3 Artificial Intelligence (AI) Stocks to Buy Now

Nvidia has been THE The most interesting artificial intelligence (AI) stocks to own over the past year and a half. However, the expectations for the stock are mind-boggling and could prove disastrous in the future.

Still, AI is here to stay, and if you’re looking to invest in this sector, I’d consider these stocks before considering Nvidia.

Taiwan Semiconductors

Semiconductor Manufacturing in Taiwan (NYSE: TSM) Nvidia makes many of the chips that power all the devices that power the incredible AI technology used today. With Nvidia’s GPUs being filled with TSMC products, it also benefits from its performance.

Another important customer is Applewhich recently announced that its AI offering is only available on the latest generation of phones. This could trigger a major wave of refreshes, from which Taiwan Semi would benefit enormously.

Regardless, management expects AI revenue to grow at a compound annual rate of 50% over the next five years, during which time it expects the segment to account for more than 20% of overall sales. Over the long term, management expects overall revenue growth of 15% to 20%, which would translate into massive market outperformance.

While Taiwan Semi’s stock has had a great run this year (up over 75%), I believe this run can continue for years to come as its products are integrated into a world that has barely scratched the surface of AI capabilities.

Alphabet

Alphabet (NASDAQ: GOOG) (NASDAQ: GOOGL) is the parent company of Google, which has long been a proponent of AI. While it seemed caught off guard by the rise of generative AI in late 2022, its recent launches have corrected that mistake, and its Gemini model has emerged as a top choice.

Alphabet has also integrated AI into various ad products, allowing advertisers to create effective campaigns and ensuring its internal models match the right ad to viewers. While these launches haven’t directly translated into massive revenue increases, they have solidified Alphabet’s top spot among where advertisers should spend.

While Alphabet won’t be as spectacular an investment as Nvidia, it will consistently outperform the market by a few percentage points each year thanks to its dividend, aggressive share buyback plan, and steady growth.

The stock trades at about 25 times forward earnings, so it’s not historically cheap, but it’s significantly cheaper than many of its peers.

Salesforce

Salesforce (NYSE: CRM) is a bit of a roundabout choice, as it is a customer relationship management software company. However, it heavily promotes its AI model to its customers to improve their businesses. It can be integrated internally to provide employees with the best possible information when closing a sale, thanks to a heavy reliance on internal customer data. It can also create AI chatbots that provide better customer service interaction than was historically available.

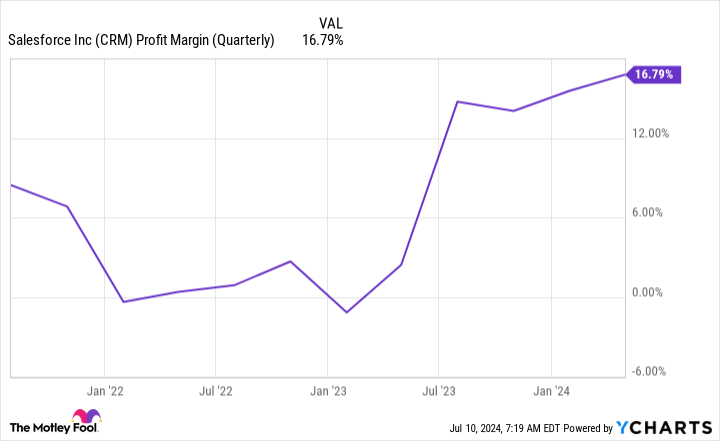

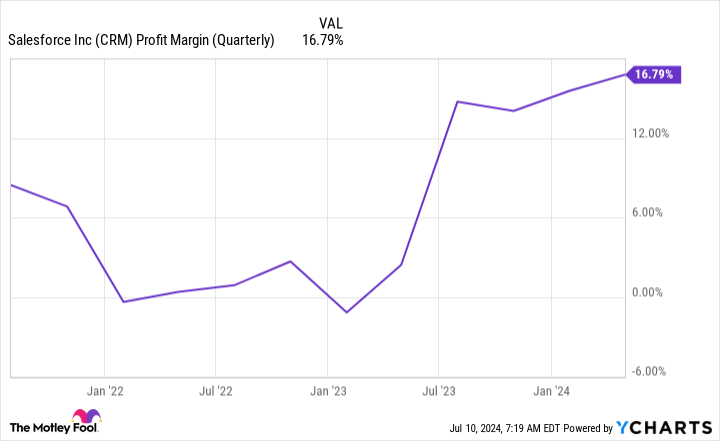

With Salesforce well positioned in the market, getting this AI offering right is essential to maintaining its market dominance. It also provides another growth lever for the company, whose maturity is beginning to be felt, with revenue growing by only a few digits.

However, it recently launched a dividend and still has a way to go before reaching the maximum profit margins for software companies (the gold standard is Adobe(the 30% margin).

All of this translates into strong growth ahead for the stock and it could beat the market in the long run.

These three companies are more stable than Nvidia, which has been cyclical throughout its existence. Picking Alphabet, Taiwan Semiconductor, and Salesforce is a smart move if you’re looking for more reasonably priced stocks with strong growth potential.

Should You Invest $1,000 in Semiconductor Manufacturing in Taiwan Right Now?

Before buying Taiwan Semiconductor Manufacturing stock, consider this:

THE Motley Fool, Securities Advisor The team of analysts has just identified what they believe to be the 10 best stocks Investors need to buy now…and Taiwan Semiconductor Manufacturing isn’t one of them. These 10 stocks could deliver monstrous returns in the years ahead.

Consider when Nvidia I made this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $791,929!*

Securities Advisor provides investors with an easy-to-follow blueprint for success, including portfolio building advice, regular analyst updates and two new stock picks each month. Securities Advisor the service has more than quadrupled the return of the S&P 500 since 2002*.

See all 10 actions »

*Stock Advisor returns as of July 8, 2024

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Keithen Drury holds positions at Adobe, Alphabet, Salesforce, and Taiwan Semiconductor Manufacturing. The Motley Fool holds positions in and recommends Adobe, Alphabet, Apple, Nvidia, Salesforce, and Taiwan Semiconductor Manufacturing. The Motley Fool has a disclosure policy.

Forget Nvidia: 3 Artificial Intelligence (AI) Stocks to Buy Now was originally published by The Motley Fool

News Source : finance.yahoo.com

Gn bussni