To exchange Unitedhealth Group Incorporated Oneh was calm on Monday. This occurs after the drop of more than 20% on Friday. The company has reduced its annual orientations to $ 26.00 to $ 26.50 per share. The previous guidelines were nearly $ 30.00 per share.

But the sale could soon end. This is why our team of traders made Uh our stock of the day.

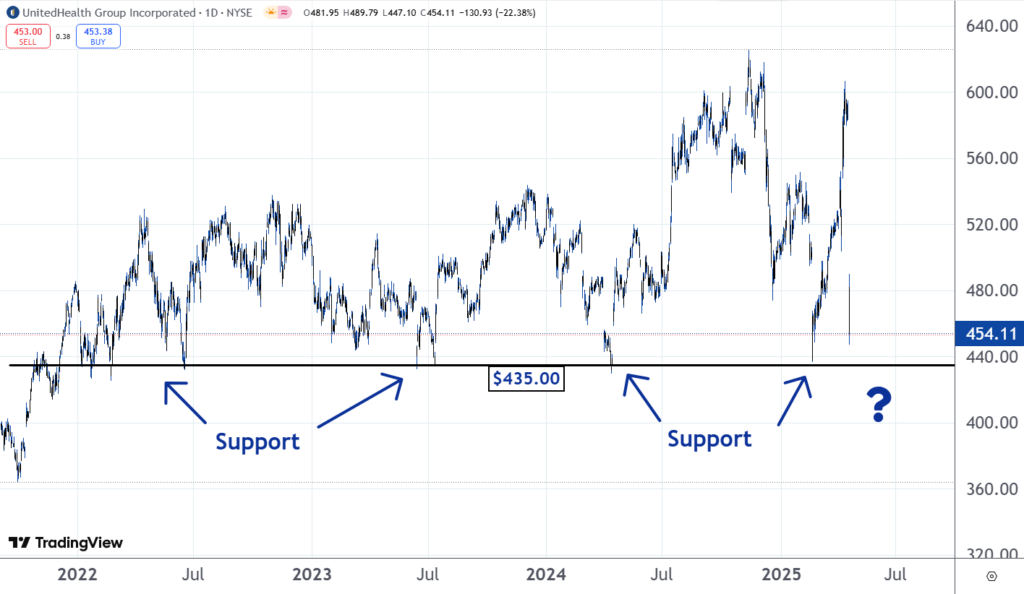

“Buying old bottoms” is an old expression at Wall Street. He refers to how, sometimes, when a stock falls to a price level that had already been support, there is a good chance that he will find support. There is also a good chance that a rally follows.

You can see on the graph that since January 2022 United has fallen in terms of $ 435.00 seven times. Each time, he found support and each time followed by a higher movement.

Read also: S&P 500 ‘approaching the territory of bubbles: “American actions are historically overvalued despite a recent correction,” explains the market researcher

Now the stock closes again at this important level.

If a stock is lower, it is because there are more actions for sale that there is to buy. Investors and merchants who wish to sell are forced to lower the price if they want to attract buyers from the key line.

This price action results in a downward trend.

Support is a price level or an area where there is a large amount of purchase of interest. There are as many actions, or perhaps even more purchase than to sell. This is why downward trends stop or end when they reach support.

Sometimes those who have created support with their purchase are concerned that others who wish to buy will be willing to pay a higher price than they are. As a result, they increase their supply prices. Other buyers concerned see it and also increase their supply prices.

This could cause an auction war that forces the stock in an upward trend. This can be about to reproduce with Unitedhealth.

Read then: Wall Street’s most specific analysts give their interpretation on 3 health care actions offering high dividend yields

Photo: Shutterstock

Market news and data brought by benzinga APIs

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.