Getty Images

Getty ImagesPrime Minister Sir Keir Starmer said he has “full confidence” in Chancellor Rachel Reeves as she faces criticism over the falling pound and rising government borrowing costs.

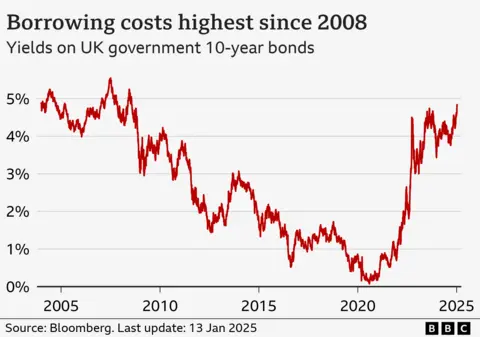

Sterling fell to $1.21 on Monday, its lowest level since November 2023, while a measure of the rate at which the government can borrow money rose to its highest level since 2008.

Borrowing costs are rising in many countries around the world, but some have argued that decisions made in the Budget appear to have made the UK more vulnerable.

Sir Keir said Reeves was “doing a fantastic job” but Tories said she was “holding on by her fingernails”.

Asked about the chancellor’s future at a press conference on Monday, Sir Keir would not publicly confirm that Reeves would still be in office at the next election.

Conservative leader Kemi Badenoch said: “The Prime Minister has simply refused to support his Chancellor remaining in office.

“Markets are in turmoil and business confidence has collapsed, but the chancellor is nowhere to be found.”

However, senior government officials have since told the BBC that the Prime Minister would “work with her in her role as chancellor for the duration of this parliament”.

The argument comes later the chancellor defended her decision to visit China improve economic ties with the country, despite uncertainty in financial markets.

The Conservatives said she had “fled to China”, but Reeves said deals in Beijing would bring £600m to the UK over the next five years.

Reeves is a central figure in the Labor government, presented to voters as a safe pair of hands in the run-up to the election. She also led work to build bridges with businesses.

But businesses and other observers were left rattled by his first budget in October, which they fear could further dampen the economy, rather than boost the growth Labor promised.

Market nervousness over the past week has heightened concerns about the government’s economic strategy.

Rising borrowing costs will have a knock-on effect on the government’s tax and spending plans as it will have to pay more interest to finance its existing debt. This leaves less spending on utilities and investments.

The Trump factor

Governments typically borrow money by selling bonds to large investors, such as pension funds. UK government bonds are known as Gilts.

The yield on the 10-year Gilt – the interest rate at which the government repays a decade-long loan to investors – rose to 4.86% on Monday, its highest level in 17 years.

The yield on 30-year bonds rose to 5.42%, its highest level in 27 years.

The cost of public debt in Germany, France, Spain and Italy also increased on Monday.

Some experts say investors are reacting to former US president’s re-election Donald Trump and his speeches on customs tariffs.

There are concerns that this will lead to more persistent inflation than previously thought, and that interest rates will therefore not fall as quickly as expected, both in the United States and elsewhere.

Strong U.S. jobs data released Friday reinforced expectations that U.S. rates would remain high for longer, helping to strengthen the value of the dollar against other currencies.

However, Emma Wall, head of investment platforms at Hargreaves Lansdown, said the UK’s problems were not solely caused by global issues, arguing that measures announced in the Budget had fueled inflation.

“If you can get inflation under control you will see interest rates fall in the UK,” she added.

Reeves also faced questions about her self-imposed rules on debt and public spending, which she said on Saturday were “non-negotiable.”

Despite her commitment, some question whether she will be able to achieve her goals without further spending cuts or tax increases, due to the rising cost of public debt.

On Monday, Sir Keir said the government would stick to its budget rules.

However, he added that the government would be “ruthless” in its decisions on the next spending review.

Trust “bruised”

The government has made growing the UK economy a key objective, but recent figures indicate the economy grew at zero between July and September, while contracting in October.

Businesses have warned that budgetary measures, such as increasing employer national insurance contributions, as well as increasing the national living wage, could lead to job losses and price rises.

Rupert Soames, president of the Confederation of British Business (CBI), said the situation was “not good” but insisted businesses remained somewhat optimistic.

“I wouldn’t say the confidence is gone,” he told the BBC’s Today programme. “I would say it’s bruised.”

However, he said the government was only making the situation worse by introducing the Employment Rights Billwhich, according to him, contain “powerful disincentives to employment”.

Unions say protections introduced in the bill, such as banning layoffs and rehires, make employees safer, while the government said it “represents the biggest improvement in labor rights since a generation.”

However, Mr Soames said the bill would lead to job losses. “Not only will businesses not employ people, they will let people go,” he said.

As part of its growth approach, the government revealed its plans on Monday making the UK the artificial intelligence capital of the world through measures such as building a new supercomputer.

Sir Keir said technology had “vast potential” to rejuvenate Britain’s public services, but the Conservatives slammed the plans as “uninspiring”.