3 Top-Ranked Mining Stocks to Buy Now

The topic of investing in gold can elicit a wide range of reactions from people, ranging from sharp vitriol to profound praise. On one hand, you have the gold bugs, whose portfolios are dominated by the yellow metal, and on the other, you have the investment purists, who claim that because the yellow metal has no no profits, it has no place in their portfolio.

As with most things in life and investing, the truth lies somewhere in between these two perspectives.

Gold has been a store of value for thousands of years, and while it has not generated the same long-term returns as U.S. stocks, it can be a valuable hedge in a widely invested portfolio and can add uncorrelated returns during the most difficult times.

Gold quietly outperforms the stock market

Most notably, gold has outperformed the US stock market since the start of the year, and over the past three months the outperformance has been even more striking. Additionally, since the start of 2022, gold has significantly outperformed the S&P 500: gold prices have increased by 28%, while the stock index has increased by 14.5% during this period.

Rather than just investing in commodities, another way to gain exposure is through gold mining companies, which offer the benefit of benefiting from gold price appreciation, but also generate profits.

Barrick Gold GOLD, Agnico Eagle Mines AEG And Harmony Gold HMY are three leading gold mining companies that investors might consider adding to their portfolio.

Image Source: TradingView

Barrick Gold: a diversified mining giant

Barrick Gold Corporation is one of the world’s leading gold mining companies, headquartered in Toronto, Canada. Founded in 1983, Barrick operates mines and projects in North America, South America, Africa and the Middle East. The company is known for its vast gold reserves, efficient production processes and commitment to sustainable mining practices.

Barrick also produces significant quantities of copper, which provides an additional bullish catalyst since it is another metal rising sharply this year.

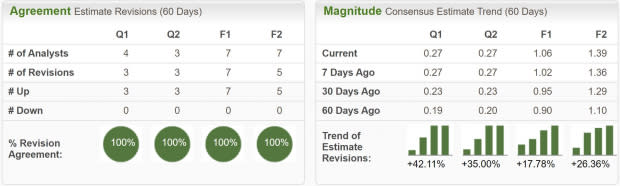

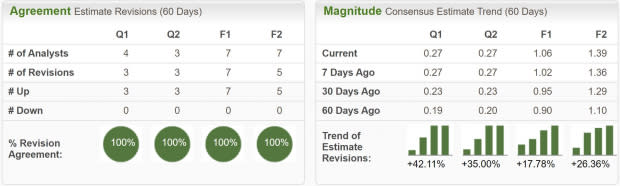

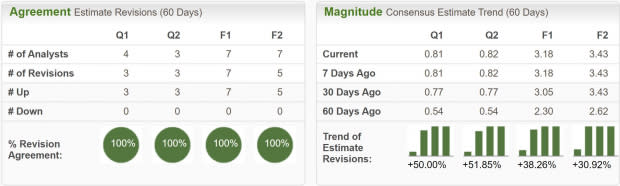

Reflecting strongly upward earnings revisions, Barrick Gold benefits from a Zacks Rank #1 (Strong Buy) rating.

As can be seen below, analysts have unanimously increased earnings over periods. EPS is expected to grow 26.2% this year and 31% next year, while sales are expected to grow 10.5% this year and next.

Image Source: Zacks Investment Research

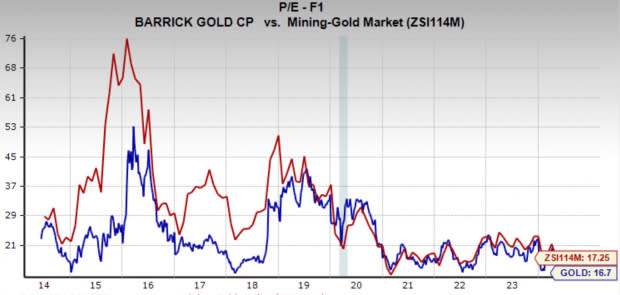

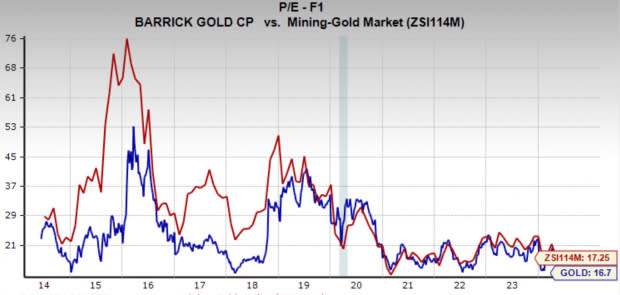

From a purely fundamental perspective, Barrick Gold is probably the most attractive stock of the group. In addition to its size, it also has the strongest expected EPS growth, as well as the cheapest valuation from a historical perspective.

Today, it trades at a one-year forward earnings multiple of 16.7x, which is below the industry average and its 10-year median of 20.9x. And with earnings expected to grow 38% annually over the next 3-5 years, GOLD has a PEG ratio of just 0.44.

Finally, Barrick pays a nice dividend yield of 2.3%, which further sweetens the deal for shareholders.

Image Source: Zacks Investment Research

Agnico Eagle Mines: Huge Earnings Growth Forecast

Agnico Eagle Mines AEM, based in Toronto, is a gold producer with mining operations in Canada, Mexico and Finland, as well as exploration activities in Canada, Europe, Latin America and the United States.

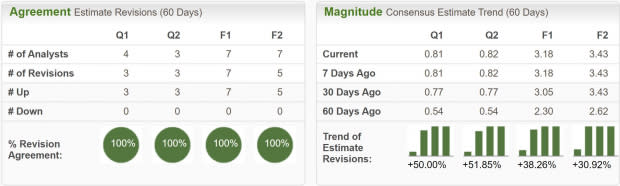

Agnico Eagle Mines currently has a number of compelling bullish catalysts for investors to consider. Over the past month, earnings estimates have risen, propelling the stock higher Zacks Rank #1 (Strong Buy) rating.

Earnings estimates for FY24 increased by 38% and for FY25 by 31%. Additionally, over the next three to five years, EPS is expected to grow at a staggering 30.2% annually.

Image Source: Zacks Investment Research

AEM currently trades at a one-year forward earnings multiple of 21.5x. That’s well below its 10-year median of 43x and just above the industry average. But as we mentioned, analysts expect EPS to rise significantly over the next three to five years.

So, based on growth estimates, the valuation is likely also undervalued. Agnico has a PEG ratio of 0.72, which represents a discount based on the metric.

Finally, it is worth noting that Agnico Eagle Mines pays a 2.3% dividend to shareholders.

Harmony Gold: Impressive share price appreciation

Harmony Gold HMY is a South Africa-based gold mining company operating underground and surface gold mines. It also carries out related activities such as exploration, processing, smelting and refining. Harmony is South Africa’s largest gold producer by volume, producing 1.47 million ounces in the 2023 financial year. Harmony also pays a dividend yield of 1.35%.

Like the others, Harmony Gold benefits from a Zacks Rank #1 (Strong Buy) rating. Analysts have increased earnings estimates for this year by 17.5% and by 35% for next year. EPS for these periods is also expected to climb 109% and 44% year-over-year, respectively.

Additionally, thanks to the wealth of the Wafi-Golpu project, whose production is estimated at some 500,000 ounces of gold, revenues are expected to grow by around 15% this year and next.

Image Source: Zacks Investment Research

Harmony Gold has also been the best performing stock in this group year to date, massively outperforming the underlying commodities and the market as a whole. Strong momentum along with a top Zacks Rank make Harmony Gold a stock to definitely watch.

Image Source: TradingView

How Gold Fits into Your Portfolio

In my own research, I have found that over the long term, a 5-15% portfolio allocation to gold gives you many of the diversification and hedging benefits of owning this commodity. Any more exposure than that and you risk missing out on some of the returns of traditional stocks.

So, for investors who have been enticed to invest in gold by the enormous momentum seen in recent years, you have good reason to add some of this shiny metal to your portfolio.

Finally, by focusing on the highest quality gold mining stocks, investors have the opportunity to benefit from both rising gold prices and growing business.

Want the latest recommendations from Zacks Investment Research? Today you can download the 7 best stocks for the next 30 days. Click to get this free report

Aegon NV (AEG): Free Stock Analysis Report

Harmony Gold Mining Company Limited (HMY): Free Stock Analysis Report

Barrick Gold Corporation (GOLD): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investing Research

yahoo