RALEIGH. NC (AP) — North Carolina homeowners insurance base premium rates will increase by an average of about 15% by mid-2026 under a settlement reached by the state Department of Insurance. State and industry.

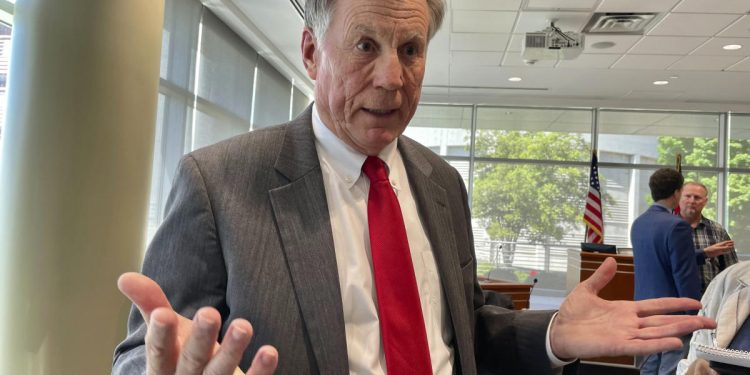

The agreement announced Friday by state Insurance Commissioner Mike Causey contrasts with the January 2024 request from the North Carolina Rate Bureau, which represents insurance companies, which sought an overall average increase of 42.2%. .

Causey, an elected official who began his third term earlier this month, formally rejected the office’s request last year. That led to a formal hearing that began in October and included several weeks of witnesses, evidence and arguments. The state Insurance Department said its witnesses would argue that rates should be lowered or raised by less than 3 percent.

Without the settlement, a hearing officer – in consultation with Causey – would have decided what the new rates should be. The Tariff Board could have appealed this decision to the courts.

Causey said in a news release that the proposed rate increases “are sufficient to ensure that insurance companies, which have paid significant sums due to natural disasters and face increasing reinsurance costs due to catastrophes national authorities, have sufficient funds to pay claims. “

The bureau attributed the significant demand to high inflation – particularly on building materials – combined with catastrophic storms and “severely inadequate” premium rates to cover losses. The increases requested by the bureau varied widely, from just over 4 percent in some parts of the mountains to more than 99 percent in some beach areas.

The agreed increases, carried out in two parts, will vary depending on the locality. On average statewide, the base rate will increase by 7.5% on June 1 and by an additional 7.5% on June 1, 2026.

The highest increases will generally occur in areas of eastern North Carolina hit hard by Hurricane Matthew in 2016 and Hurricane Florence in 2018, the Raleigh News & Observer reported. For example, beach areas from Carteret Counties to Brunswick Counties will see an average increase of 16% by mid-2025 and an additional 15.9% by mid-2026.

Areas most affected by historic flooding from Hurricane Helene in the fall will face below-average increases. Base rates in Buncombe, Watauga and Yancey counties, for example, will increase 4.4% in 2025 and 4.5% in mid-2026.

Among highly populated areas, base rates in Raleigh and Durham will increase by an average of 7.5% in each of the next two years. In Charlotte, rates would increase 9.3% in 2025 and 9.2% in 2026.

The settlement also prohibits the Rate Bureau from undertaking an effort to increase rates again before June 1, 2027, Causey’s statement said.