6 Days of Bitcoin ETF Releases – Where Are BlackRock and Fidelity?

- Bitcoin ETFs Faced Outflows, But BlackRock’s IBTC Remains Stable and Increases Holdings

- Analyst Thomas believes that Bitcoin’s current decline is a harbinger of a significant rise.

As the crypto community prepares for the launch of Ethereum (ETH) spot ETFs, interest in Bitcoin (BTC) spot ETFs appears to be waning.

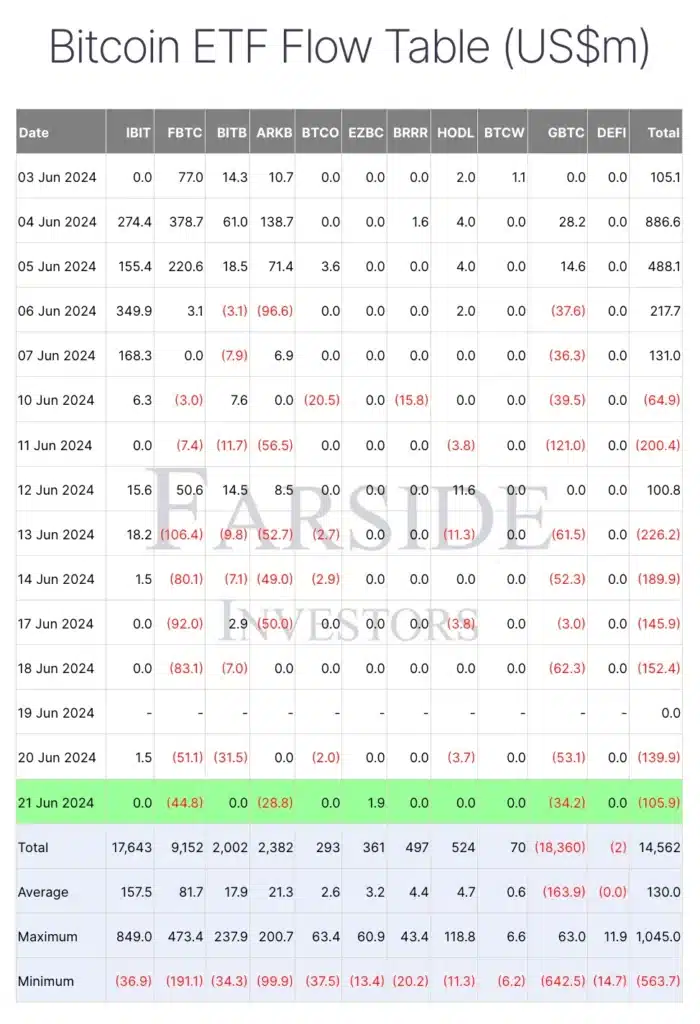

Bitcoin ETF Flow Analysis

Data from Farside Investors revealed that Bitcoin ETFs saw six consecutive days of outflows from June 13 to 21 (excluding June 19).

As of June 21, the Fidelity Wise Origin Bitcoin Fund (FBTC) was hit the hardest with outflows totaling $44.8 million, followed by Grayscale Bitcoin Trust (GBTC) which saw outflows of $34.2 million in a single day.

Source: Farside Investors

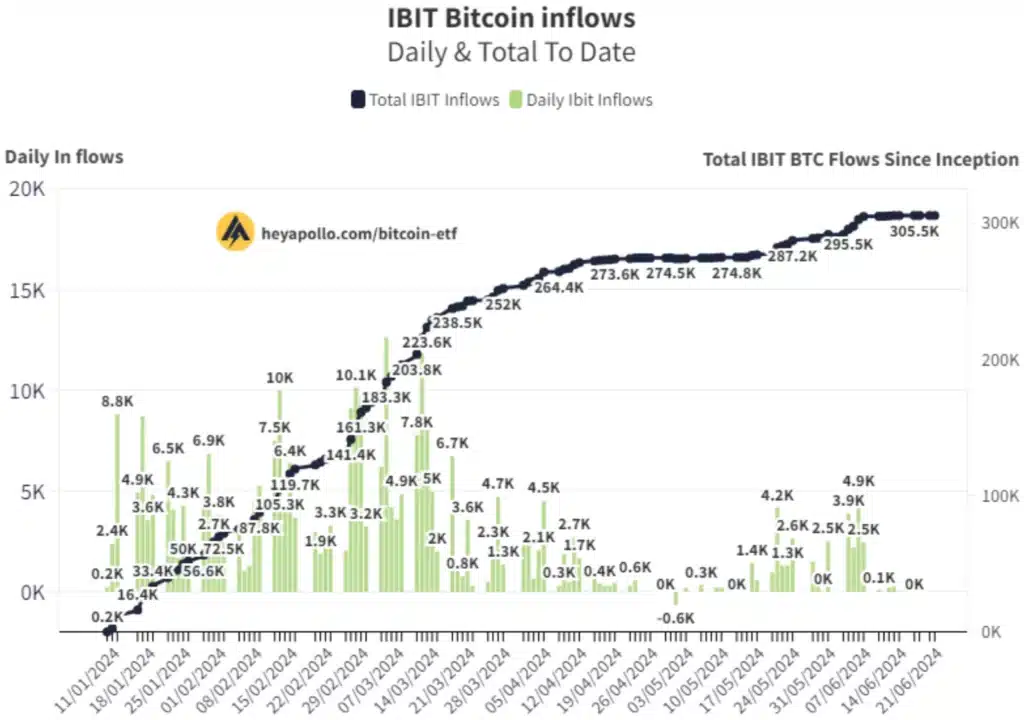

However, not all Bitcoin ETFs have seen significant outflows. BlackRock IBTC has remained stable, with zero days of outflows during this period and even before.

Making the same point, ApolloSats co-founder Thomas spoke to X (formerly Twitter) and noted:

“Blackrock continues to HODL. Zero outings today. +23 Bitcoin this week while all other major ETFs are experiencing a bloodbath. Larry, you’ve done it again.

Source: Thomas/X

This divergence in investor interest highlights the changing dynamics within the cryptocurrency market.

BlackRock remains strong

While some Bitcoin ETFs have faced significant outflows, the stability of BlackRock’s IBTC is a sign of selective confidence among investors.

Additionally, BlackRock’s recent increase in Bitcoin holdings highlights institutional confidence in Bitcoin’s role as a hedge and investment against inflation.

On June 5, BlackRock purchased 3,894 Bitcoins, worth approximately $276.19 million, bringing its total holdings to 295,457 Bitcoins, valued at approximately $20.95 billion.

The move is seen as a positive signal for the market, likely to influence other investors and increase demand for Bitcoin.

Additionally, executives believe that BlackRock’s accumulation could contribute to a supply shortage, further increasing Bitcoin prices amid changing economic and regulatory conditions.

Impact on the price of Bitcoin

At the same time, it is worth pointing out that BTC, although stable, has not been able to record a consistent uptrend on the charts. In fact, at press time it was well below the $70,000 mark.

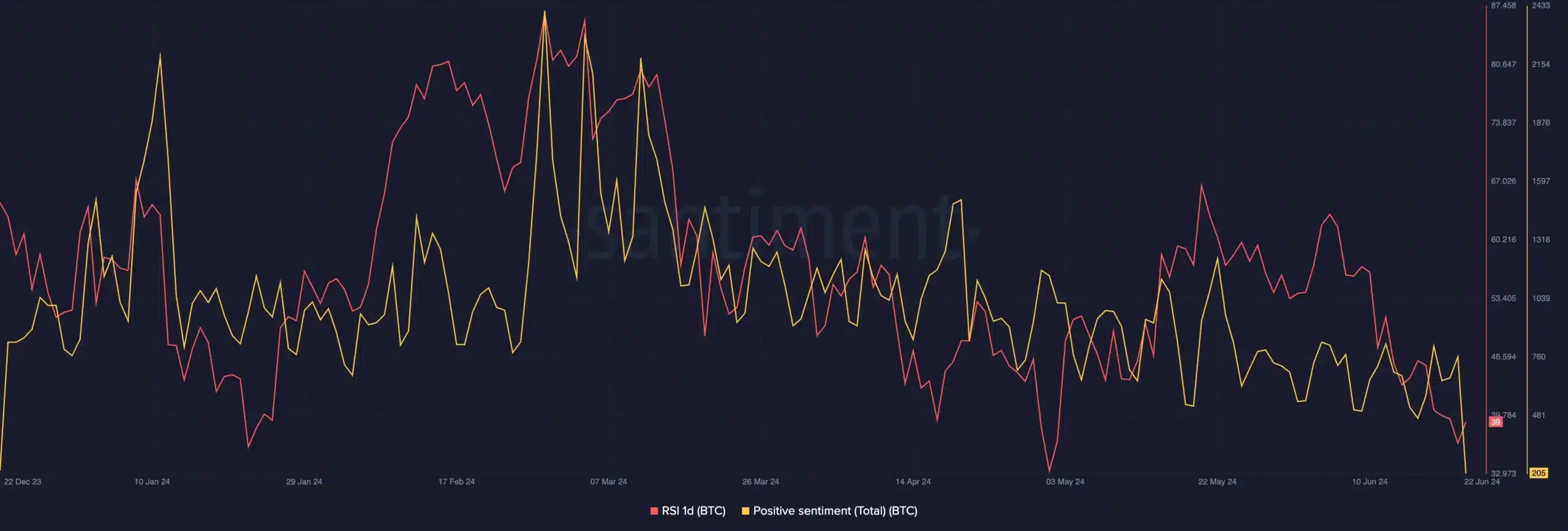

Thomas, in a separate analysis, drew parallels to previous Bitcoin halving cycles. According to him, the current slowdown reflects past trends, with the analyst also stating that he expects a rise in the coming days.

Source: Thomas/X

However, according to analysis of Santiment data by AMBCrypto, positive sentiment has dropped significantly. Despite this, the one-day relative strength index (RSI) appeared to be recovering from its lows – a sign of a possible reversal.

Source: Santiment

News Source : ambcrypto.com

Gn bussni