All About Litecoin’s 8-Year Cycle and the Path to $100,000

- Litecoin price has increased by 3% in the last 24 hours.

- Market sentiment around the coin remained bullish.

Litecoin (LTC)Like most other cryptocurrencies, LTC has had a rough time in the last month as it has lost a substantial portion of its value. In fact, considering the latest data, LTC could be in an 8-year cycle, which at first glance seems worrisome.

But there is more to this story.

What’s going on with Litecoin?

CoinMarketCap data Litecoin price has corrected by over 22% in the last 30 days alone. The downward trend didn’t stop last week, as it dropped by 13%.

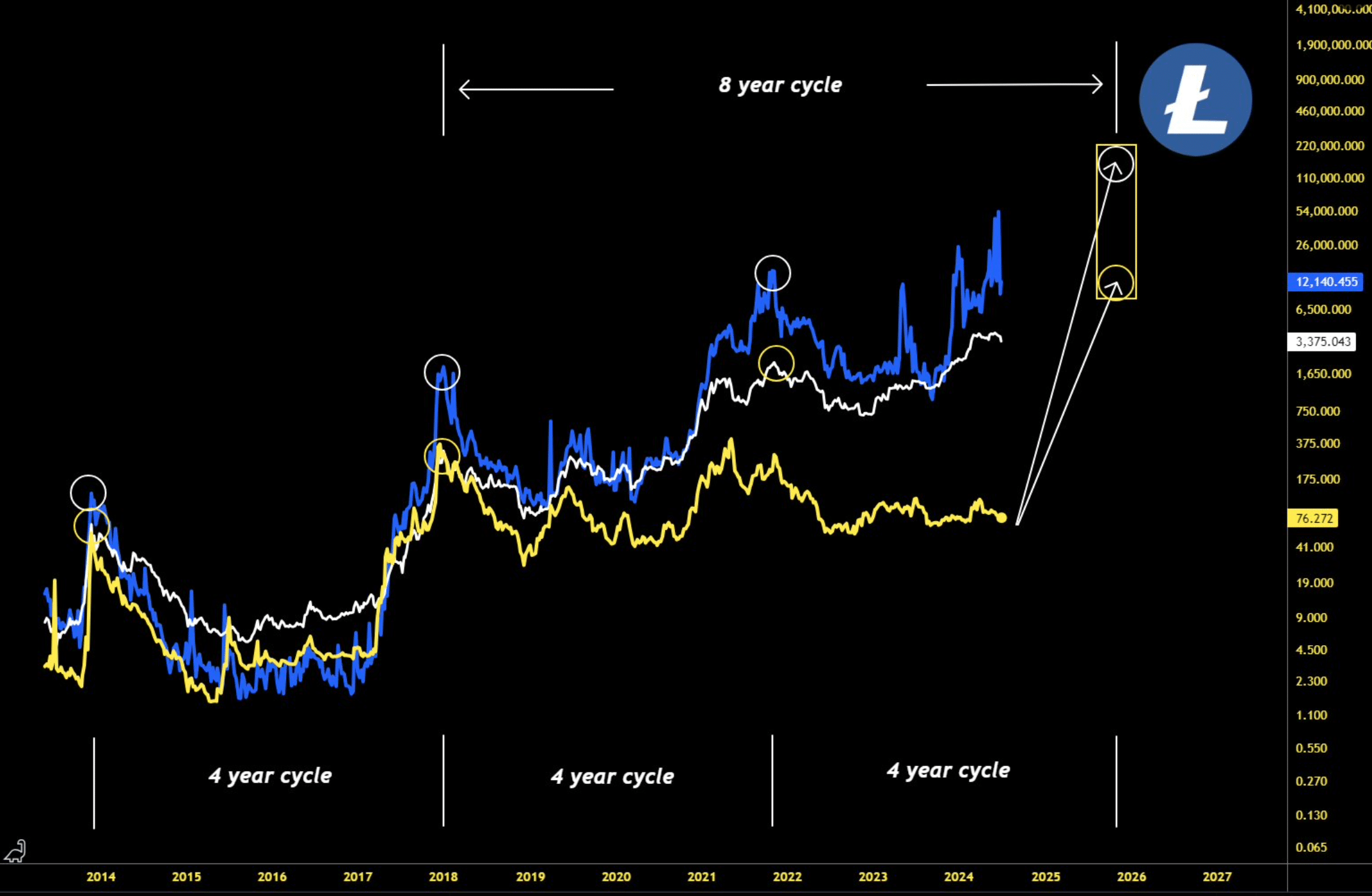

Although this is worrying, the latest analysis Master, a well-known crypto analyst, revealed a different picture. According to the tweet, Litecoin is now in its 8-year cycle.

If this is true, investors will see LTC peak in October 2025. Historically, during every 4-year cycle, LTC has peaked. To be precise, during the years 2014, 2018 and 2022.

If history repeats itself, LTC could range between $65,000 and over $100,000 at its next peak.

Source: X

This can be expected in the short term.

Since it is a bit early to consider the 2025 peak at the moment, AMBCrypto plans to check the current status of the coin to see what can be expected in the short term.

The good news is that like several other cryptos, LTC has also gained bullish momentum over the past 24 hours, with its price surging by more than 3%.

At the time of writing, LTC was trading at $64.73 with a market cap of over $4.8 billion, making it the 21st largest crypto.

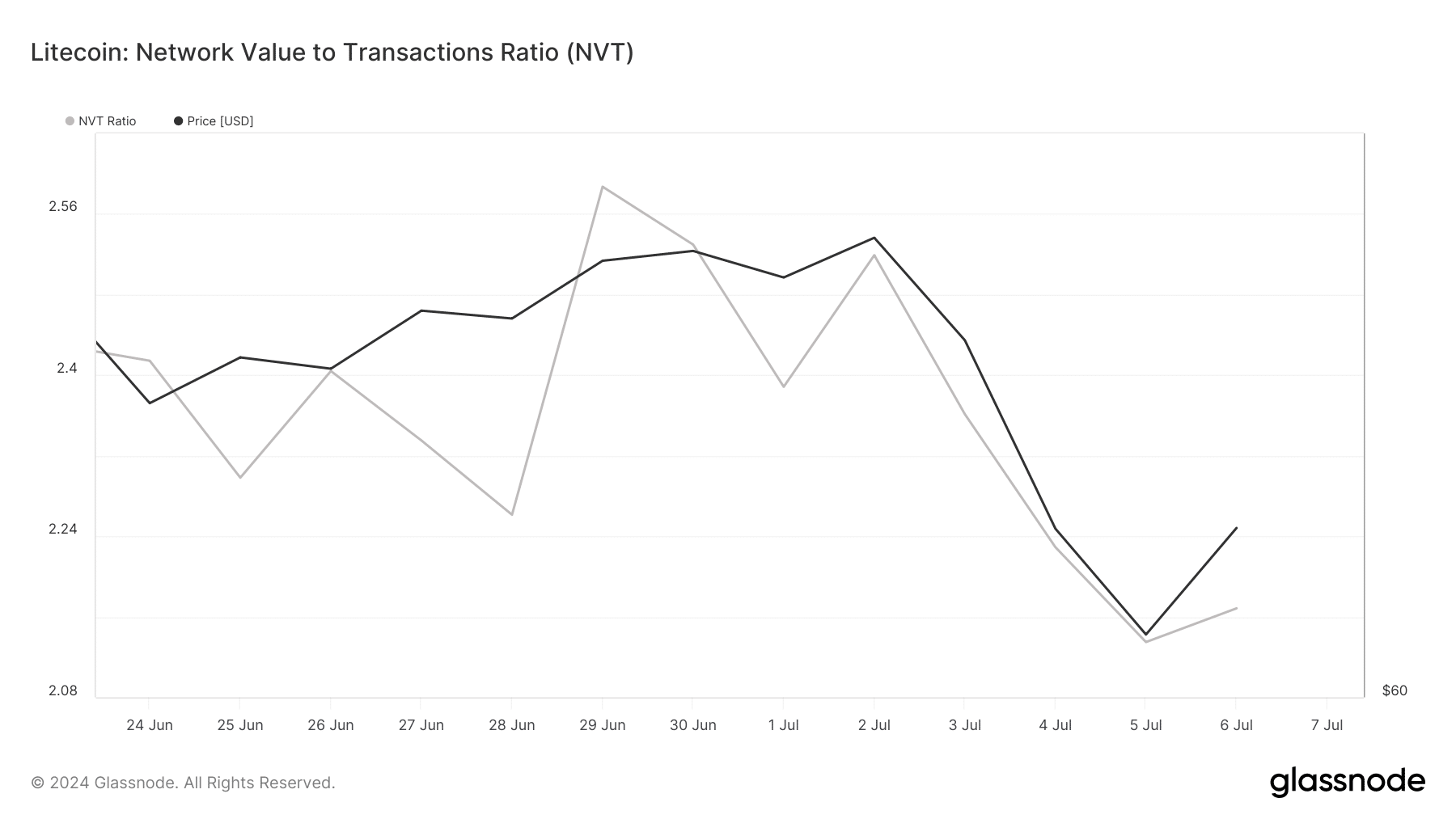

Things may soon improve, as the cryptocurrency’s NVT ratio dropped last week. A drop in this value means that an asset is undervalued, which suggests a price increase.

Source: Glassnode

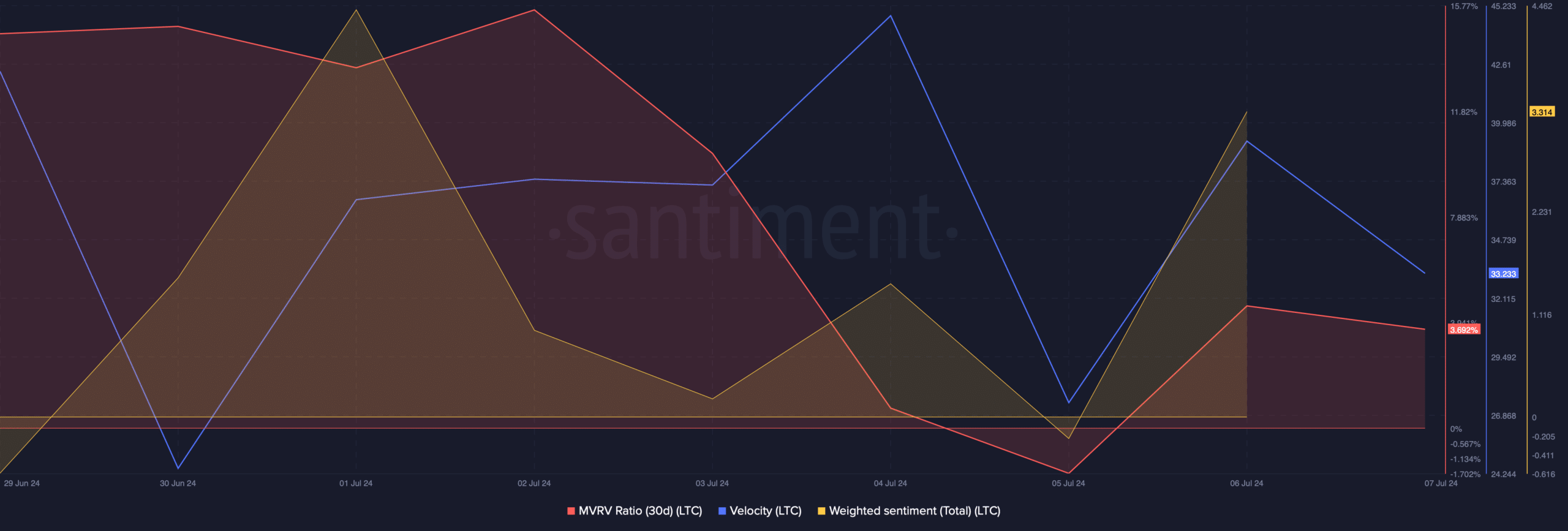

Investor confidence in the cryptocurrency also seems to have improved as its weighted sentiment improved. This clearly means that the bullish sentiment around the cryptocurrency was dominant in the market.

However, not all indicators were optimistic. For example, the MVRV ratio recorded a decline. Its velocity has also decreased in recent days, which means that LTC was used less often in transactions during a given period.

Source: Santiment

Is your wallet green? Check it out Litecoin Profit Calculator

Our analysis of Coinglass data revealed that its long/short ratio also decreased, meaning there were more short positions in the market than long positions.

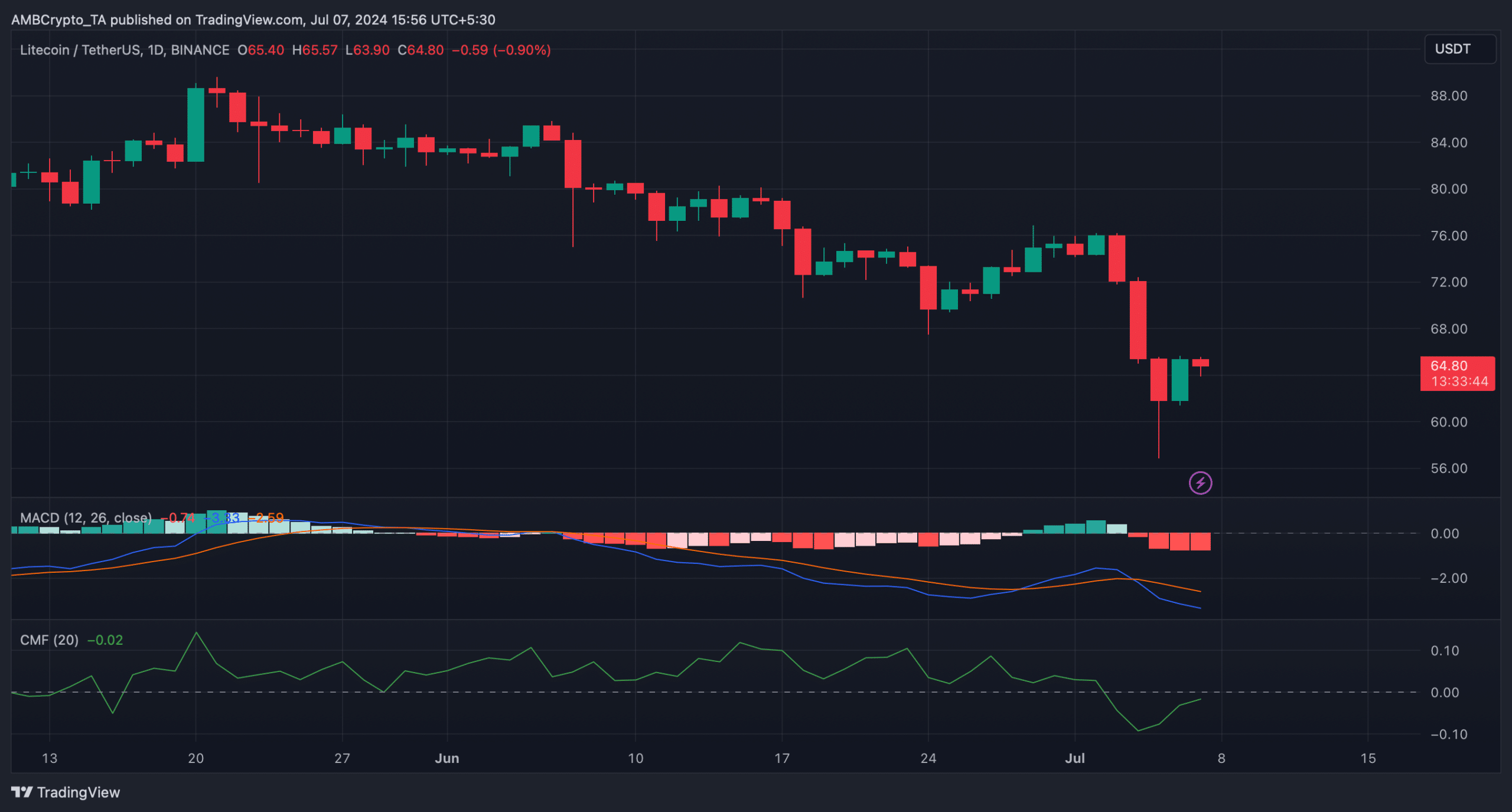

The cryptocurrency’s MACD has shown a bearish trend in the market. However, nothing can be said with utmost certainty as the Chaikin Money Flow (CMF) has registered an increase, indicating a continued price rise.

Source: TradingView

News Source : ambcrypto.com

Gn bussni