After Biden’s departure, markets focus on earnings, data By Reuters

By Yoruk Bahceli and Tom Westbrook

(Reuters) – Global markets steadied on Tuesday as investors looked beyond Joe Biden’s withdrawal from the U.S. presidential race to corporate earnings and economic data.

Biden’s withdrawal from the race casts doubt on a Republican victory under Donald Trump and could prompt investors to unwind positions betting that such a victory would add to U.S. fiscal and inflationary pressures.

Vice President Kamala Harris will campaign in the key swing state of Wisconsin on Tuesday as the presumptive Democratic nominee.

The pan-European STOXX index rose 0.1% while U.S. futures fell 0.2% after rising 1.1% on Monday.

The U.S. dollar, which had gained slightly on Monday, was unchanged against a basket of currencies on Tuesday.

“Markets appear to be in a sort of waiting phase this morning, having digested the weekend’s news flow announcing Biden’s withdrawal from the presidential race,” said Michael Brown, senior strategist at brokerage Pepperstone in London.

Investors will now focus on whether polls show a closer race against Trump than when Biden was the Democratic nominee, Brown said.

“One would expect that if the polls narrowed and the race was seen as a closer contest, there would be increased volatility and perhaps some downside in the stock market,” he added.

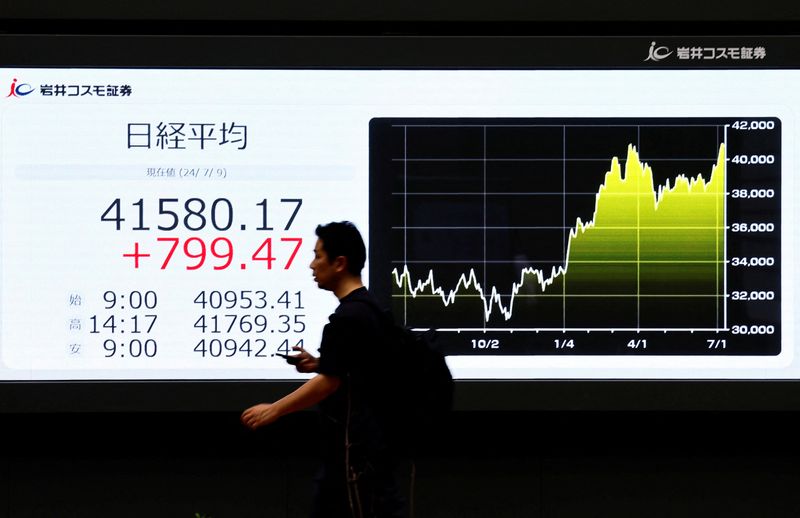

Asian markets remained buoyant on Tuesday, however, with Taiwan’s benchmark index ending five sessions of losses, rising more than 2%.

That followed a broader rebound in chipmaking stocks, clawing back some of the $100 billion in market value that was wiped off the portfolio of Taiwan’s TSMC, the world’s largest contract chipmaker, in previous sessions.

The stock came under pressure after Trump’s comments that Taiwan should pay to be defended and accusing the island of stealing U.S. chip business.

Earnings were clearly the focus on Tuesday, with Tesla (NASDAQ:) and Alphabet (NASDAQ:) due to report after the close of trading in New York, marking the start of the season for the “Magnificent Seven” mega-cap group.

According to LSEG IBES, the technology sector is expected to increase its year-on-year earnings by 17%, while the communications services sector’s earnings are expected to increase by around 22%, but high-valuation stocks are also prone to disappointments.

Other companies reporting results include French group LVMH, which will be closely watched as falling Chinese demand has hit the sector.

DATA MONITORING

In foreign exchange markets, the main driver was the yen, which rose 0.6% against the dollar to 156.04.

Comments from a senior Japanese policymaker on Monday added to pressure on the Bank of Japan, which meets on July 31, to keep raising rates to boost its currency, which Tokyo has stepped in to support this month.

The currencies of Australia and New Zealand, often seen as liquid proxies for the single currency, also fell after China’s surprise interest rate cut on Monday, which also highlighted weakness in the world’s second-largest economy.

The euro fell 0.2% to $1.0873.

Central banks remain in focus. Markets have priced in two U.S. rate cuts this year, with the first scheduled for September, but expectations could be upended by growth and consumer price data due later this week.

After rising on Monday, 10-year Treasury yields fell 2 basis points to 4.24% and two-year yields, which are sensitive to interest rate expectations, fell 2 bps to 4.51%.

U.S. gross domestic product is expected to grow at a 2% annualized rate in the second quarter, while the Atlanta Fed’s closely watched GDPNow indicator points to growth of 2.7%, suggesting some upside risk.

The core personal consumption expenditures index, the Fed’s preferred measure of inflation, is expected to rise 0.1% in June, reducing the annual pace by just a little to 2.5%.

Gold prices were set around $2,400 after peaking above $2,450 last week. Futures, which hit a one-month low on Monday, rose 0.1% to $82.48 a barrel.

which rose on bets that the Trump administration would take a light-handed approach to cryptocurrency regulation, fell 1.8% to $66,920.