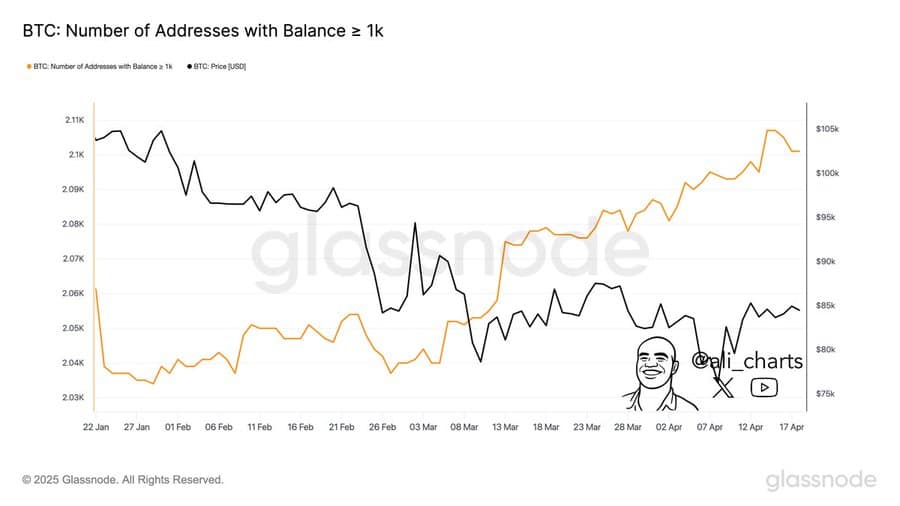

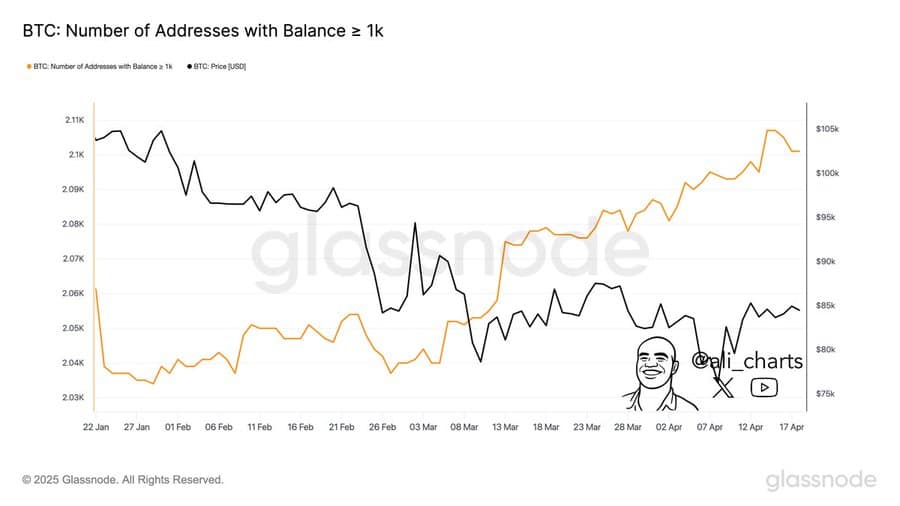

- The whales have started to buy more bitcoin, spending tens of millions of millions in acquisitions in recent months.

- The feeling of the market shows that these whales could have long -term assets.

Bitcoin (BTC) has maintained a stable threshold on the market, moving in a tight beach and registering no significant gain, up to 1% in the last month.

New Market Insight suggests that feeling could soon change, bitcoin potentially increasing value while whales continue to accumulate the active.

The interests of whales for bitcoin increases

The whales, known to control an important part of any active, have shown a renewed interest in Bitcoin in recent months.

Since the beginning of March, the analysis has shown that new whales have entered the market and have started acquiring bitcoin. Until now, 60 of these investors have each bought no less than 1,000 bitcoin, totaling around $ 85 million.

Source: Glassnode

Naturally, this influx came while the BTC was negotiated well below its top of all time, referring to the undervaluation in the eyes of large investors.

This increase in the participation of whales is also remarkable given the overall decrease in the liquidity of the cryptography market.

In the past two weeks, Capital Flow has increased from $ 8.2 billion to $ 2.38 billion.

With the narrowing of the funds entering the market, assets receiving liquidity become more interesting, as they are likely to surpass others. BTC whale activity confirms that it can continue to carry out market gains.

Key institutions and whales make movements

That said, it was not only the whales that bought the dive.

Ambcrypto analysis has identified a whale taking advantage of the recent drop in bitcoin prices to accumulate a significant amount of the asset.

According to information from Arkham Intelligence, a whale identified as “Abraxas Capital MGMT” has actively acquired bitcoin.

Since the beginning of April, this whale has gone from its Bitcoin assets of $ 2.8 million to $ 253 million, confirming a strong bias of investors to the asset.

Interestingly, under a different address, this whale also contains $ 43 million from LBTC, bringing its total to 296 million dollars.

Source: Coringlass

Institutional investors have also slowed down their sale and finished the week with entries in the Bitcoin FNB (funds negotiated on the stock market). The analysis shows that this group bought a value of $ 106.90 million BTC by the end of the week.

If the accumulation by whales and institutions continues, the value of Bitcoin could increase, which could lead to a rally.

Long -term merchants buy

To determine whether this accumulation is temporary or durable, Ambcrypto has examined the behavior of long -term holders.

Using the metric of the coin of Bitcoin (CDD) which indicates whether long -term holders sell or hold, Ambcrypto found that the latter was true.

Source: cryptocurrency

Currently, the trendy CDD near zero – long -term long -term holders did not sell. In fact, they continued to occupy their positions, even through the market.

With the whales that accumulate, the institutions that turn and long -term holders remaining on site, Bitcoin has become the main liquidity magnet in a drying market.

If these rear winds persist, the BTC may not be content to hold stable – it could prepare for its next rally.