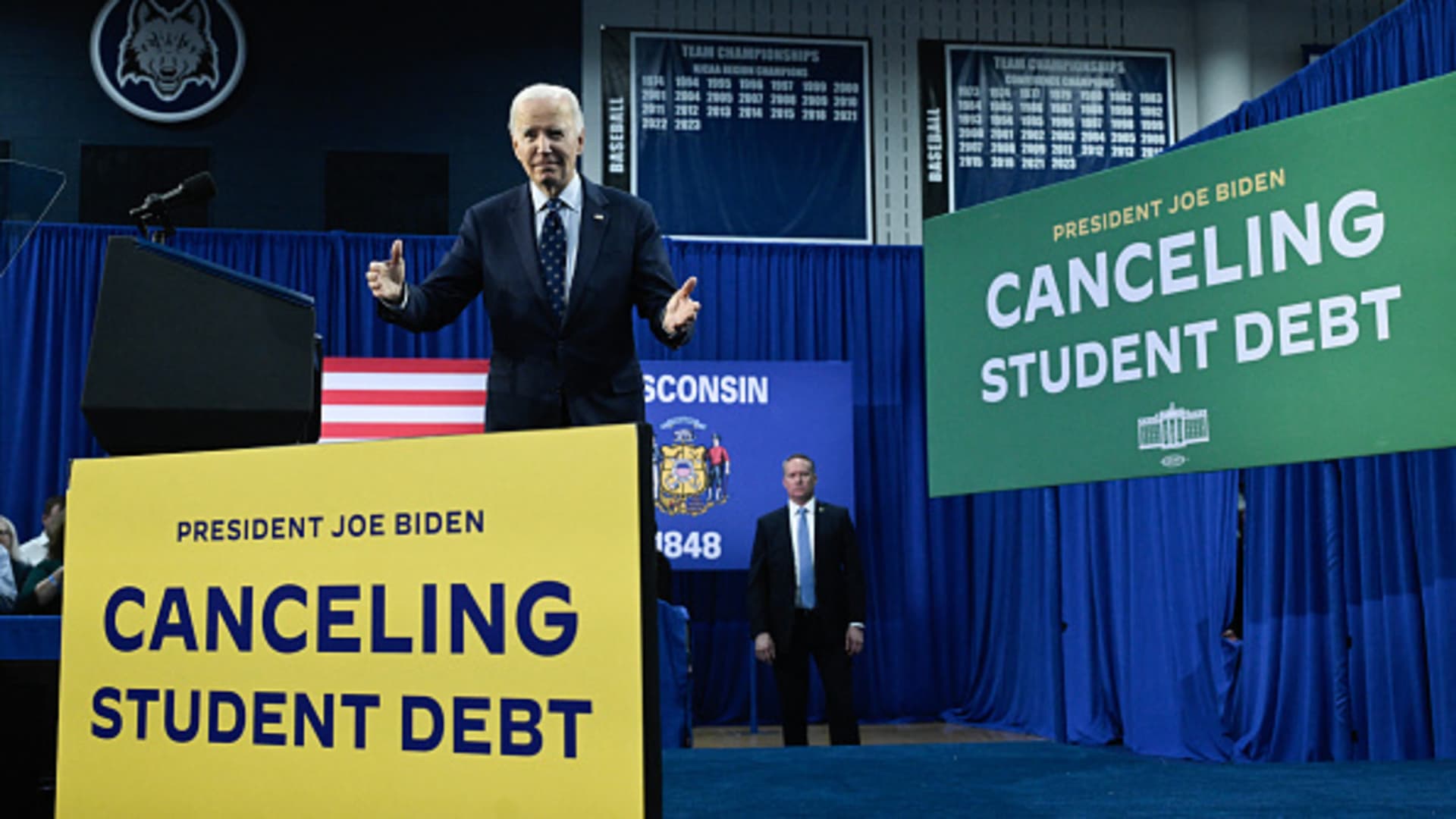

U.S. President Joe Biden gestures after speaking about student debt relief at Madison Area Technical College in Madison, Wisconsin, April 8, 2024.

Andrew Caballero-Reynolds | AFP | Getty Images

The Biden administration released its new student loan forgiveness proposal, putting it on track to begin clearing debt for millions of borrowers this fall.

The public has 30 days, until May 17, to comment on the details of the revised aid package.

Since the U.S. Supreme Court rejected President Joe Biden’s first attempt at large-scale loan forgiveness last summer, his administration has been working on this overhaul plan.

Biden wants the program to survive legal challenges this time. To that end, the U.S. Department of Education has made aid more targeted and turned to the regulatory process. The president first attempted to cancel student debt through executive action.

Outstanding federal education debt in the United States is approximately $1.6 trillion and represents a greater burden on Americans than credit card or auto debt. More than 40 million people benefit from student loans.

Here’s what you need to know about Biden’s new relief plan.

What the revised plan includes

While Biden’s previous relief plan canceled student debt for most borrowers, this aid package targets specific groups of people and loan interest.

It calls for canceling “the full amount” of a person’s debt that has increased from their original balance when they began repaying. To qualify for this provision, these borrowers would also have to be enrolled in one of the Department of Education’s income-driven repayment plans and earn less than a certain amount, including $120,000 or less as a filer unique.

Regardless of their income, borrowers would be eligible for forgiveness of up to $20,000 on the portion of their debt that represents unpaid interest.

Consumer advocates have long criticized the fact that interest rates on federal student loans can exceed 8%, which can make it difficult for borrowers who fall behind or are on certain payment plans to reduce their balances.

More than 25 million federal student loan borrowers owe more than they originally borrowed, according to the Biden administration.

Learn more about personal finance:

FAFSA ‘fiasco’ could lead to lower college enrollment

Harvard once again becomes the “dream” school par excellence

More and more of the country’s most prestigious universities are implementing no-loan policies

Borrowers who have been repaying their undergraduate loans for 20 years or more, or more than 25 years for their graduate loans, would receive full debt forgiveness.

The plan also erases debt for people who are already eligible for this relief but did not receive it or apply for it. Such stories are common.

Finally, it provides relief to borrowers who enrolled and incurred debt to attend low financial value schools and programs or institutions that failed to provide sufficient financial value.

The Department of Education has excluded the group of borrowers experiencing financial difficulties from its relief proposal for now. Previously, his plan was supposed to include people in this situation.

“As President Biden said last week, our administration is working as quickly as possible to provide relief to as many borrowers as possible,” an Education Department spokesperson said in a statement.

As a result, while continuing to craft a proposal for those struggling financially, he moved forward “with these proposed rules today so we can begin providing relief to borrowers as early as this fall,” the spokesperson said. word.

And what comes next…

After the 30-day public comment period, the Biden administration must review the comments it received on its plan. It will then publish its final rule, probably this summer. Soon after, it could begin reducing and eliminating borrowers’ balances.

However, legal challenges could disrupt this schedule.

After Biden first touted his revised relief package on April 8, Missouri Attorney General Andrew Bailey, a Republican, written the that the president “shamelessly attempts to eclipse the Constitution.”

“See you in court,” Bailey wrote.

cnbc