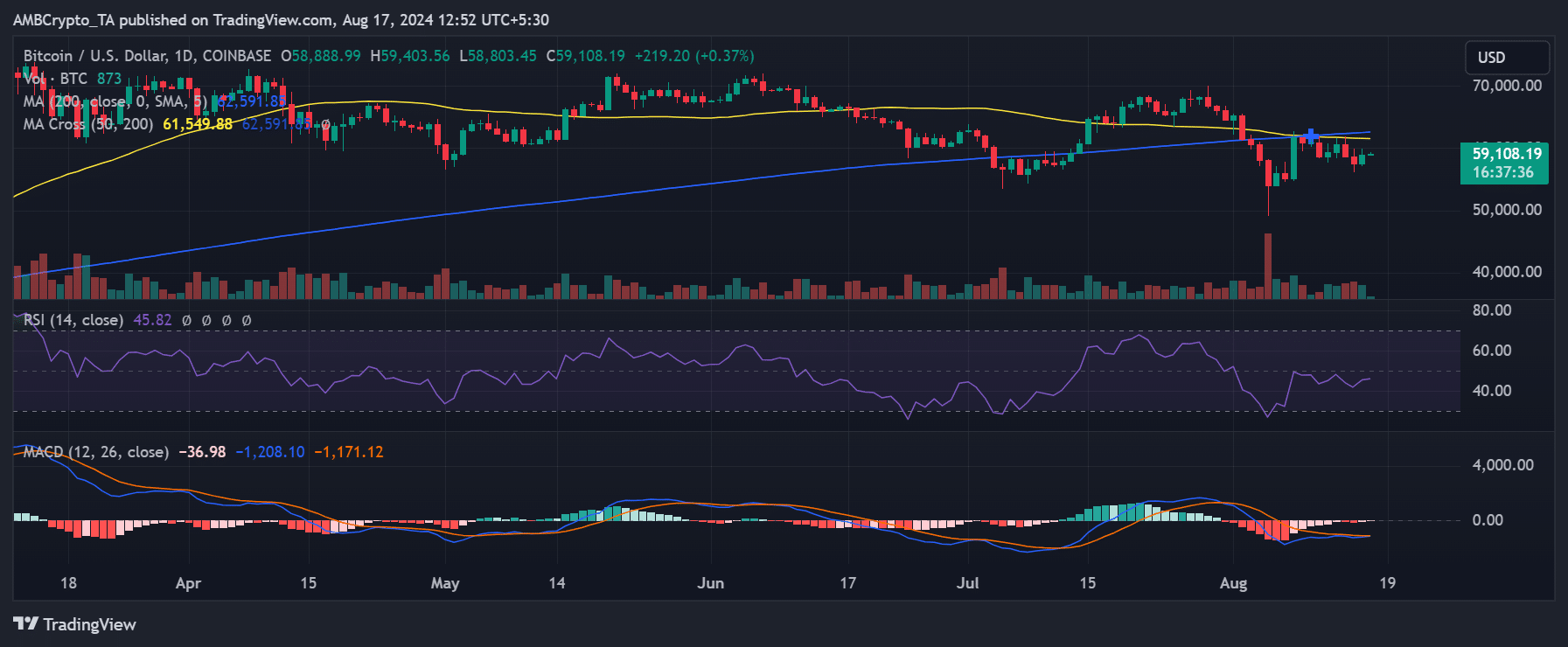

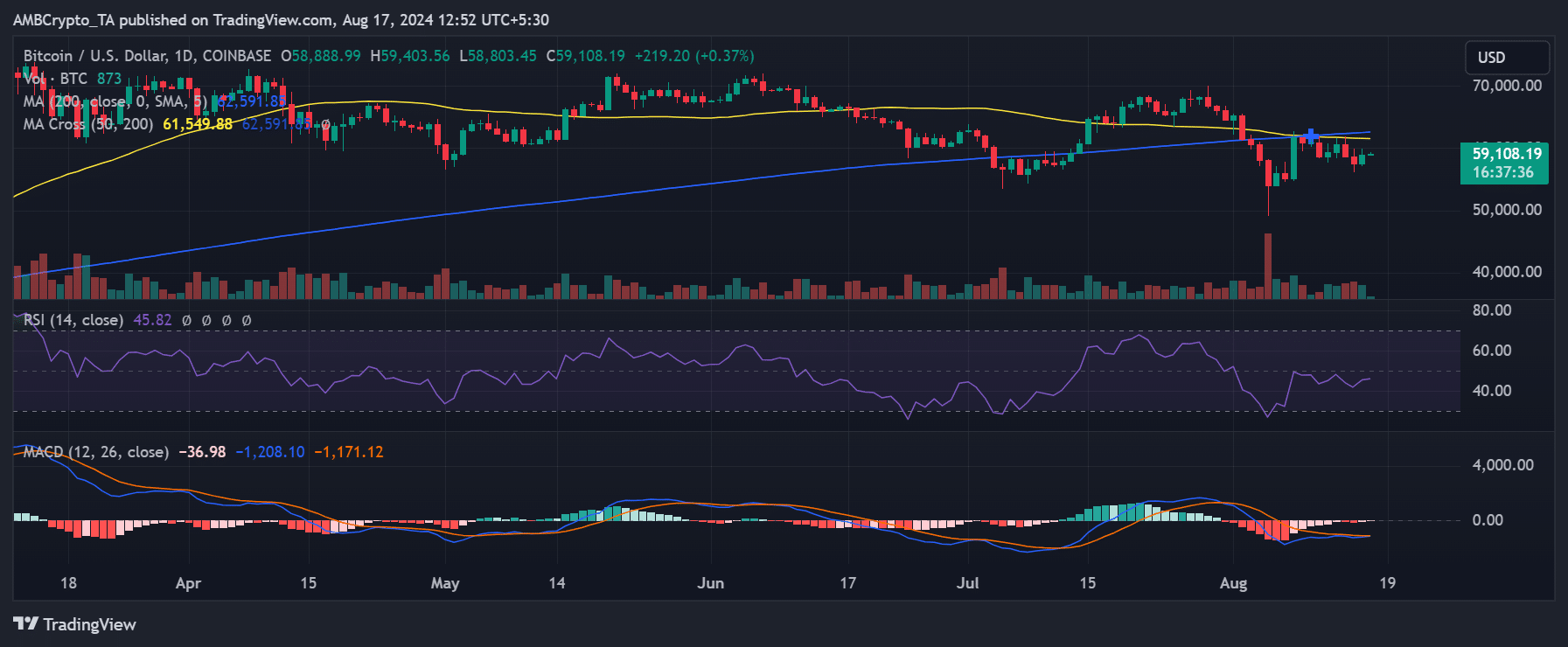

Resistance at $60,000 despite recent gains

Since Bitcoin broke below its short- and long-term moving averages (yellow and blue lines), the $60,000 price range has consistently served as an important resistance level. Analysis of the Bitcoin daily time frame chart indicated that the yellow line offers resistance around $61,000, while the blue line marks another resistance point at around $62,000.

At the time of writing, Bitcoin has seen a surge of over 2% in the last trading session, closing above $58,000.

While this recovery is not yet a return to previous highs, it marks a positive development from the recent drop to $49,000, which triggered the miner capitulation.

Source: TradingView

– Read Bitcoin (BTC) Price Prediction 2024-25

Although it is still far from breaking the critical resistance of $60,000, this rise could precipitate a gradual recovery.

However, Bitcoin needs to overcome these key resistance levels to regain stronger bullish momentum and move closer to its previous highs.