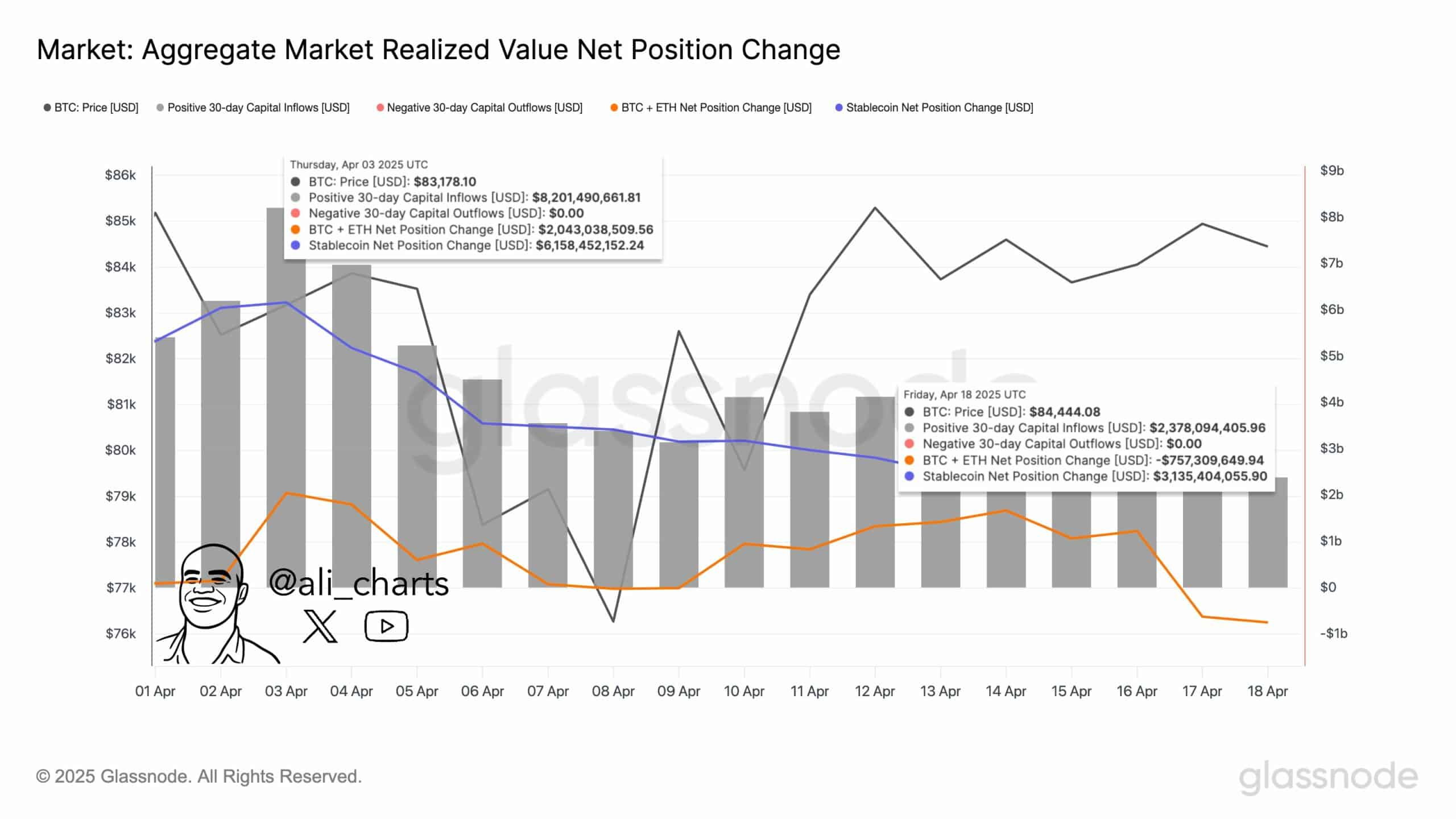

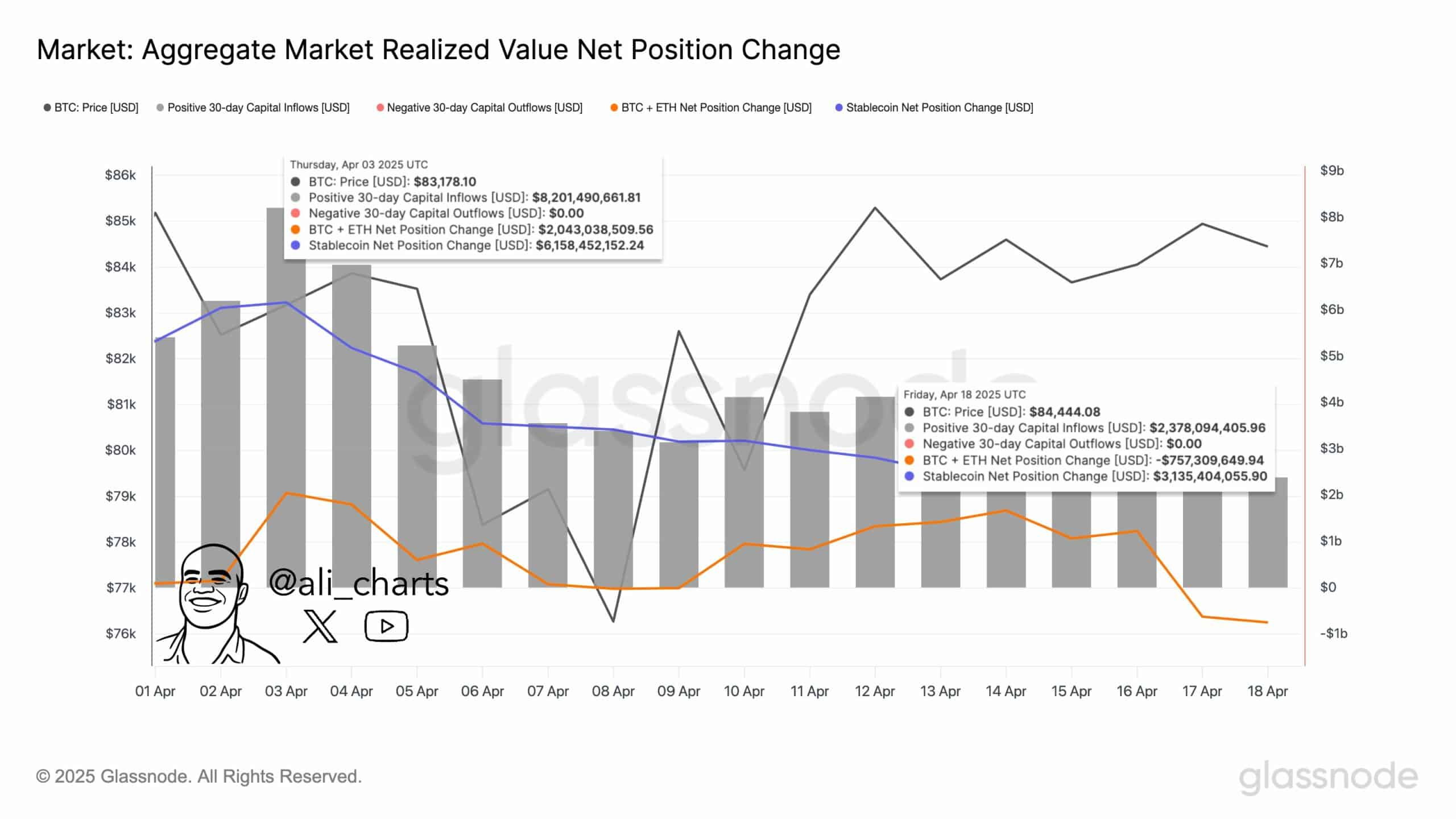

- Cryptographic capital entries plunged 70% in two weeks, while the levels of fear remained unchanged.

- Bitcoin ETF entries remained solid, signaling an institutional conviction in the middle of the withdrawal of retail.

Capital is placed in the cryptography market strongly plunged more than 70% in just two weeks, accumulating from $ 8.2 billion on April 4 to only $ 2.38 billion on April 18.

This spectacular contraction reflects a wave of prudence of investors in the midst of increasing market volatility and the intensification of macroeconomic pressure.

The sudden slowdown signals a change in the appetite for risks, because participants in retail and institutional people reduce exposure to volatile assets.

Although the market has supported an upper momentum earlier in the year, the current conditions suggest that participants re -assess their positions in response to the broader economic environment.

Source: X / Ali_charts

Why fear again captures the cryptography market

Of course, feeling data supported this change in behavior. The Fear and Greed index was stable at 33 – in “fear” territory.

This level remained unchanged for weeks, hovering at 32 last week and 31 the previous month. Consequently, the market is trapped in a psychological impasse, with buyers reluctant to intervene aggressively.

Historically, the phases of prolonged fear preceded acute rebounds and deeper corrections.

However, the lack of volatility of feeling involves hesitation rather than panic, suggesting that participants expect macro or stronger price clues before making decisive movements.

Source: CoinmarketCap

How the fears of inflation weigh on cryptographic confidence

In addition to that, the macro pressure has only intensified. According to recent data, inflation expectations at 1 year jumped 1.7 percentage points in April, reaching 6.7%, the highest level since 1981.

This marks the fourth consecutive monthly increase, inflation expectations increasing a total of 4.1 percentage points since November 2024.

In addition, inflation expectations over 5 years are now at 4.4%, the highest since June 1991. At the same time, consumers’ feeling fell to its second lowest level ever recorded.

Together, these figures shouted stagflation. And of course, the crypto – always considered a class of high -risk assets – raised this growing fear.

Can ETF entries prevent a full-fledged retirement?

However, there is a bright point in the middle of the gloom. Bitcoin ETFs (BTC) recorded a net entrance of $ 107 million on April 17, which increases the monthly total to $ 156 million.

In fact, in the past three months, FNB net entries have crossed $ 1 billion, which, according to the institutions, the institutions were not completely far from cryptography.

While the ETHEREUM ETHEREUM remained flat, this divergence highlights the perceived force of Bitcoin as a safer bet.

In addition, supported FNB entries can offer the market a degree of stability and prevent capitulation focused on short -term panic.

Source: CoinmarketCap

Where does the cryptography market go?

The sharp drop in capital entrances and persistent fear signals increasing prudence. However, regular institutional entries through FNB suggest that investors do not abandon the cryptography market.

Instead, this seems to be a short -term reset motivated by macro fears rather than a structural break. If the expectations of inflation stabilize and the feeling improves, cryptographic markets could find a foot for a renewed rally.